Broker Revenue Forecasts For Nufarm Limited (ASX:NUF) Are Surging Higher

Celebrations may be in order for Nufarm Limited (ASX:NUF) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects. Investor sentiment seems to be improving too, with the share price up 8.1% to AU$5.90 over the past 7 days. Could this big upgrade push the stock even higher?

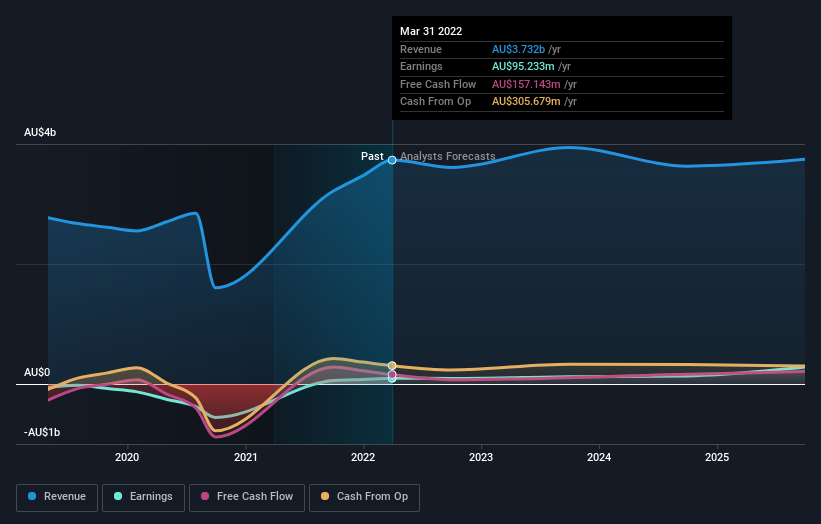

Following the latest upgrade, Nufarm's eleven analysts currently expect revenues in 2023 to be AU$3.7b, approximately in line with the last 12 months. Statutory earnings per share are presumed to shoot up 32% to AU$0.33. Prior to this update, the analysts had been forecasting revenues of AU$3.5b and earnings per share (EPS) of AU$0.29 in 2023. There's been a pretty noticeable increase in sentiment, with the analysts upgrading revenues and making a nice increase in earnings per share in particular.

Our analysis indicates that NUF is potentially undervalued!

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of AU$6.65, suggesting that the forecast performance does not have a long term impact on the company's valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Nufarm at AU$7.40 per share, while the most bearish prices it at AU$5.58. Still, with such a tight range of estimates, it suggests the analysts have a pretty good idea of what they think the company is worth.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would also point out that the forecast 0.03% annualised revenue decline to the end of 2023 is better than the historical trend, which saw revenues shrink 0.2% annually over the past five years Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 6.5% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Nufarm to suffer worse than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Nufarm.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Nufarm going out to 2025, and you can see them free on our platform here..

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Nufarm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NUF

Nufarm

Develops, manufactures, and sells crop protection solutions and seed technologies in Europe, the Middle East, Africa, North America, and the Asia Pacific.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives