- Australia

- /

- Metals and Mining

- /

- ASX:NIC

ASX Stocks That May Be Undervalued In October 2025

Reviewed by Simply Wall St

As the Australian market experiences a slight pullback following a bullish surge, investors are keenly observing the ASX 200's movements amidst fluctuating global economic factors such as U.S. government shutdown concerns and rising gold prices. In this context, identifying undervalued stocks can be particularly appealing, as they may offer potential opportunities for growth in a market that is currently experiencing volatility and consolidation.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$3.25 | A$5.67 | 42.7% |

| Resimac Group (ASX:RMC) | A$1.15 | A$2.17 | 47.1% |

| Reckon (ASX:RKN) | A$0.63 | A$1.18 | 46.8% |

| NRW Holdings (ASX:NWH) | A$4.68 | A$8.58 | 45.5% |

| Immutep (ASX:IMM) | A$0.275 | A$0.5 | 44.7% |

| Elders (ASX:ELD) | A$7.46 | A$14.04 | 46.9% |

| Cynata Therapeutics (ASX:CYP) | A$0.225 | A$0.44 | 48.9% |

| Credit Clear (ASX:CCR) | A$0.27 | A$0.47 | 42.2% |

| CleanSpace Holdings (ASX:CSX) | A$0.73 | A$1.41 | 48.1% |

| Airtasker (ASX:ART) | A$0.41 | A$0.72 | 42.7% |

We'll examine a selection from our screener results.

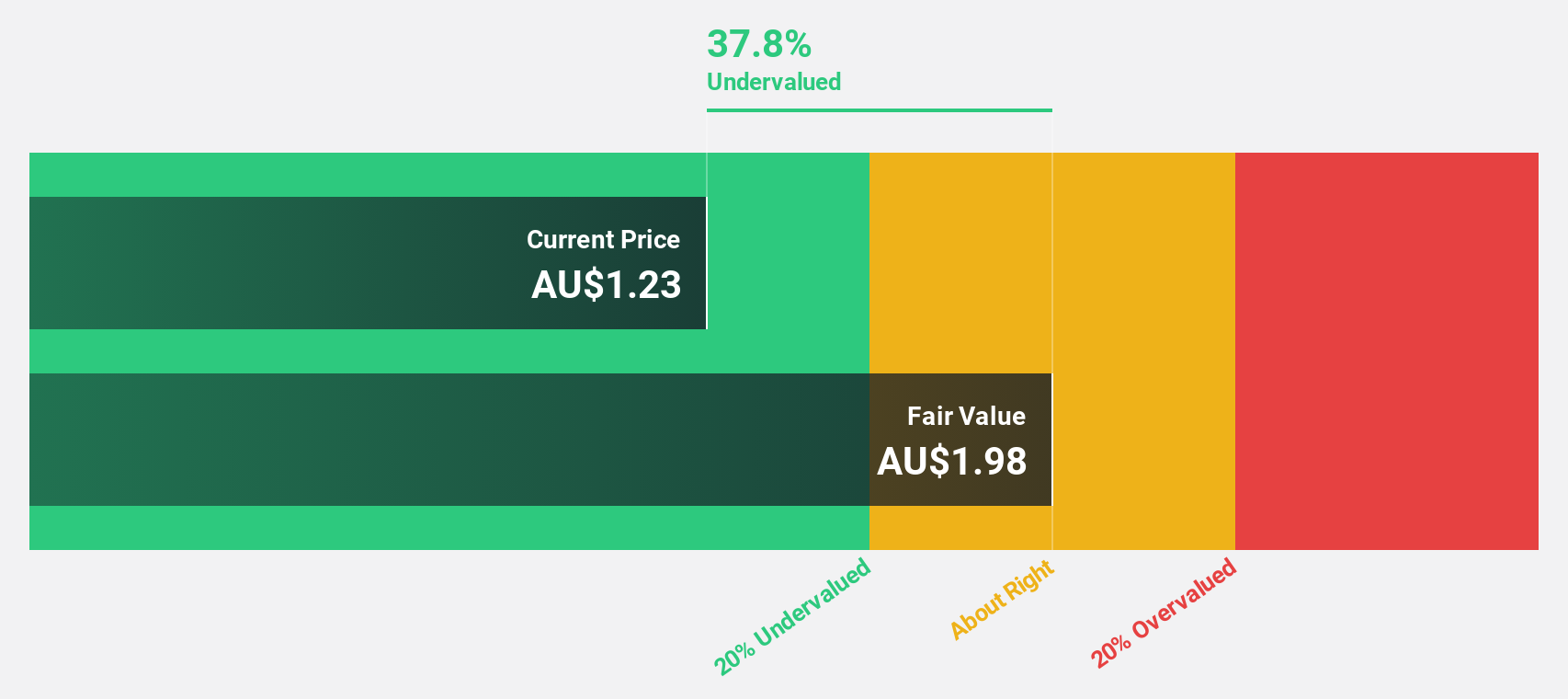

Infomedia (ASX:IFM)

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market cap of A$635.80 million.

