- Australia

- /

- Metals and Mining

- /

- ASX:NST

Is Northern Star Resources Fairly Priced After $500 Million KCGM Expansion Announcement?

Reviewed by Simply Wall St

Thinking about your next move with Northern Star Resources? You are not alone. With gold prices often grabbing headlines and volatility common in global markets, investors are keeping a close eye on this ASX-listed miner’s share price. If you are feeling stuck between the fear of missing out on more upside and worry about a potential cool-down, you are in good company.

Let’s break down what has been happening lately. Over the past year, Northern Star’s stock is up an impressive 23%, and its year-to-date return has reached nearly 17%. After a strong 8% gain in the last month, it is not surprising that market chatter around this stock has picked up. However, the last quarter’s 11% pullback shows there is still some caution in the air as investors digest recent results and shifting market dynamics. Some industry observers believe that gold market fundamentals and the company’s steady revenue and earnings growth have contributed to renewed optimism, even as risk sentiment fluctuates.

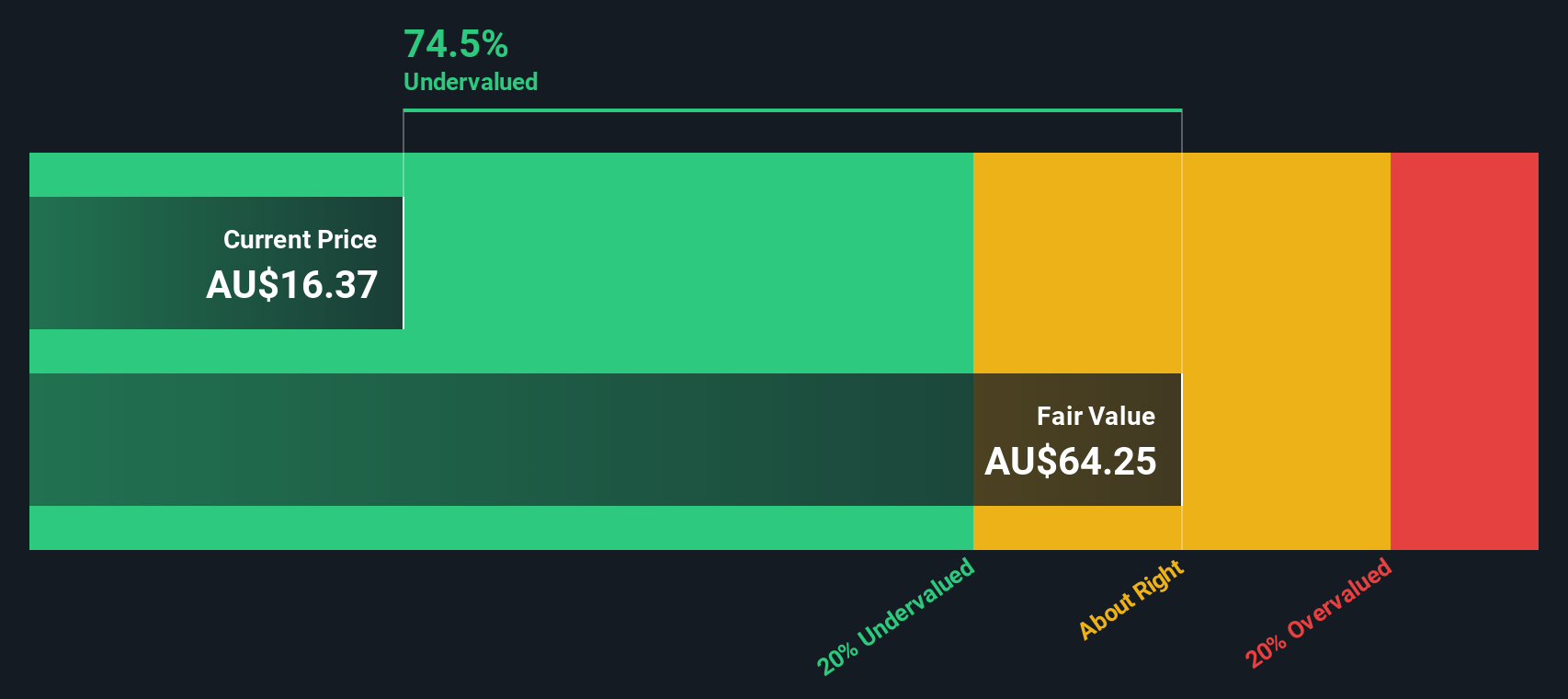

So, how does Northern Star stack up when we look beneath the surface? Out of six key valuation checks, the company is undervalued in just two, giving it a valuation score of 2. This is not exactly a home run, but it also does not rule out hidden value. In the next section, we will dive into how analysts and different valuation methods approach Northern Star. Before we finish, we will also explore whether there is a smarter, more holistic way to understand the company’s true worth.

Northern Star Resources delivered 23.3% returns over the last year. See how this stacks up to the rest of the Metals and Mining industry.Approach 1: Northern Star Resources Cash Flows

A Discounted Cash Flow (DCF) model estimates a company’s true worth by forecasting future cash flows and discounting them to present value. This approach helps investors assess whether a stock appears cheap or expensive.

For Northern Star Resources, the most recent Free Cash Flow is A$964.5 million. Analysts project that by 2030, the company’s Free Cash Flow could reach around A$2.3 billion. This expected growth is tracked year by year, incorporating multiple analyst forecasts and anticipating a steady climb over the next decade.

Using a 2 Stage Free Cash Flow to Equity DCF calculation, the model arrives at an intrinsic value of about A$21.29 per share. Based on this calculation, Northern Star Resources appears roughly 15.2% undervalued at current prices, which suggests the market may not fully account for future cash generation. For investors considering cash flows, this indicates the stock could be attractively priced relative to its fundamentals.

Result: UNDERVALUED

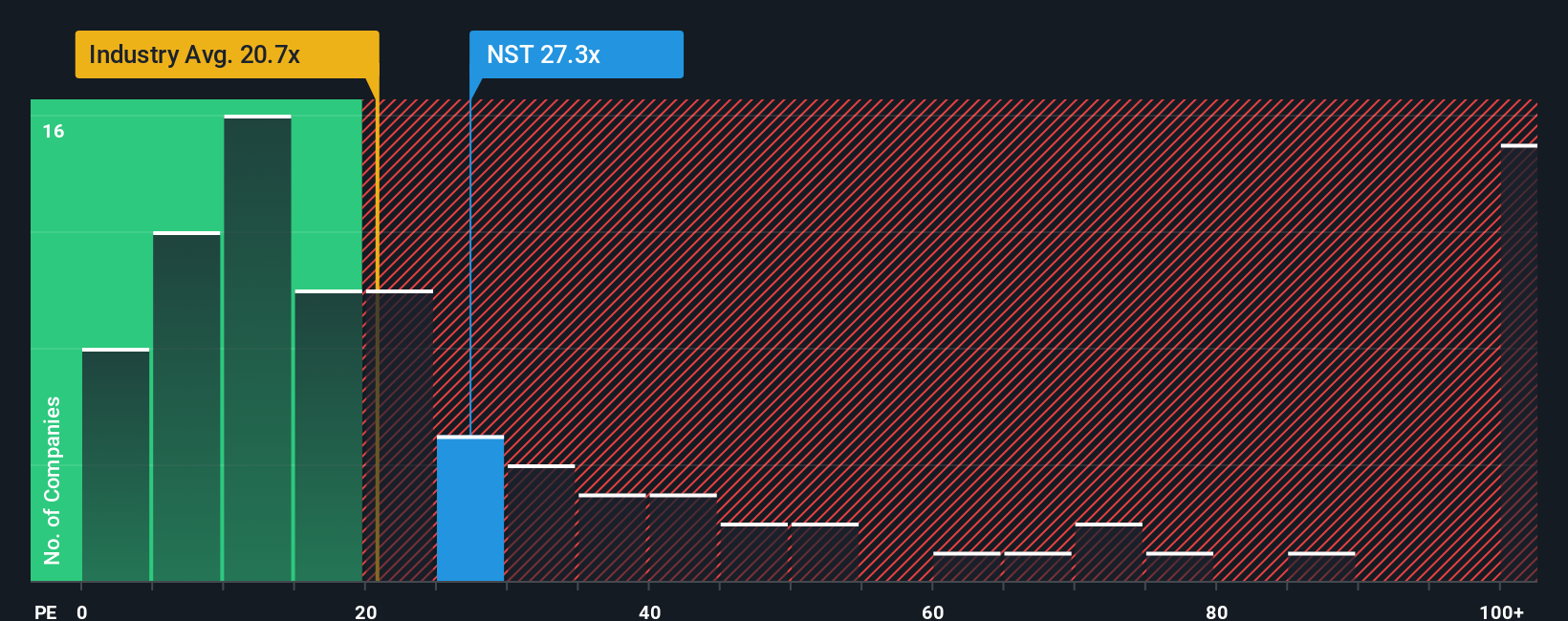

Approach 2: Northern Star Resources Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Northern Star Resources, as it reflects how much investors are willing to pay for each dollar of current earnings. This metric is particularly insightful for established businesses because it captures both growth expectations and the perceived risk associated with future profitability.

What constitutes a “fair” PE ratio can differ depending on factors such as projected earnings growth and the company’s risk profile. In general, investors are willing to accept higher PE ratios for companies that are growing quickly or operate in less risky environments. On the other hand, a lower PE is often justified if there are concerns about stability or the sustainability of profits.

Currently, Northern Star trades at a PE of 19.26x. This places it above the broader Metals and Mining industry average of 14.17x but below its peer group’s average of 24.33x. According to Simply Wall St’s proprietary Fair Ratio, which accounts for various factors from earnings growth to risk and profit margins, a fair PE for Northern Star stands at 18.72x. This is very close to the current multiple and suggests that the stock is trading at roughly fair value based on earnings.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Northern Star Resources Narrative

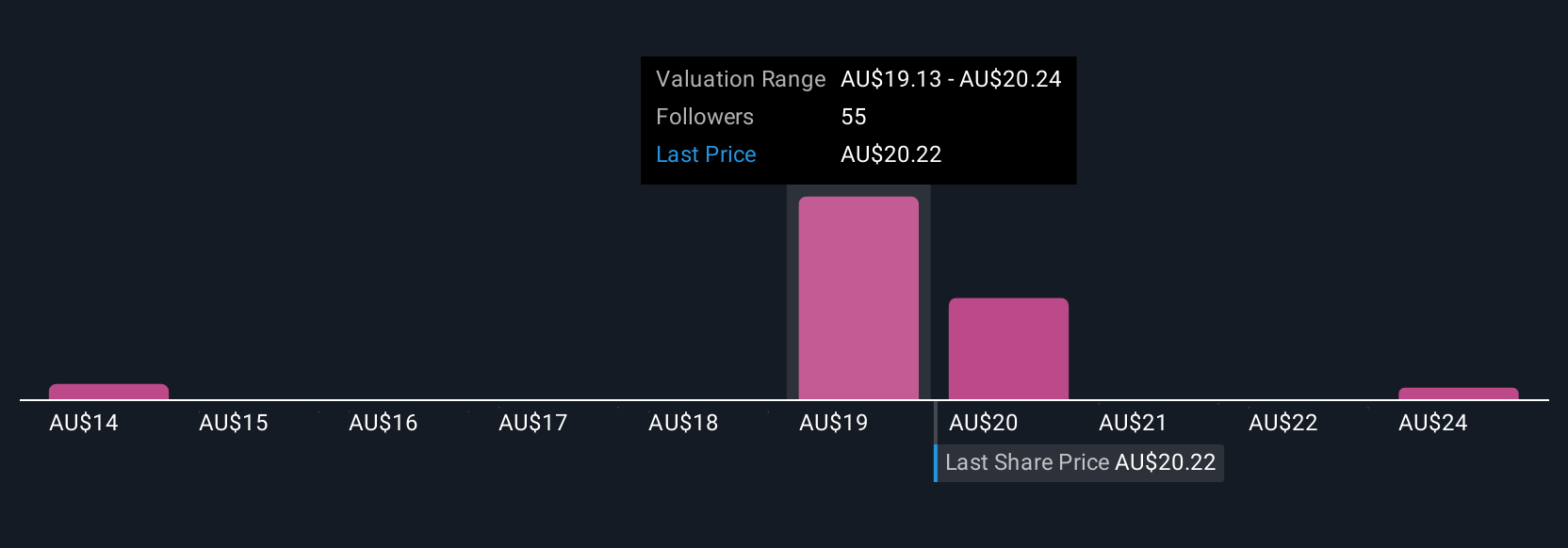

Instead of relying only on traditional valuation ratios, Narratives offer a powerful way to bring together the story you believe about Northern Star Resources and connect it to a financial forecast and a fair value estimate.

A Narrative is essentially your perspective on the company’s future, including what you expect for its revenue, earnings, and profit margins. These views are connected to real-world events such as acquisitions, expansions, or production challenges. Narratives are at the core of the Simply Wall St platform and community, helping millions of investors easily compare their own perspectives to analyst estimates and see what really drives a stock’s value.

Using Narratives allows you to quickly assess whether you expect Northern Star Resources’ fair value to be above or below the current price. This can help guide your investment decisions. Narratives update dynamically whenever new information, such as news or earnings announcements, reaches the market, ensuring your investment story stays aligned with reality.

For example, some investors analyzing Northern Star Resources believe revenue may grow quickly and margins will increase, leading to a fair value as high as A$25.0 per share. Others are more concerned about cost pressures and operational risks, estimating a fair value closer to A$13.0 per share.

Do you think there's more to the story for Northern Star Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Star Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NST

Northern Star Resources

Engages in the exploration, development, mining, and processing of gold deposits.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives