- Australia

- /

- Metals and Mining

- /

- ASX:RML

Does Resolution Minerals’ Major Idaho Gold Discovery Transform the Bull Case for ASX:RML?

Reviewed by Sasha Jovanovic

- Resolution Minerals Ltd recently announced a major gold discovery at the Golden Gate Prospect within its Horse Heaven Project in Idaho, reporting a maiden drilling intercept of 189.2 metres at 1.30 g/t gold from near surface.

- This discovery highlights the project's potential for district-scale mineralisation and positions the company to explore additional opportunities in gold and critical minerals.

- With confirmation of an intrusion-related gold system, we’ll explore how this result shapes Resolution Minerals’ overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Resolution Minerals' Investment Narrative?

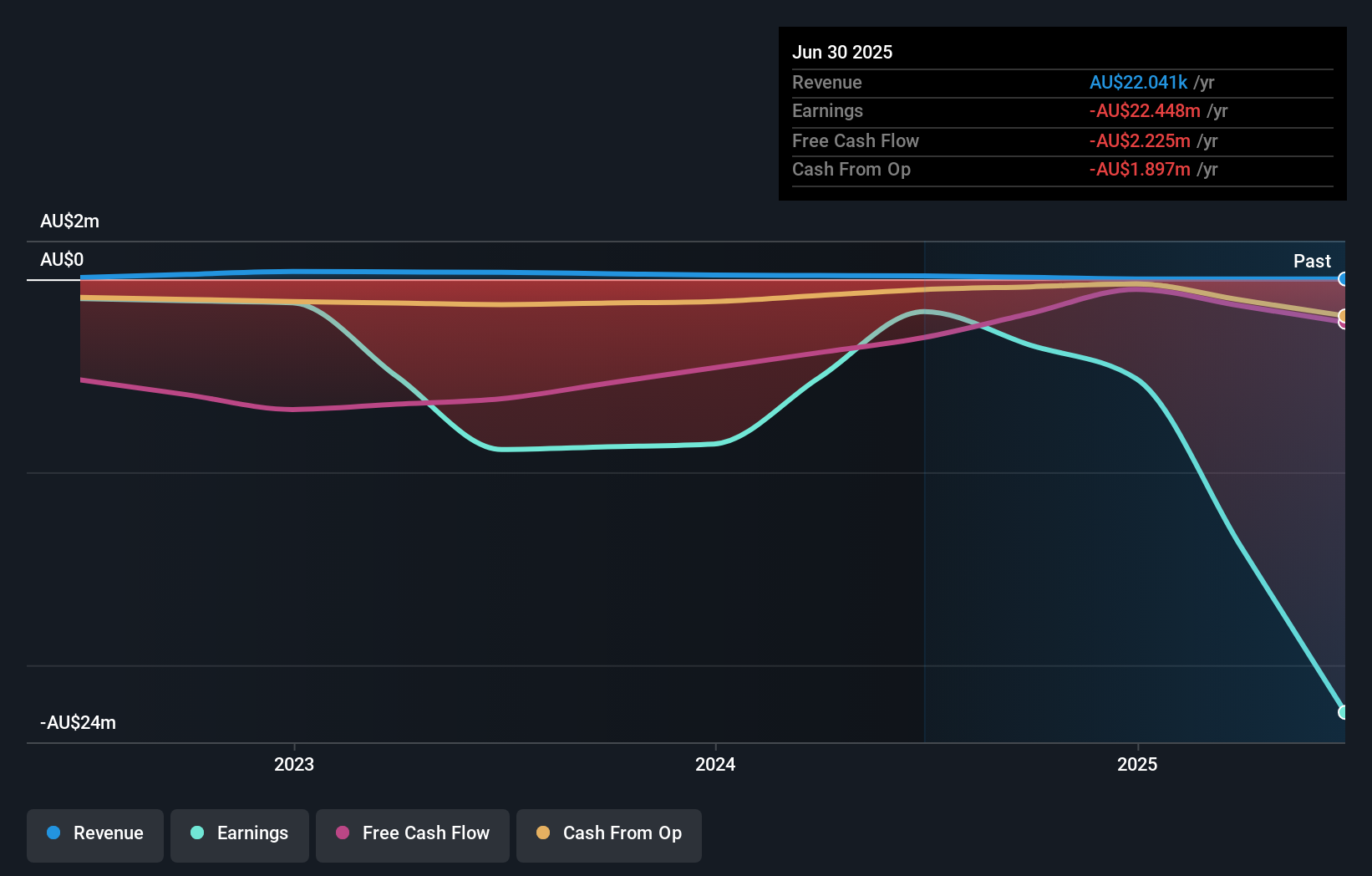

Owning shares in Resolution Minerals has always hinged on a belief in the company's ability to deliver world-class mineral discoveries that translate into real value, despite the clear risks of high cash burn, continued net losses (A$22.45 million last fiscal year), and heavy shareholder dilution. The recent discovery at the Golden Gate Prospect marks a step change for the short-term outlook. Investors now have a new, highly material catalyst to watch, with assay results pending from nine more drill holes and an expanded drill program in the works. This could shift the narrative from one of persistent financial strain and early-stage risk to genuine resource potential if follow-up results confirm a major gold system. However, while the discovery brings optimism, it also raises the stakes given ongoing funding needs, an inexperienced board, and clear doubts flagged by auditors over the company's ability to remain a going concern.

But balancing that discovery, concerns around financial sustainability are still in sharp focus for investors. Our expertly prepared valuation report on Resolution Minerals implies its share price may be too high.Exploring Other Perspectives

Explore 4 other fair value estimates on Resolution Minerals - why the stock might be worth over 7x more than the current price!

Build Your Own Resolution Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Resolution Minerals research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Resolution Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Resolution Minerals' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RML

Resolution Minerals

A mineral exploration company, engages in the acquisition, exploration, and development of mineral properties in Australia and the United States.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion