- Australia

- /

- Metals and Mining

- /

- ASX:PLS

Will Global Lithium Supply Shifts Alter Pilbara Minerals' Strategic Edge (ASX:PLS)?

Reviewed by Sasha Jovanovic

- In recent days, Australian lithium producer Pilbara Minerals has faced market volatility following approvals for major lithium mine projects in China and new U.S. government funding for American lithium developments.

- These global supply shifts highlight how Pilbara Minerals, as a pure-play lithium company, remains acutely responsive to changes in international battery metals markets.

- We’ll assess how this renewed supply uncertainty in China could reshape Pilbara Minerals’ investment case as global lithium markets fluctuate.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Pilbara Minerals Investment Narrative Recap

To be a Pilbara Minerals shareholder, you need to believe in lithium’s critical role in powering the global shift toward electric vehicles and energy storage, and that future demand will eventually offset any near-term pricing volatility from additional supply hitting the market. The recent approvals for major Chinese lithium projects and new US government funding have intensified short-term price uncertainty, leaving oversupply concerns as the key risk. These events may cloud the strongest catalyst: recovery in lithium prices as the demand cycle strengthens, though the overall impact in the near term is material due to price sensitivity.

Among Pilbara’s latest milestones, the breakthrough of its shares above the A$2.50 resistance level came shortly after the company pushed forward with its Mid-Stream Demonstration Plant Project. Supported by a government grant and focused on producing higher-value lithium products at the mine site, this initiative could help insulate Pilbara from pure commodity price swings, making it particularly relevant in light of changing global supply conditions.

But while lithium remains fundamental to the green energy story, the risk of prolonged oversupply is something every investor should understand...

Read the full narrative on Pilbara Minerals (it's free!)

Pilbara Minerals' narrative projects A$1.4 billion revenue and A$247.0 million earnings by 2028. This requires 23.0% yearly revenue growth and a A$442.8 million increase in earnings from the current A$-195.8 million.

Uncover how Pilbara Minerals' forecasts yield a A$2.16 fair value, a 15% downside to its current price.

Exploring Other Perspectives

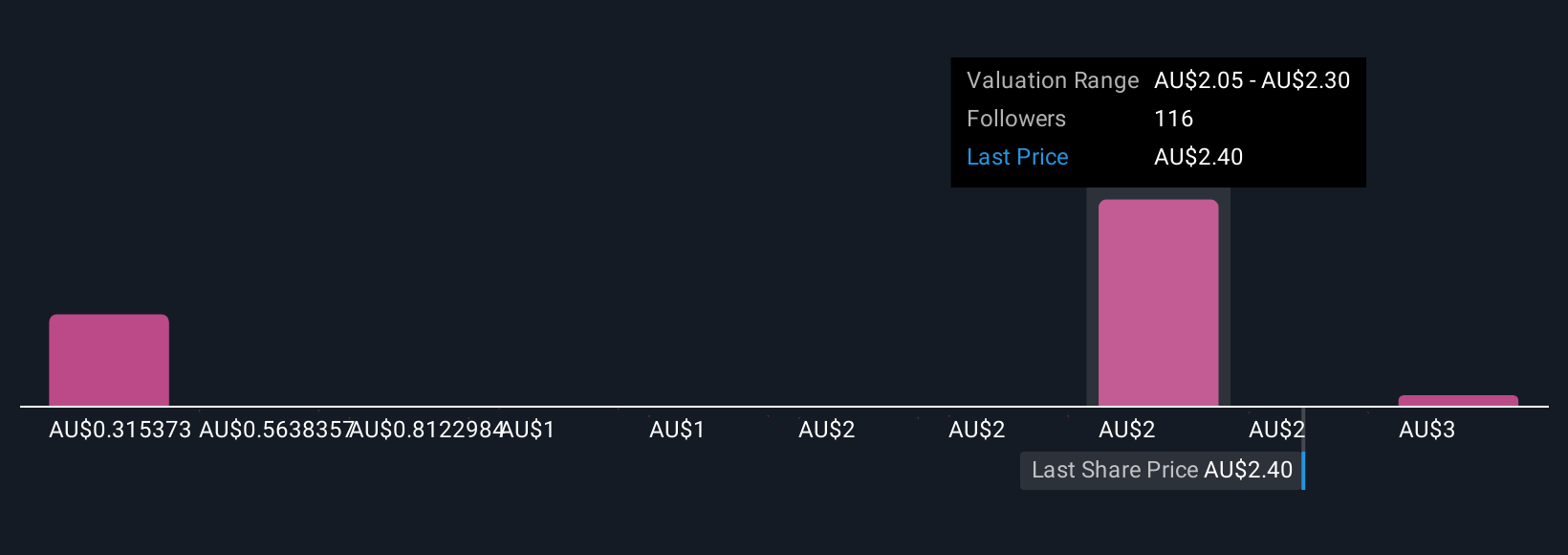

Eighteen members of the Simply Wall St Community place Pilbara’s fair value anywhere from A$0.38 to A$2.80 per share. As lithium supply concerns weigh heavily, future market balance could prove just as influential as current valuation signals, so consider how your view lines up with others before making decisions.

Explore 18 other fair value estimates on Pilbara Minerals - why the stock might be worth less than half the current price!

Build Your Own Pilbara Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pilbara Minerals research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Pilbara Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pilbara Minerals' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PLS

Pilbara Minerals

Engages in the exploration, development, and operation of mineral resources in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives