Pact Group Holdings' (ASX:PGH) Shareholders Will Receive A Bigger Dividend Than Last Year

Pact Group Holdings Ltd (ASX:PGH) has announced that it will be increasing its dividend on the 7th of October to AU$0.06. This takes the dividend yield to 2.5%, which shareholders will be pleased with.

Check out our latest analysis for Pact Group Holdings

Pact Group Holdings' Earnings Easily Cover the Distributions

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. The last dividend was quite easily covered by Pact Group Holdings' earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

The next year is set to see EPS grow by 4.2%. If the dividend continues on this path, the payout ratio could be 36% by next year, which we think can be pretty sustainable going forward.

Pact Group Holdings' Dividend Has Lacked Consistency

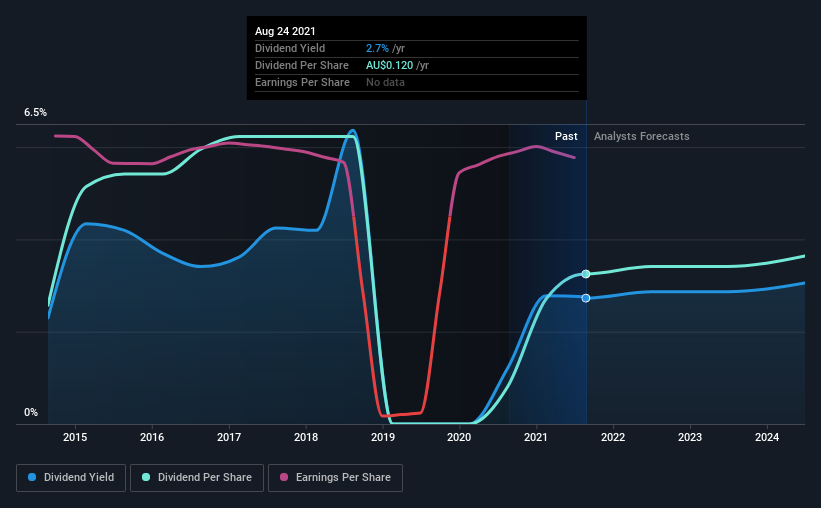

Even in its relatively short history, the company has reduced the dividend at least once. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The dividend has gone from AU$0.095 in 2014 to the most recent annual payment of AU$0.12. This works out to be a compound annual growth rate (CAGR) of approximately 3.4% a year over that time. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Over the past five years, it looks as though Pact Group Holdings' EPS has declined at around 2.5% a year. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Pact Group Holdings' payments are rock solid. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for Pact Group Holdings that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

When trading Pact Group Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:PGH

Pact Group Holdings

Engages in the manufacture and supply of rigid plastic and metal packaging in Australia, New Zealand, Asia, and internationally.

Low and slightly overvalued.

Market Insights

Community Narratives