- Australia

- /

- Metals and Mining

- /

- ASX:PLS

Pilbara Minerals (ASX:PLS) Valuation in Focus as Lithium Market Shifts After China Mine Restart News

Reviewed by Kshitija Bhandaru

Investor interest in Pilbara Minerals (ASX:PLS) has picked up as global lithium market dynamics shift. Chinese approval for lithium mine restarts is fueling talk of oversupply, which is impacting prices and keeping ASX-listed lithium producers in the spotlight.

See our latest analysis for Pilbara Minerals.

After a turbulent stretch for ASX-listed lithium miners, Pilbara Minerals shares have recently climbed above the A$2.50 level as market sentiment steadies following volatility sparked by news out of China. While its 1-year total shareholder return is modestly negative, the latest share price action hints at renewed confidence in response to sector-wide developments and operational updates. Momentum is stabilising, but investors remain focused on the company’s exposure to lithium’s long-term growth themes and supply-side risks.

If you’re curious about where else industry trends could create opportunities, now might be the right moment to broaden your search with fast growing stocks with high insider ownership

With volatility dominating the sector and Pilbara Minerals rebounding above A$2.50, investors are left wondering if current prices reflect real value or if market enthusiasm has already priced in much of the growth potential.

Most Popular Narrative: 17% Overvalued

Pilbara Minerals' current market price of A$2.54 stands above the narrative's fair value estimate of A$2.16, indicating a premium in the eyes of consensus analysts. This gap sets the tone for a valuation debate driven by divergent views around sector growth, margins, and capital projects.

The company's strategy of diversification, such as downstream joint ventures (Gwangyang hydroxide plant in South Korea) and advancing new resources (Colina project in Brazil), broadens revenue streams and reduces reliance on any single market. This approach lowers risk and supports more stable, long-term earnings growth.

Curious what specific revenue ambitions and margin shifts justify such a high valuation compared to current profits? The calculation behind this price is not what you might expect, relying on bold profitability targets and significant market changes. To see which aggressive forecasts and underlying assumptions are behind the narrative’s premium, you will want to explore the full story.

Result: Fair Value of $2.16 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in lithium prices or delays in planned projects could quickly undermine the bullish case that is currently driving sentiment for Pilbara Minerals.

Find out about the key risks to this Pilbara Minerals narrative.

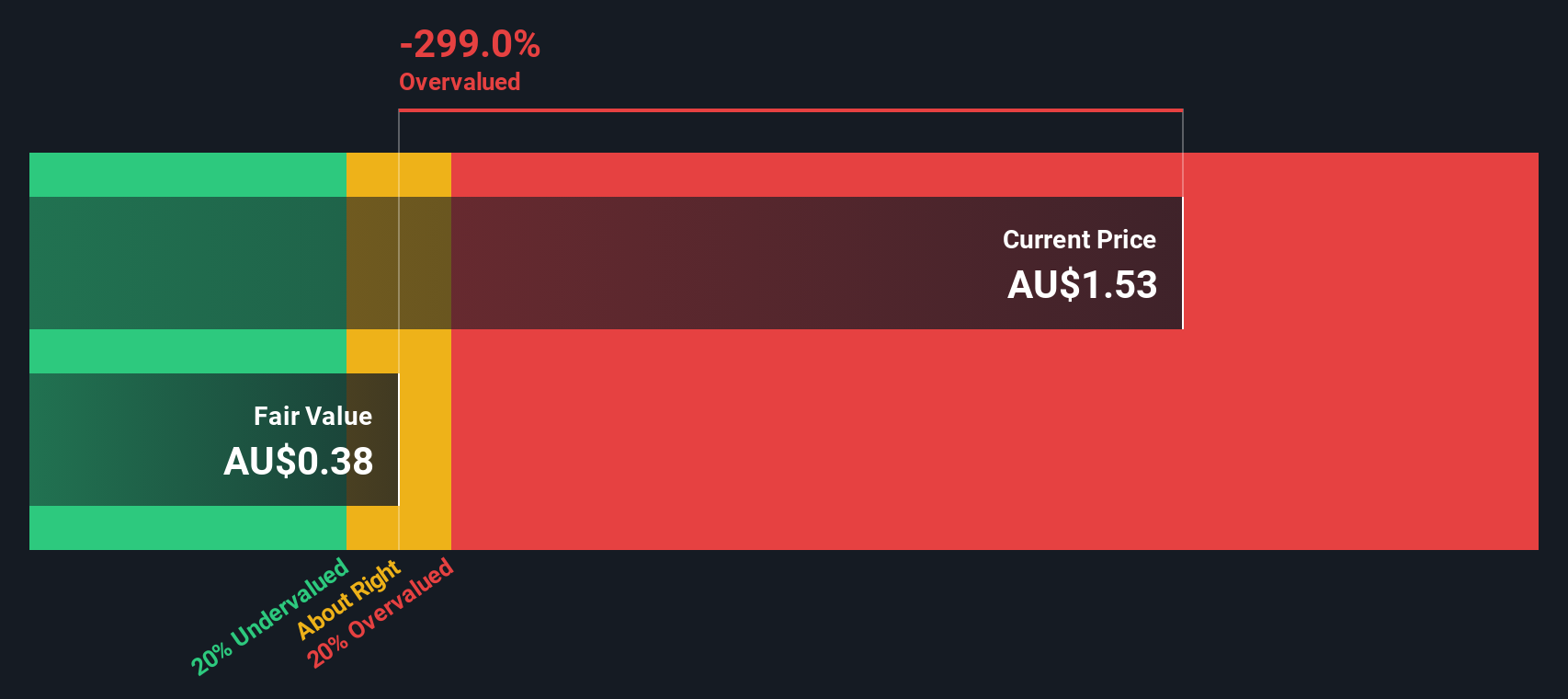

Another View: DCF Model Paints a Sharper Contrast

Looking at Pilbara Minerals through the strictly data-driven lens of the SWS DCF model, the picture shifts dramatically. This method values the company well below its current market price, suggesting the shares are overvalued if future cash flows do not improve much more than expected. Could the market be pricing in too much optimism? Or does the narrative hold up against hard numbers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pilbara Minerals Narrative

If you have a different perspective or want to dig into the numbers yourself, you can develop your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Pilbara Minerals.

Looking for more investment ideas?

Don’t let opportunity pass you by while others unlock market potential. Use the Simply Wall Street Screener to find your next winning investment in moments.

- Start building wealth with steady income by selecting from these 19 dividend stocks with yields > 3%, which consistently offer yields above 3% and reward shareholders year after year.

- Get ahead of tech trends and fuel your portfolio with rapid innovation by reviewing these 24 AI penny stocks, which are at the forefront of artificial intelligence advancements.

- Take advantage of attractive valuations and spot real bargains among these 896 undervalued stocks based on cash flows based on their strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PLS

Pilbara Minerals

Engages in the exploration, development, and operation of mineral resources in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives