- Australia

- /

- Metals and Mining

- /

- ASX:RMS

Will Ramelius Resources’ (ASX:RMS) 5 Year Pathway Reframe Its Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- On October 27, 2025, Ramelius Resources Limited released its Q1 2026 sales and trading statement and held a special call to discuss its 5 Year Growth Pathway and mining studies.

- These updates provided stakeholders with both an immediate financial snapshot and rare insights into the company's long-term expansion and strategy.

- We'll explore how the company's 5 Year Growth Pathway discussion could influence confidence in its exploration and project integration outlook.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Ramelius Resources Investment Narrative Recap

To own shares in Ramelius Resources, you need to believe that its aggressive reserve expansion, disciplined integration of acquisitions, and leverage to sustained high gold prices can translate into robust, long-term profit growth. The recent Q1 2026 sales and trading update, paired with management's 5 Year Growth Pathway discussion, provides more clarity on both exploration ambitions and ongoing integration, but does not appear to have materially changed the balance between the near-term outlook for new project development and the persistent risks around cost and timeline delivery. Of recent company news, Ramelius's addition to the S&P/ASX 100 Index most directly highlights shifting market perceptions and potentially improved access to capital for future projects. This recognition coincides with fresh management commentary on growth and integration, spotlighting the interplay between investor confidence and execution risks for major production expansions. However, when expectations for timely and efficient integration clash with the financial reality of cost overruns and delays, investors should watch for signs of...

Read the full narrative on Ramelius Resources (it's free!)

Ramelius Resources is projected to reach A$1.6 billion in revenue and A$409.5 million in earnings by 2028. This outlook assumes a 10.9% annual revenue growth rate; however, earnings are expected to decline by A$64.7 million from the current A$474.2 million.

Uncover how Ramelius Resources' forecasts yield a A$4.14 fair value, a 25% upside to its current price.

Exploring Other Perspectives

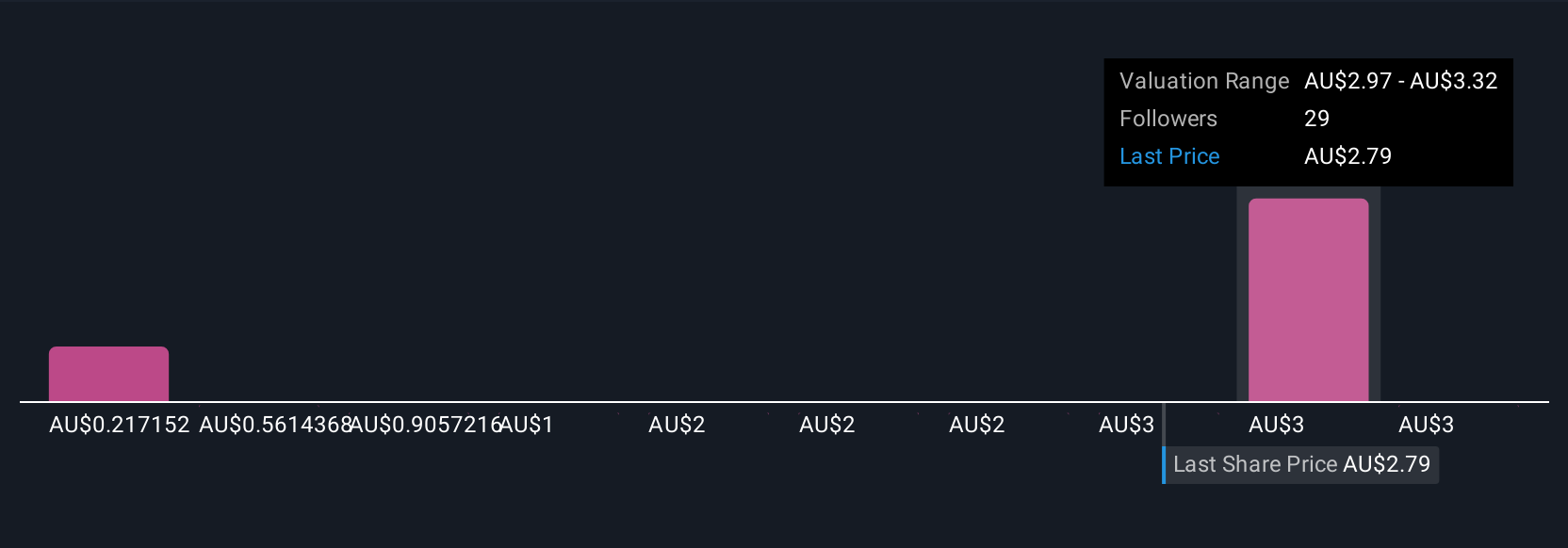

Seven Simply Wall St Community valuations for Ramelius Resources range from A$1.68 to A$23.23 per share, revealing sharply contrasting fair value views. Overlaying this with the company's ambitious reserve expansion and integration goals, it is clear your outlook can swing widely depending on your confidence in future execution.

Explore 7 other fair value estimates on Ramelius Resources - why the stock might be worth over 7x more than the current price!

Build Your Own Ramelius Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ramelius Resources research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ramelius Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ramelius Resources' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RMS

Ramelius Resources

Engages in the exploration, evaluation, mine development and operation, production, and sale of gold.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives