- Australia

- /

- Metals and Mining

- /

- ASX:NTU

Northern Minerals (ASX:NTU) Is Up 24.4% After Surge in Government-Backed Rare Earth Sector Activity

Reviewed by Sasha Jovanovic

- In recent months, rare earth sector activity has accelerated as China's export controls and new US-Australia policy initiatives led to strong company updates, including Lynas's A$750 million capital raise and expansion plans.

- These moves highlight growing government involvement in securing critical minerals supply chains, signaling potential opportunities for Australian producers such as Northern Minerals.

- We'll explore how increased government-backed investment and price support mechanisms are influencing Northern Minerals' overall investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Northern Minerals' Investment Narrative?

For anyone considering Northern Minerals, the core thesis is all about faith in major geopolitical and industrial tailwinds, specifically, the global scramble to secure non-Chinese rare earth supply. The recent US-Australia minerals deal and price floor for NdPr signals meaningful policy backing, mirroring the extraordinary price moves seen this year elsewhere in the sector. While this support could offer some uplift to short-term catalysts like funding access and offtake confidence, it doesn't instantly resolve big challenges. Northern Minerals continues to wrestle with declining revenues, consistent losses, the risk of capital raisings and looming doubts around its ability to keep operating as a going concern. Boardroom disputes and management turnover add further unpredictability. The policy news is encouraging, but until it translates into stronger operating results or financial stability, the risks remain substantial.

But despite this optimism, persistent doubts over funding and business viability should not be ignored.

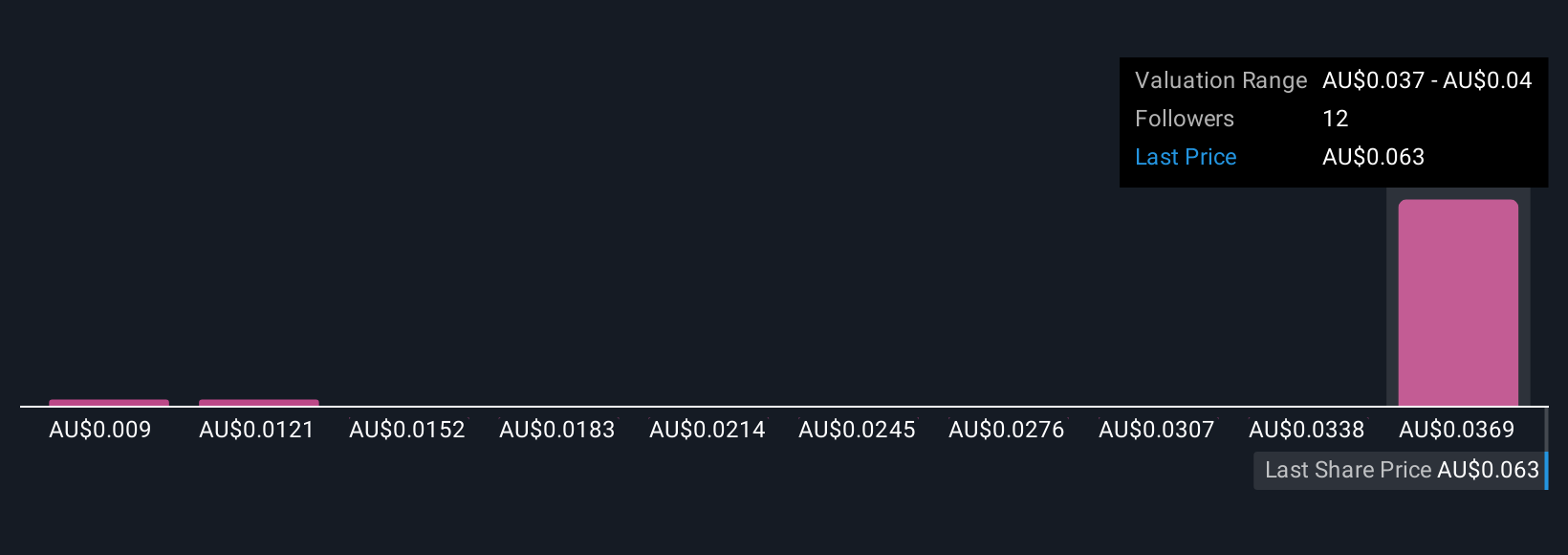

Our comprehensive valuation report raises the possibility that Northern Minerals is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 3 other fair value estimates on Northern Minerals - why the stock might be worth as much as A$0.04!

Build Your Own Northern Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Minerals research is our analysis highlighting 6 important warning signs that could impact your investment decision.

- Our free Northern Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Minerals' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NTU

Northern Minerals

Operates in the mineral exploration industry in Australia.

Medium-low risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives