- New Zealand

- /

- REITS

- /

- NZSE:ARG

Asian Undervalued Small Caps With Insider Activity In April 2025

Reviewed by Simply Wall St

In April 2025, Asian markets are navigating a complex landscape marked by global trade tensions and economic policy shifts. Despite these challenges, smaller-cap indexes have shown resilience, outperforming larger counterparts as investors seek opportunities in sectors less impacted by international trade disputes. In this environment, stocks that demonstrate strong fundamentals and insider activity can offer intriguing potential for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.2x | 1.0x | 46.62% | ★★★★★★ |

| New Hope | 5.4x | 1.6x | 49.13% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 36.42% | ★★★★★☆ |

| Puregold Price Club | 8.6x | 0.4x | 32.14% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 41.55% | ★★★★☆☆ |

| PWR Holdings | 33.3x | 4.6x | 27.39% | ★★★☆☆☆ |

| Hansen Technologies | 297.0x | 2.9x | 21.86% | ★★★☆☆☆ |

| Integral Diagnostics | 149.3x | 1.7x | 44.27% | ★★★☆☆☆ |

| Manawa Energy | NA | 2.7x | 40.62% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 11.0x | 25.51% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Ramelius Resources (ASX:RMS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ramelius Resources is a gold production and exploration company operating primarily through its Edna May and Mt Magnet projects, with a market capitalization of A$1.33 billion.

Operations: The company generates revenue primarily from its operations at Edna May and Mt Magnet, with recent revenues reaching A$1.04 billion. Over time, the gross profit margin has shown a notable trend, increasing to 46.03% as of December 2024. Operating expenses and non-operating expenses have fluctuated but remained significant factors in overall profitability.

PE: 8.6x

Ramelius Resources, a small player in the mining sector, recently announced an acquisition of Spartan Resources, signaling potential strategic growth. Despite forecasted earnings declines of 14.2% annually over the coming three years and reliance on external borrowing for funding, their recent financials show significant improvement with sales reaching A$507.96 million and net income at A$170.37 million for H1 2024 compared to previous periods. Insider confidence is evident from share purchases earlier this year, suggesting belief in future prospects despite current challenges.

- Click here to discover the nuances of Ramelius Resources with our detailed analytical valuation report.

Understand Ramelius Resources' track record by examining our Past report.

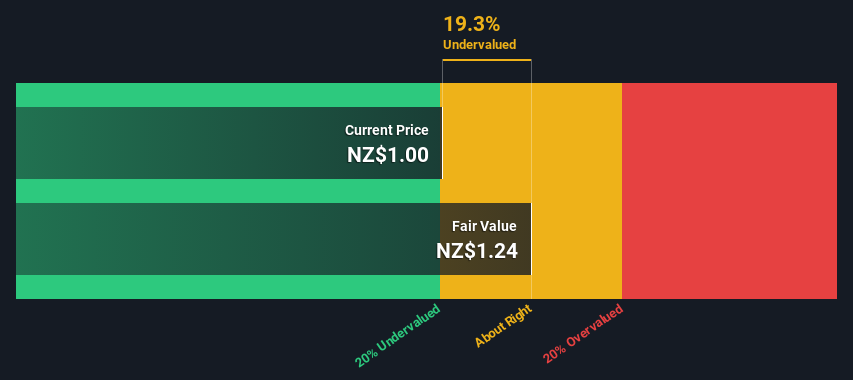

Argosy Property (NZSE:ARG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Argosy Property is a New Zealand-based real estate investment trust focused on owning and managing a diversified portfolio of industrial, office, and retail properties with a market capitalization of approximately NZ$1.37 billion.

Operations: Argosy Property's revenue primarily comes from its operations, with a gross profit margin that decreased from 81.38% in September 2016 to 75.08% by April 2025. The company experienced fluctuations in net income, turning negative from March 2023 onward due to rising non-operating expenses. Operating expenses have shown a gradual increase over time, impacting overall profitability.

PE: -286.7x

Argosy Property, a key player in the property sector, is attracting attention with its strategic lease agreements and sustainable initiatives. Recent insider confidence has been demonstrated through share purchases over the past quarter, hinting at potential growth. The company secured a 12-year lease with Bascik Transport and a 10-year lease with Viatris Ltd., both targeting a 6 Green Star Built rating. Despite relying on external borrowing for funding, earnings are projected to grow by 21% annually.

