- Australia

- /

- Oil and Gas

- /

- ASX:GHY

ASX Penny Stocks With Market Caps Under A$3B

Reviewed by Simply Wall St

The ASX200 is set to open slightly higher today, buoyed by optimism from a recent US trade deal framework with the UK, which has lifted global market sentiment. Penny stocks, often seen as a niche investment area, represent opportunities for growth through smaller or newer companies that can offer significant potential when backed by strong fundamentals. In this article, we explore three penny stocks on the ASX that combine solid financial health with promising prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.72 | A$138.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.91 | A$1.08B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.54 | A$72.65M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.69 | A$414.75M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.41M | ✅ 3 ⚠️ 2 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.70 | A$451.85M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.34 | A$158.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.11 | A$709.31M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.54 | A$754.72M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.81 | A$1.29B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 991 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Gold Hydrogen (ASX:GHY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gold Hydrogen Limited focuses on the discovery, exploration, and development of hydrogen and helium gas in Australia with a market cap of A$117.41 million.

Operations: Currently, there are no reported revenue segments for Gold Hydrogen Limited.

Market Cap: A$117.41M

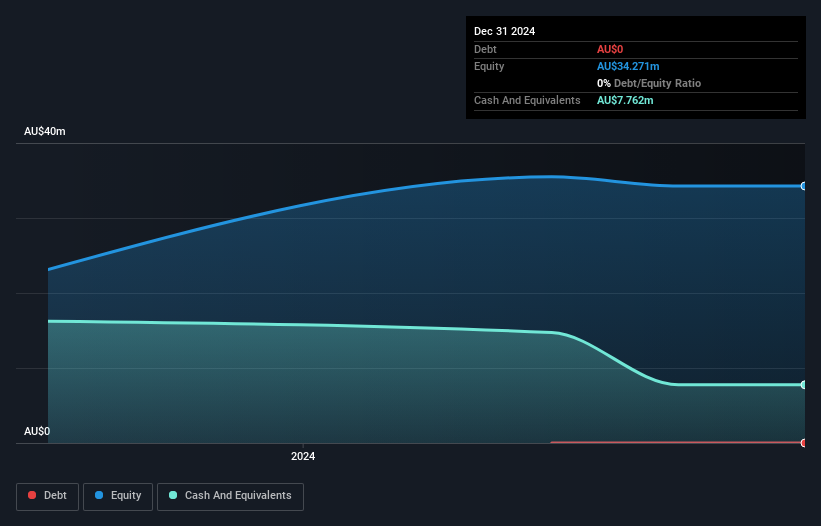

Gold Hydrogen Limited, with a market cap of A$117.41 million, is a pre-revenue company focused on hydrogen and helium exploration in Australia. Despite being debt-free for the past five years and having short-term assets (A$8.0M) exceeding both short- and long-term liabilities, its high volatility remains a concern as it surpasses 75% of Australian stocks. The company has less than a year of cash runway if current free cash flow trends persist, while management's limited experience may pose challenges. Recent earnings reported a net loss of A$1.31 million for the half-year ending December 2024, slightly widening from the previous year’s loss.

- Navigate through the intricacies of Gold Hydrogen with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Gold Hydrogen's track record.

Horizon Oil (ASX:HZN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Horizon Oil Limited, with a market cap of A$300.68 million, is involved in the exploration, development, and production of oil and gas properties across China, New Zealand, and Australia.

Operations: The company's revenue is primarily derived from its exploration and development activities in China, generating $60.53 million, and New Zealand, contributing $34.26 million.

Market Cap: A$300.68M

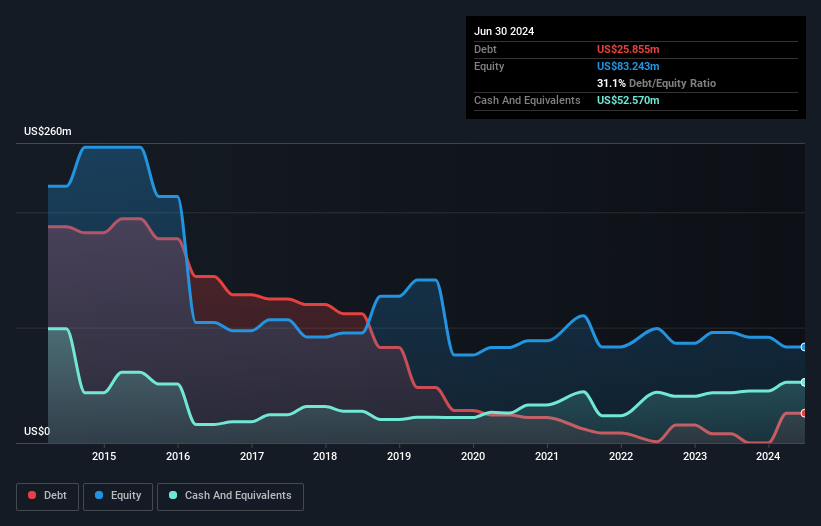

Horizon Oil Limited, with a market cap of A$300.68 million, is engaged in oil and gas exploration and production across China, New Zealand, and Australia. The company reported half-year sales of US$55.86 million but experienced a decline in net income to US$6.58 million from the previous year. Despite reduced profit margins and negative earnings growth over the past year, Horizon maintains strong interest coverage at 60.8 times EBIT and holds more cash than total debt. However, its dividend yield of 15% is not well supported by earnings or free cash flow, raising sustainability concerns for investors seeking stable returns from penny stocks.

- Get an in-depth perspective on Horizon Oil's performance by reading our balance sheet health report here.

- Understand Horizon Oil's track record by examining our performance history report.

Ora Banda Mining (ASX:OBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties with a market cap of A$2.20 billion.

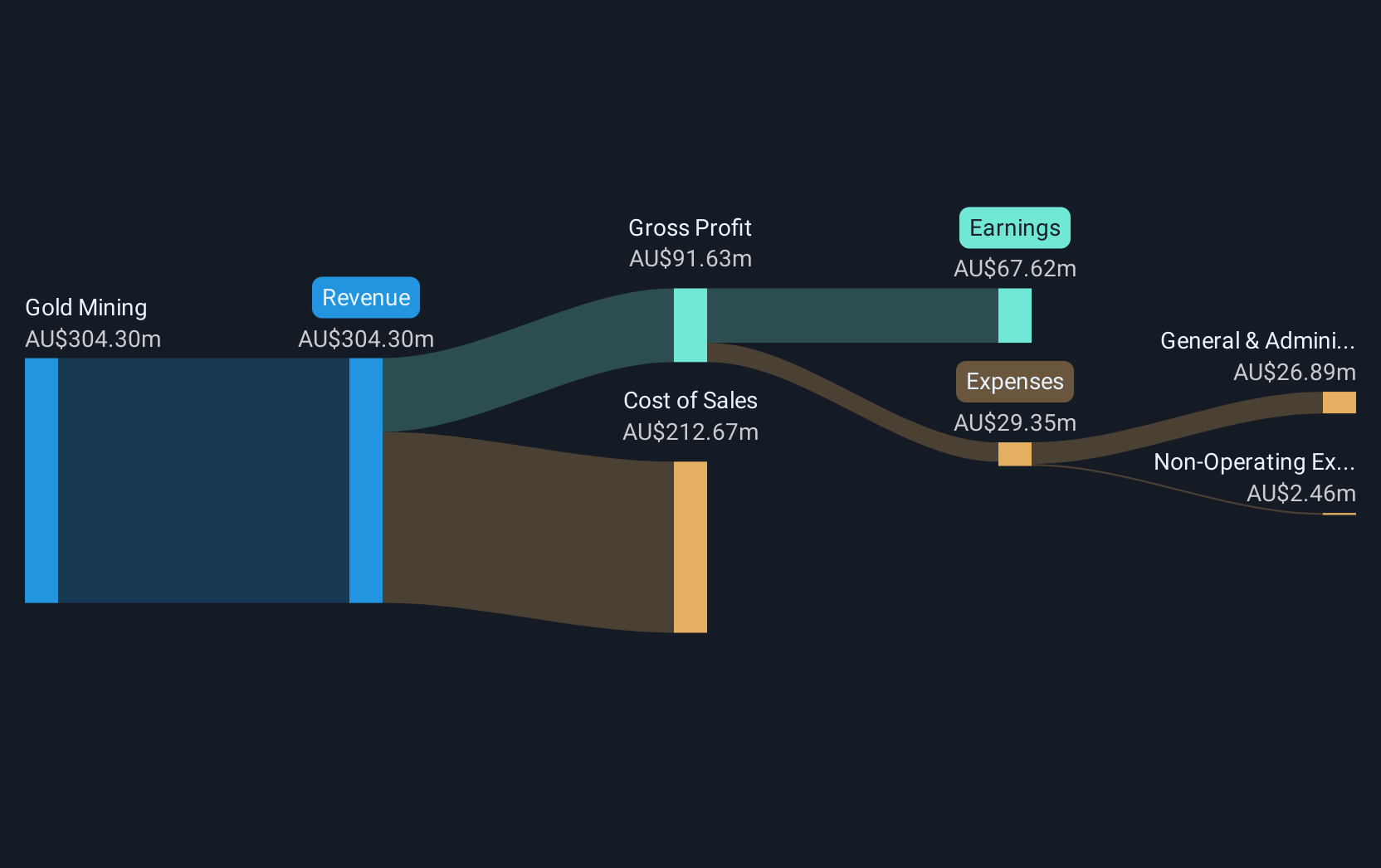

Operations: The company's revenue is derived entirely from its gold mining operations, amounting to A$304.30 million.

Market Cap: A$2.2B

Ora Banda Mining Limited, with a market cap of A$2.20 billion, has shown significant financial improvement, reporting half-year sales of A$186.42 million and net income of A$50.84 million compared to the previous year. The company's interest payments are well covered by EBIT at 29.2 times coverage, and its debt is efficiently managed with operating cash flow covering 2923% of debt levels. Despite recent executive changes and a relatively new management team, Ora Banda's inclusion in the S&P/ASX indices reflects growing investor confidence. The secured Syndicated Facility Agreement enhances liquidity beyond A$100 million, supporting future operations amidst volatile gold prices.

- Take a closer look at Ora Banda Mining's potential here in our financial health report.

- Evaluate Ora Banda Mining's prospects by accessing our earnings growth report.

Next Steps

- Explore the 991 names from our ASX Penny Stocks screener here.

- Looking For Alternative Opportunities? Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GHY

Gold Hydrogen

Engages in the discovery, exploration, and development of hydrogen and helium gas in Australia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives