- Australia

- /

- Metals and Mining

- /

- ASX:PLS

Assessing Pilbara Minerals (ASX:PLS) Valuation as Lithium Optimism and Analyst Interest Reignite Investor Focus

Reviewed by Simply Wall St

PLS Group (ASX:PLS) is back in the spotlight after renewed optimism in lithium, as electric vehicles and large battery projects draw investors toward producers seen as well placed for a multi year demand cycle.

See our latest analysis for PLS Group.

That backdrop helps explain why PLS Group’s 1 day share price return of 4.64 percent sits on top of an 83.71 percent year to date share price gain and an 87.10 percent total shareholder return over the past year. This suggests momentum is building as lithium optimism and recent capital structure moves feed into sentiment.

If this lithium rebound has your attention, it may be worth broadening your watchlist and exploring fast growing stocks with high insider ownership for other fast moving opportunities with conviction backing.

Yet with PLS now trading above consensus price targets despite recent losses, investors face a key question: is the market underestimating its long term lithium leverage, or already baking in the next leg of growth?

Most Popular Narrative: 36% Overvalued

With PLS Group closing at A$4.06 against a narrative fair value of about A$3.00, the prevailing storyline leans toward a stretched valuation that still banks on aggressive execution.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.6x on those 2028 earnings, up from -37.5x today. This future PE is greater than the current PE for the AU Metals and Mining industry at 15.5x.

Curious why a miner with current losses is being valued on a profit multiple more typical of high growth leaders? The narrative quietly leans on rapid revenue expansion, sharply improving margins, and a sizeable jump in future earnings power to make the numbers add up, but the exact mix of assumptions may surprise you when you see how they connect.

Result: Fair Value of $3.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly weak lithium prices or costly delays at projects like Colina could quickly challenge the upbeat growth and valuation assumptions underpinning PLS Group.

Find out about the key risks to this PLS Group narrative.

Another Angle on Valuation

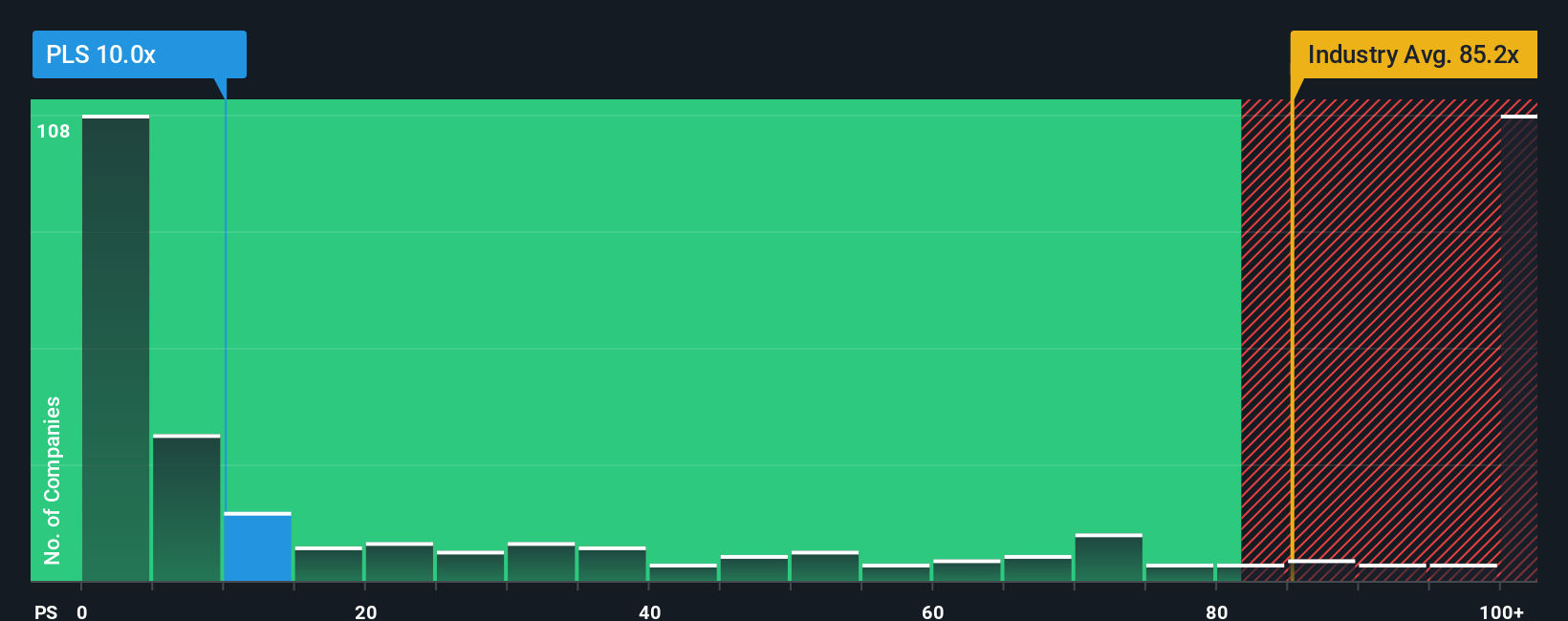

While the narrative fair value sits at about A$3.00, the price to sales lens paints a sharper warning. PLS trades on roughly 17 times sales versus an industry average near 122 times, but well above peer levels around 9.3 times and a fair ratio of just 1.6 times that the market could drift toward. That gap looks less like a margin of safety and more like valuation risk. How confident are you that sentiment will stay this strong if lithium wobbles again?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PLS Group Narrative

If you see the story differently or want to interrogate the numbers yourself, you can quickly craft your own view in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding PLS Group.

Looking for more investment ideas?

Put your research momentum to work and secure your next opportunity by using the Simply Wall St Screener before the market prices in the most compelling stories.

- Capture potential multi baggers early by scanning these 3638 penny stocks with strong financials that already show stronger balance sheets and fundamentals than typical speculative names.

- Position ahead of structural tech shifts by targeting these 26 AI penny stocks building real products around machine learning, automation, and intelligent data platforms.

- Review potential value opportunities by exploring these 913 undervalued stocks based on cash flows where market prices may differ from assessed long term cash flow potential and quality metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PLS

PLS Group

Engages in the exploration, development, and operation of mineral resources in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)