- Australia

- /

- Metals and Mining

- /

- ASX:NST

Why Northern Star Resources Limited (ASX:NST) Could Be Your Next Investment

Building up an investment case requires looking at a stock holistically. Today I've chosen to put the spotlight on Northern Star Resources Limited (ASX:NST) due to its excellent fundamentals in more than one area. NST is a company with robust financial health as well as an optimistic growth outlook. Below, I've touched on some key aspects you should know on a high level. For those interested in understanding where the figures come from and want to see the analysis, read the full report on Northern Star Resources here.

Flawless balance sheet with reasonable growth potential

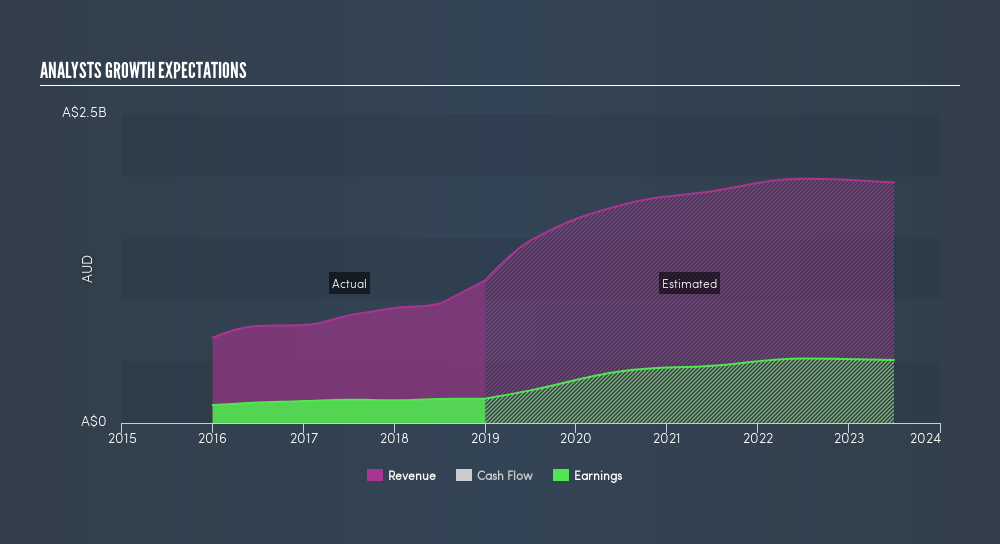

Investors in search of impressive top-line expansion should look no further than NST, with its expected 58% revenue growth in the upcoming year. This underlies the notable 26% return on equity over the next few years leading up to 2022. NST's ability to maintain an adequate level of cash to meet upcoming liabilities is a good sign for its financial health. This indicates that NST has sufficient cash flows and proper cash management in place, which is a crucial insight into the health of the company. NST appears to have made good use of debt, producing operating cash levels of 9.51x total debt in the prior year. This is a strong indication that debt is reasonably met with cash generated.

Next Steps:

For Northern Star Resources, I've compiled three key factors you should further research:

- Historical Performance: What has NST's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Valuation: What is NST worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether NST is currently mispriced by the market.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of NST? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:NST

Northern Star Resources

Engages in the exploration, development, mining, and processing of gold deposits.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026