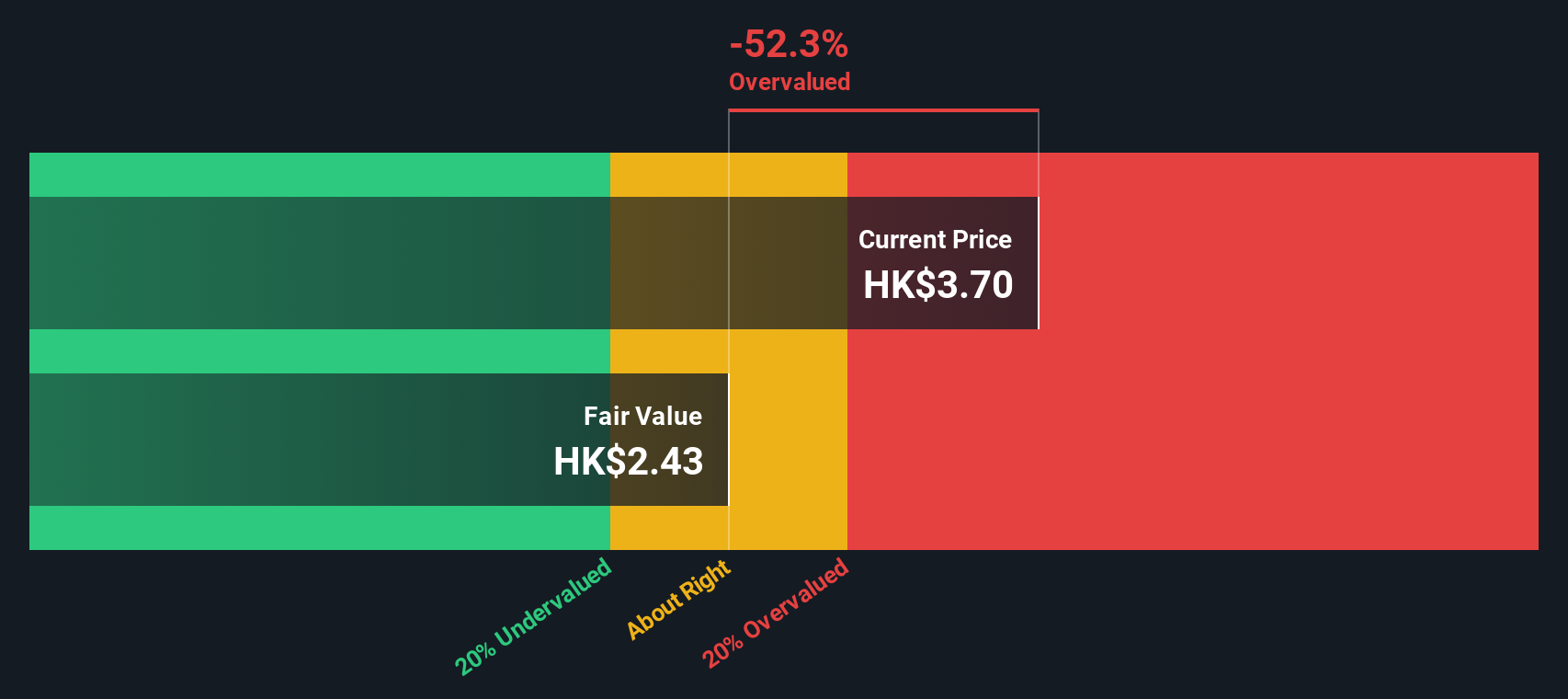

NagaCorp (SEHK:3918)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NagaCorp operates primarily in the casino and hotel entertainment sectors, with a market capitalization of approximately HKD 22.7 billion.

Operations: The company generates revenue primarily from casino operations, with additional income from hotel and entertainment activities. Over recent periods, the gross profit margin has shown a trend of increasing percentages, reaching 86.44% as of December 2024. Operating expenses are a significant cost factor, consistently exceeding $200 million in recent quarters.

PE: 16.0x

NagaCorp, a notable player in the Asian gaming industry, has seen its gross gaming revenue rise to US$171.16 million for Q1 2025 from US$145.41 million a year ago, indicating potential growth despite profit margins dropping from 35.4% to 20.7%. The company's earnings are projected to grow by 29% annually, showcasing promising future prospects. Although net income fell to US$109.59 million in 2024 from US$177.73 million previously, insider confidence is evident with recent share purchases by key individuals within the company over the past months.

- Dive into the specifics of NagaCorp here with our thorough valuation report.

Gain insights into NagaCorp's past trends and performance with our Past report.

Summing It All Up

- Click this link to deep-dive into the 67 companies within our Undervalued Asian Small Caps With Insider Buying screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:ARG

Argosy Property

Argosy Property Limited (APL or the Company) is an FMC Reporting Entity under the Financial Markets Conduct Act 2013 and the Financial Reporting Act 2013.

6 star dividend payer and good value.

Market Insights

Community Narratives