Operations: The company's revenue primarily comes from its Publishing - Periodicals segment, which generated A$146.51 million.

Estimated Discount To Fair Value: 18.8%

Infomedia is trading at A$1.69, below its estimated fair value of A$2.07, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 20% annually, surpassing the Australian market's growth rate. However, its dividend yield of 2.49% is not well covered by earnings. Recent developments include a scheme implementation agreement with TPG Growth Capital Asia Limited for acquisition valued at approximately A$650 million or A$1.72 per share.

- Our expertly prepared growth report on Infomedia implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Infomedia stock in this financial health report.

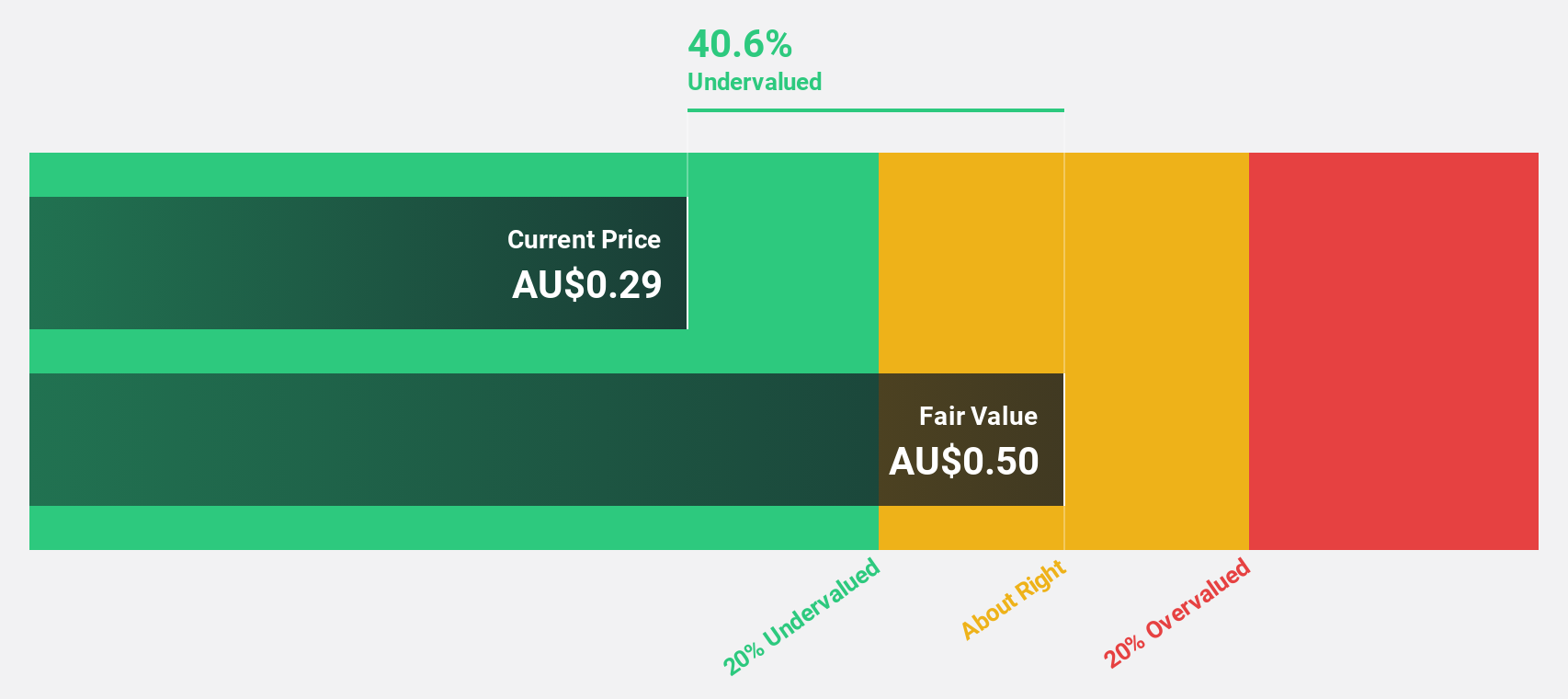

Immutep (ASX:IMM)

Overview: Immutep Limited is a biotechnology company focused on developing novel Lymphocyte Activation Gene-3 related immunotherapies for cancer and autoimmune diseases in Australia, with a market cap of A$403.66 million.

Operations: The company's revenue is primarily derived from its immunotherapy segment, amounting to A$5.03 million.

Estimated Discount To Fair Value: 44.7%

Immutep is trading at A$0.28, significantly below its estimated fair value of A$0.50, suggesting undervaluation based on cash flows. Despite a net loss of A$61.43 million for the year ending June 2025, revenue grew to A$10.33 million from the previous year’s A$7.84 million. The company anticipates profitability within three years and forecasts robust annual revenue growth exceeding 100%, driven by strategic alliances and promising clinical trials in cancer immunotherapy treatments like eftilagimod alfa (efti).

- The growth report we've compiled suggests that Immutep's future prospects could be on the up.

- Get an in-depth perspective on Immutep's balance sheet by reading our health report here.

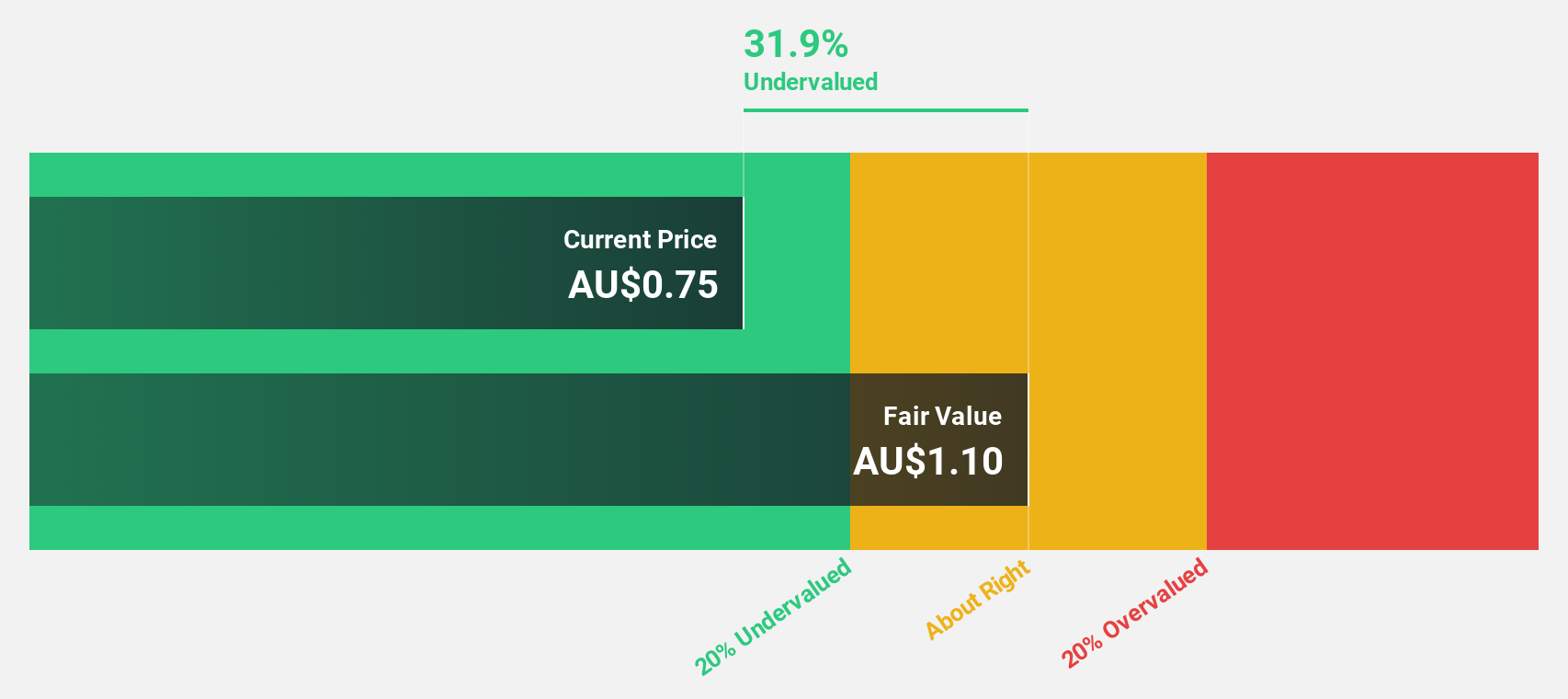

Nickel Industries (ASX:NIC)

Overview: Nickel Industries Limited is involved in nickel ore mining and the production of nickel pig iron, cobalt, and nickel matte, with a market cap of A$3.30 billion.

Operations: The company's revenue segments include $120.89 million from Indonesia's nickel ore mining, $109.25 million from HPAL projects in Indonesia and Hong Kong, and $1.50 billion from RKEF projects in Indonesia and Singapore.

Estimated Discount To Fair Value: 30.9%

Nickel Industries, trading at A$0.76, is undervalued based on discounted cash flow analysis with a fair value estimate of A$1.1. Recent debt restructuring through an US$800 million note issuance at 9% enhances its financial flexibility by extending debt maturity to 2030 and replacing higher-cost notes due 2028. The company reported improved net income of US$11.27 million for H1 2025, up from US$5.14 million a year prior, with earnings expected to grow annually by over 55%.

- Insights from our recent growth report point to a promising forecast for Nickel Industries' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Nickel Industries.

Make It Happen

- Click this link to deep-dive into the 30 companies within our Undervalued ASX Stocks Based On Cash Flows screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nickel Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NIC

Nickel Industries

Engages in nickel ore mining, nickel pig iron, cobalt, and nickel matte production activities.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success