- Australia

- /

- Metals and Mining

- /

- ASX:PRG

Adore Beauty Group And 2 Other Promising ASX Penny Stocks

Reviewed by Simply Wall St

As the Australian market faces a potential dip, influenced by global tech earnings and local corporate developments, investors are seeking alternative avenues for growth. Penny stocks, often representing smaller or newer companies, continue to capture interest due to their affordability and potential for significant returns. While the term may seem outdated, these stocks can offer compelling opportunities when backed by strong financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.61 | A$72.09M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.805 | A$281.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$322.48M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$828.23M | ★★★★★☆ |

| Joyce (ASX:JYC) | A$4.35 | A$124.48M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$63.17M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.175 | A$1.08B | ★★★★★★ |

| SRG Global (ASX:SRG) | A$1.12 | A$682.42M | ★★★★★★ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Adore Beauty Group (ASX:ABY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Adore Beauty Group Limited operates an integrated content, marketing, and e-commerce retail platform in Australia and New Zealand with a market cap of A$100.53 million.

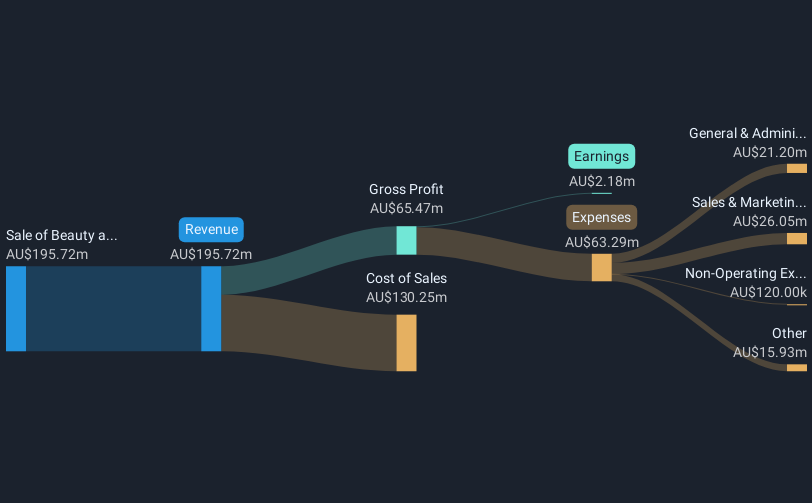

Operations: The company generates revenue of A$195.72 million from selling beauty and personal care products via its online platform.

Market Cap: A$100.53M

Adore Beauty Group, with a market cap of A$100.53 million, has become profitable this year, reporting a net income of A$2.18 million for the full year ended June 30, 2024. The company is debt-free and trades at 86.8% below its estimated fair value according to analysts. Revenue is forecasted to grow by 9.66% annually, although past earnings have declined by an average of 10.6% over five years. Despite low return on equity at 5.5%, Adore's short-term assets significantly cover both short and long-term liabilities, indicating financial stability amidst recent executive changes.

- Navigate through the intricacies of Adore Beauty Group with our comprehensive balance sheet health report here.

- Learn about Adore Beauty Group's future growth trajectory here.

Kuniko (ASX:KNI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kuniko Limited focuses on exploring mineral properties for electromobility in Norway and Canada, with a market cap of A$15.62 million.

Operations: Kuniko Limited does not currently report any specific revenue segments.

Market Cap: A$15.62M

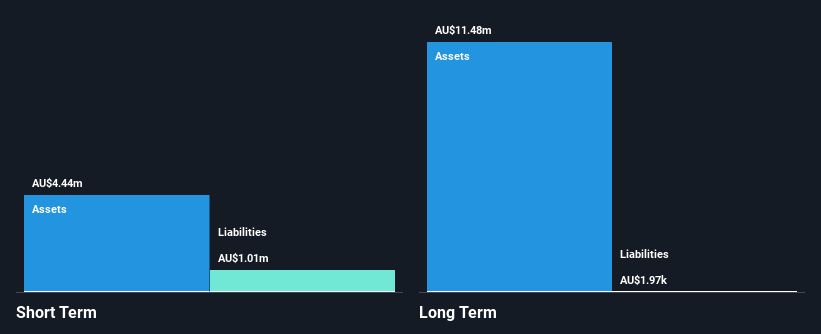

Kuniko Limited, with a market cap of A$15.62 million, is pre-revenue and focuses on mineral exploration for electromobility in Norway and Canada. Despite being debt-free and having short-term assets (A$4.4M) exceeding liabilities, the company faces challenges with less than a year of cash runway based on current free cash flow trends. Kuniko's earnings have declined significantly over the past five years, leading to negative equity returns (-19.51%). However, recent results show improvement with net losses narrowing from A$3.39 million to A$1.16 million for the half-year ended June 2024, reflecting potential operational progress amidst high share price volatility.

- Take a closer look at Kuniko's potential here in our financial health report.

- Gain insights into Kuniko's historical outcomes by reviewing our past performance report.

PRL Global (ASX:PRG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PRL Global Ltd. operates in the mining, processing, and sale of phosphate rock, phosphate dust, and chalk across multiple continents including Africa, Asia, Europe, Australia, North America, and Oceania with a market cap of A$138.44 million.

Operations: The company's revenue is primarily derived from its Logistics segment, which generated A$1.06 billion, and its Fertiliser segment, contributing A$177.04 million.

Market Cap: A$138.44M

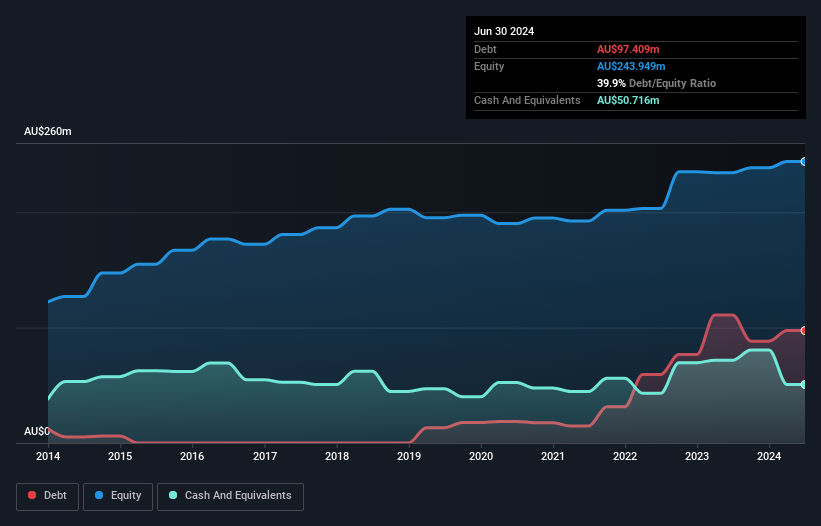

PRL Global Ltd. operates with a market cap of A$138.44 million, showing significant revenue from its Logistics (A$1.06 billion) and Fertiliser (A$177.04 million) segments, though recent earnings have declined with net income at A$21.88 million compared to A$25.27 million last year. Despite seasoned management and board teams, the company's debt to equity ratio has increased over five years, indicating rising leverage concerns not fully covered by operating cash flow (16.3%). The firm announced a share buyback program worth A$5 million but faces challenges with reduced profit margins and low return on equity (3.5%).

- Click here and access our complete financial health analysis report to understand the dynamics of PRL Global.

- Review our historical performance report to gain insights into PRL Global's track record.

Key Takeaways

- Navigate through the entire inventory of 1,033 ASX Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PRG

PRL Global

Engages in the mining, processing, and sale of phosphate rock, phosphate dust, and chalk in Africa, Asia, Europe, Australia, North America, and Oceania.

Mediocre balance sheet low.

Market Insights

Community Narratives