- Australia

- /

- Metals and Mining

- /

- ASX:NST

Northern Star Resources (ASX:NST): Evaluating Valuation After Quarterly Results and Forward Guidance Reaffirmation

Reviewed by Simply Wall St

Northern Star Resources (ASX:NST) released its first quarter results, selling 381,000 ounces of gold at an all-in sustaining cost of A$2,522 per ounce. The company also reaffirmed its guidance for fiscal year 2026.

See our latest analysis for Northern Star Resources.

After a year of sustained momentum, Northern Star Resources has seen its share price climb 54.8% year-to-date, with a three-year total shareholder return of 175.6% highlighting steady outperformance. This recent rally suggests investors are rewarding its reliable production outlook and are growing more optimistic about its longer-term growth story.

If Northern Star’s resilience has you searching for the next big mover, now is a great time to discover fast growing stocks with high insider ownership

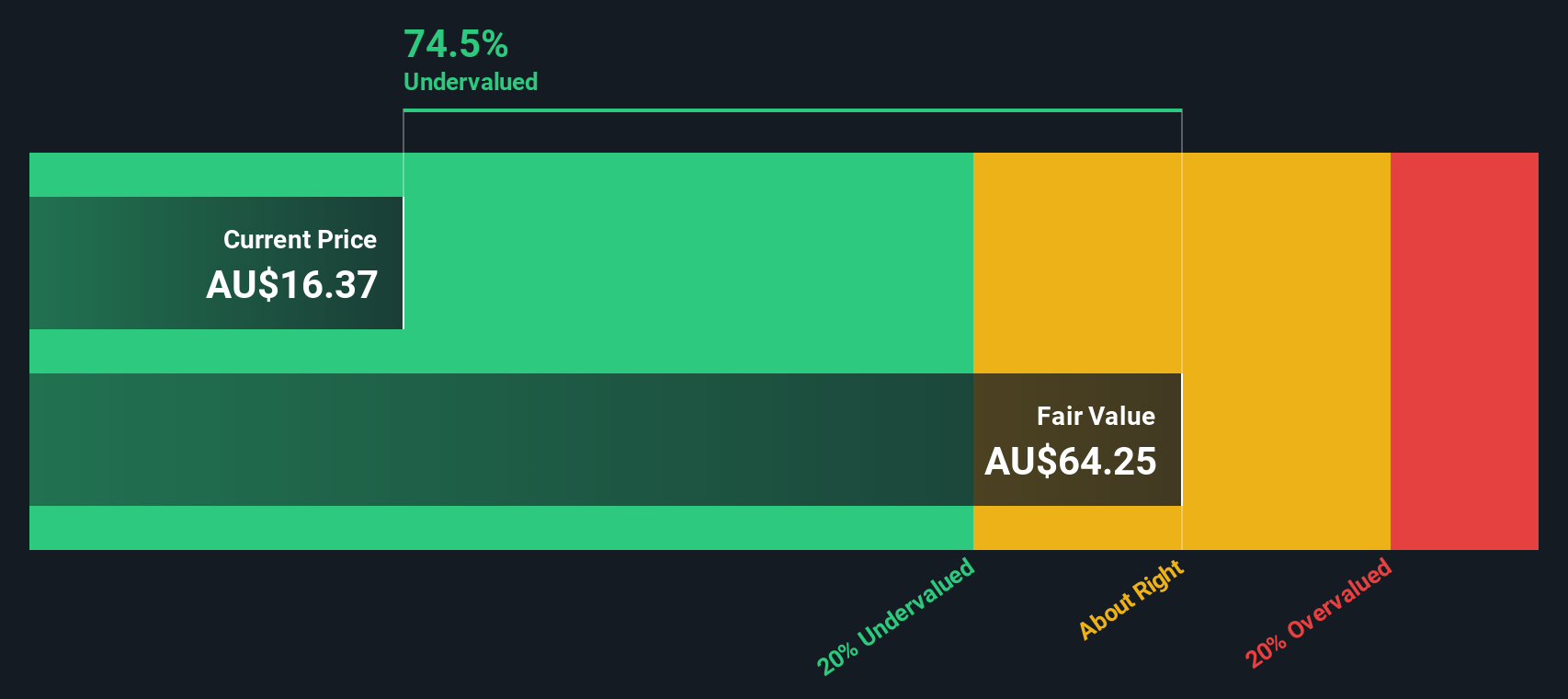

With the stock trading near record highs and recent results already factored into the price, the question now is whether Northern Star is still undervalued or if the market has already priced in its growth prospects.

Most Popular Narrative: 8.7% Overvalued

According to the most widely followed narrative, Northern Star’s recent closing price sits above the calculated fair value of $22. This suggests the shares may be trading ahead of their estimated worth. The narrative outlines the underlying assumptions shaping this perspective.

Finding genuine value in the current market is becoming increasingly difficult. Stock indices are at or near all-time highs. Ironically, despite this strength, there remains significant uncertainty surrounding international trade and the ongoing stability of the US dollar as the world’s reserve currency. This uncertainty has driven the gold price sharply higher, suggesting there may now be some value to find in gold producers.

Want to know the growth formula behind this valuation? The narrative bases its fair value on one central argument: Northern Star’s substantial reserves and a potential future production increase. The numbers behind these projections could significantly change how you view the company’s potential. Interested in the assumptions that drive this price estimate? Explore and discover the key details shaping the full story.

Result: Fair Value of $22.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected regulatory changes or a sharp downturn in gold prices could quickly challenge these optimistic assumptions for Northern Star’s outlook.

Find out about the key risks to this Northern Star Resources narrative.

Another View: Our DCF Model Sees Upside

While multiples suggest Northern Star is priced above its fair value, our SWS DCF model presents a different view. Based on future cash flows, it indicates the stock is trading around 44.6% below its intrinsic value, which may point to strong underlying value if the growth outlook holds. Which perspective will prove more accurate as market dynamics change?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northern Star Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northern Star Resources Narrative

If you believe there’s another side to the story or want to dive into the numbers yourself, it’s easy to create a custom narrative in just a few minutes. Do it your way

A great starting point for your Northern Star Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to put your money to work in places others are missing. The right opportunity may be just one smart move away, so don’t let it slip by.

- Boost your portfolio’s potential by targeting companies with strong financials using these 3598 penny stocks with strong financials before the crowd catches on.

- Seize the advantage in cutting-edge healthcare with these 33 healthcare AI stocks and position yourself at the intersection of medicine and machine learning.

- Capture reliable income streams by locking in yields above 3% with these 18 dividend stocks with yields > 3%, and watch your returns compound over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Star Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NST

Northern Star Resources

Engages in the exploration, development, mining, and processing of gold deposits.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives