- Australia

- /

- Metals and Mining

- /

- ASX:PLS

Pilbara Minerals (ASX:PLS) Reports 2024 Earnings Decline, Highlights Strategic Alliances and Growth Prospects

Reviewed by Simply Wall St

Pilbara Minerals (ASX:PLS) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a 26% increase in production and a 43% rise in sales, juxtaposed against declining pricing and high operating costs. In the discussion that follows, we will explore Pilbara Minerals' financial health, operational efficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click here to discover the nuances of Pilbara Minerals with our detailed analytical report.

Strengths: Core Advantages Driving Sustained Success For Pilbara Minerals

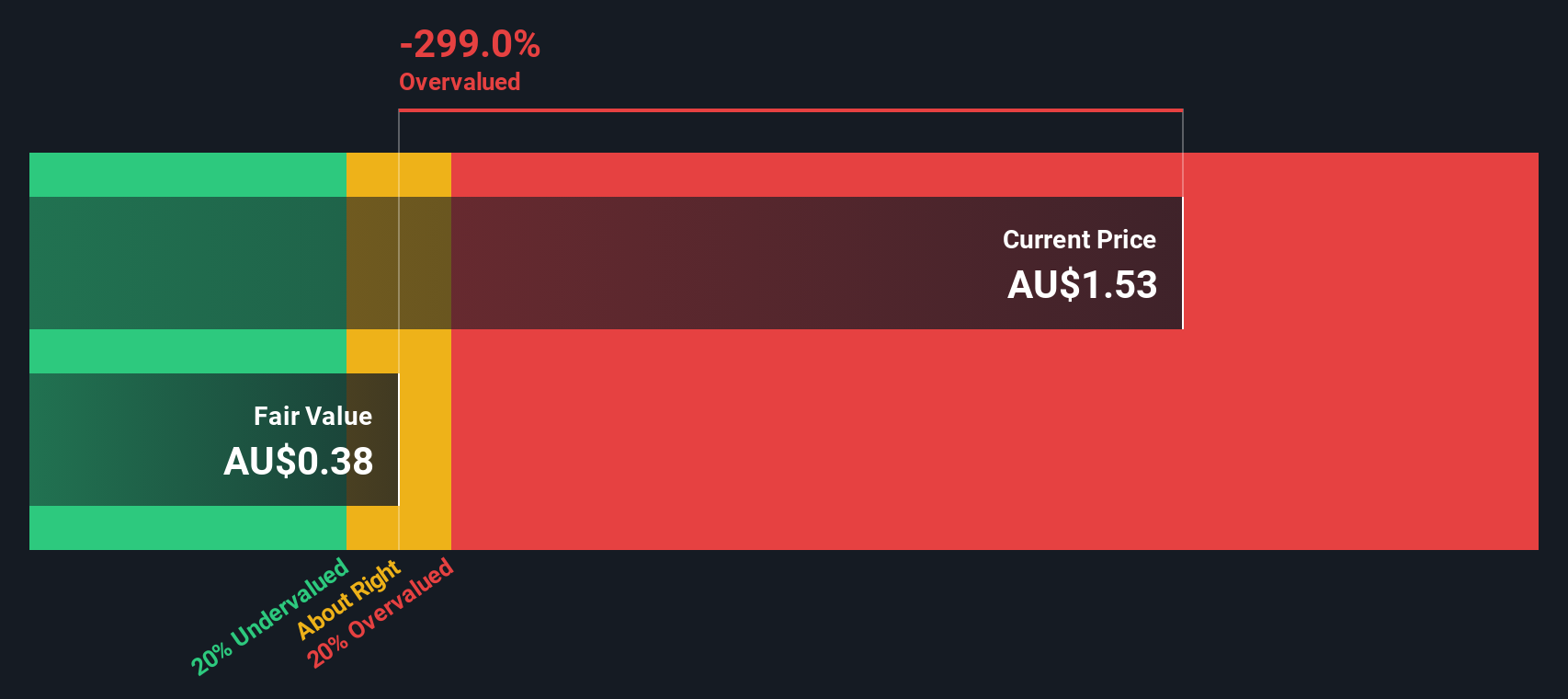

Pilbara Minerals has demonstrated operational performance, with a 26% increase in production to 226,000 tonnes and a 43% increase in sales to 36,000 tonnes, as highlighted by Dale Henderson, Managing Director and CEO, in the latest earnings call. The company's financial health is strong, boasting a cash balance of $1.6 billion as of June 30. Additionally, the firm has achieved a 12% reduction in unit operating costs, reflecting efficient cost management. Despite a high Price-To-Earnings Ratio (34.6x) compared to the industry average (13.2x), Pilbara is trading at $2.95, significantly below its estimated fair value of $8.41, indicating potential undervaluation.

To dive deeper into how Pilbara Minerals's valuation metrics are shaping its market position, check out our detailed analysis of Pilbara Minerals's Valuation.

Weaknesses: Critical Issues Affecting Pilbara Minerals's Performance and Areas For Growth

Pilbara Minerals faces challenges with declining pricing, as noted by Dale Henderson, and high operating costs, despite recent improvements. The company's Return on Equity is forecasted to be low at 15.4% in three years, which is below industry benchmarks. Additionally, the company's net profit margins have decreased from 58.8% to 20.5% over the past year. The high level of non-cash earnings further complicates the financial picture. While trading below fair value, the high Price-To-Earnings Ratio compared to the industry average suggests that the stock may still be considered expensive.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Pilbara Minerals is well-positioned to capitalize on several growth opportunities. The P2000 project, which promises a future production capacity of 2 million tonnes per annum, is a significant milestone. The company's joint venture with POSCO is progressing well, opening new avenues for downstream integration. The growing demand for electric vehicles (EVs) presents a substantial market opportunity, supported by government initiatives like the European Commission's grant to Volvo. Pilbara's earnings are forecasted to grow at 26.7% per year, significantly outpacing the Australian market's 12.2% growth rate.

To gain deeper insights into Pilbara Minerals's historical performance, explore our detailed analysis of past performance.

Threats: Key Risks and Challenges That Could Impact Pilbara Minerals's Success

Pilbara Minerals faces several threats. Competition remains fierce, with higher-cost supply sources exiting the market and limited access to capital for new projects. Economic factors, such as the softening of pricing observed in the latest earnings call, pose additional risks. Regulatory issues, including increased tariffs on Chinese EVs by the U.S. government, could impact market dynamics. Operational risks are also a concern, as scaling up production is inherently challenging, as noted by Dale Henderson. These factors could potentially hinder the company's long-term growth and market share.

Conclusion

Pilbara Minerals' operational efficiency and strong financial health, highlighted by increased production and sales, a substantial cash balance, and reduced unit operating costs, position the company well for future growth. However, challenges such as declining pricing, high operating costs, and lower forecasted Return on Equity indicate areas for improvement. The company's strategic initiatives, including the P2000 project and joint venture with POSCO, along with the growing demand for electric vehicles, present significant growth opportunities. The company faces risks from fierce competition and economic factors. Currently trading at A$2.95, below its estimated fair value of A$8.41, Pilbara Minerals may offer potential for investors, considering its projected earnings growth and market opportunities.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:PLS

Pilbara Minerals

Engages in the exploration, development, and operation of mineral resources in Australia.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives