The Australian market is poised for a positive start, with the ASX 200 futures indicating a slight rise as global markets remain resilient despite recent tariff news. In this context, penny stocks—though an older term—continue to represent intriguing opportunities within the investment landscape. By focusing on companies with solid financials and potential for growth, investors can uncover promising prospects among these smaller or newer entities.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.81M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.895 | A$89.39M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$3.03 | A$251.22M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$330.52M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.17 | A$336.11M | ★★★★☆☆ |

| Centrepoint Alliance (ASX:CAF) | A$0.32 | A$63.64M | ★★★★★☆ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Aussie Broadband (ASX:ABB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market capitalization of A$1.17 billion.

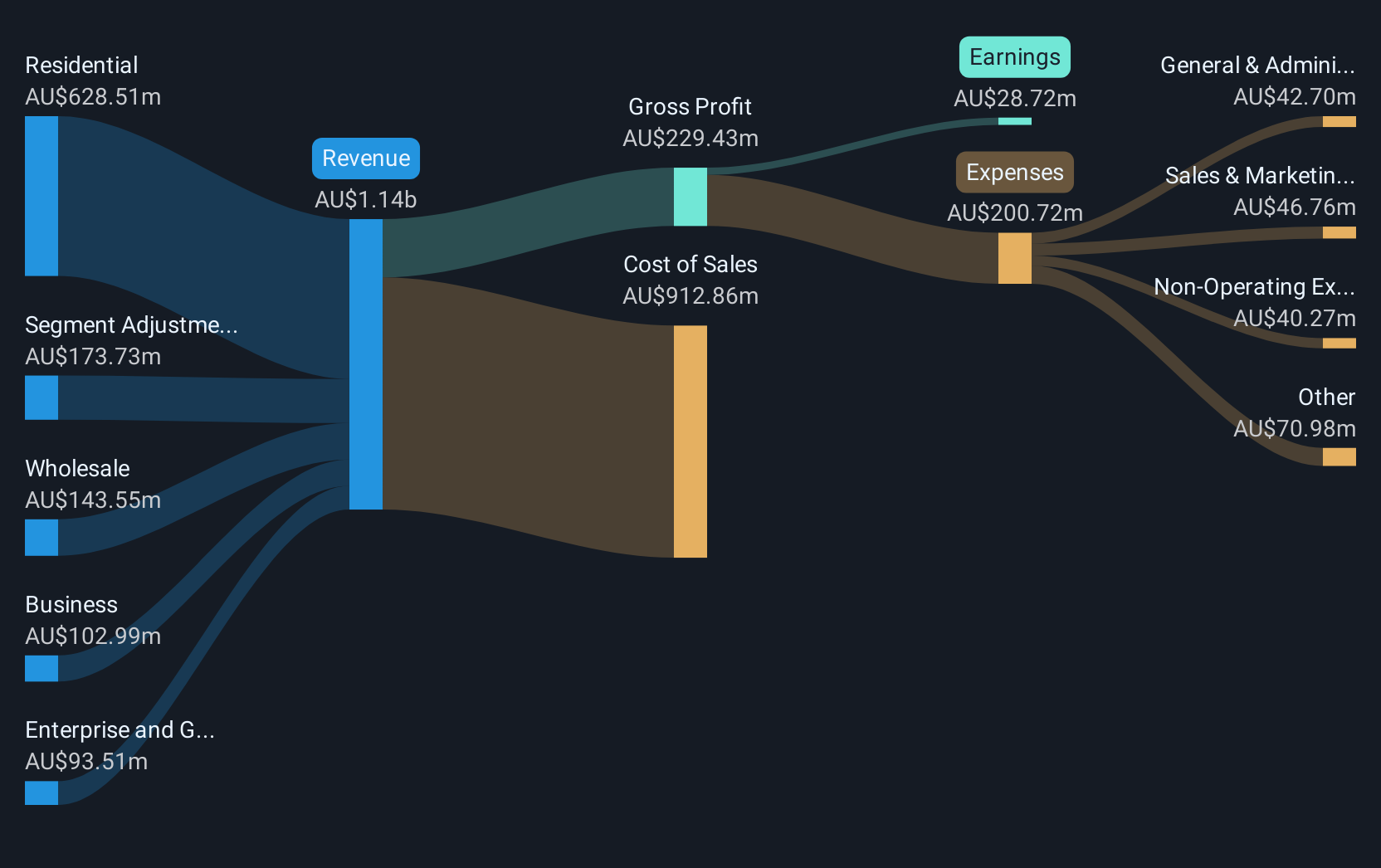

Operations: The company's revenue is primarily generated from its Residential segment at A$585.07 million, followed by Wholesale at A$159.73 million, Business at A$96.97 million, Enterprise and Government at A$88.04 million, and Symbio Group contributing A$69.93 million.

Market Cap: A$1.17B

Aussie Broadband Limited, with a market capitalization of A$1.17 billion, has shown promising growth in earnings, surpassing the telecom industry's average over the past year. Despite lower net profit margins compared to last year and a low return on equity at 4.6%, the company has not diluted shareholders recently and maintains satisfactory debt levels with operating cash flow covering its debt well. Recent management changes include Phillip Britt's transition to a non-executive role while Brian Maher steps up as CEO, ensuring continuity in leadership amidst strategic initiatives like their share buyback program aimed at enhancing shareholder value.

- Click to explore a detailed breakdown of our findings in Aussie Broadband's financial health report.

- Assess Aussie Broadband's future earnings estimates with our detailed growth reports.

Nickel Industries (ASX:NIC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nickel Industries Limited is involved in nickel ore mining and the production of nickel pig iron, cobalt, and nickel matte, with a market cap of A$3.22 billion.

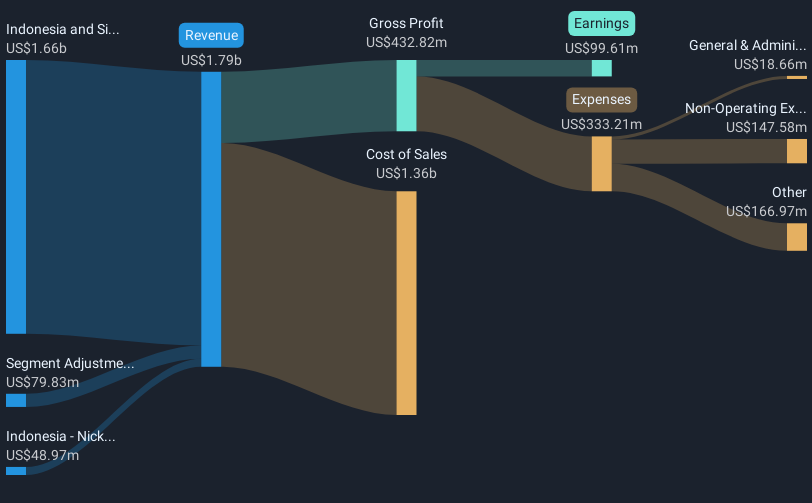

Operations: The company's revenue is primarily derived from its RKEF Projects in Indonesia and Singapore, amounting to $1.66 billion, and nickel ore mining operations in Indonesia, contributing $48.97 million.

Market Cap: A$3.22B

Nickel Industries Limited, with a market cap of A$3.22 billion, derives significant revenue from its RKEF Projects and nickel ore mining in Indonesia. Despite a slight decrease in net profit margins to 5.6% and a low return on equity at 5%, the company has experienced earnings growth of 6.3% over the past year, outpacing the industry average. The management team and board are seasoned with average tenures exceeding three years, contributing to stability. While dividends are not well covered by earnings, NIC's debt is well managed with operating cash flow covering interest payments effectively at 4.7 times EBIT coverage.

- Click here and access our complete financial health analysis report to understand the dynamics of Nickel Industries.

- Learn about Nickel Industries' future growth trajectory here.

Platinum Investment Management (ASX:PTM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Platinum Investment Management Limited is a publicly owned hedge fund sponsor with a market cap of A$386.71 million.

Operations: The company's revenue is primarily derived from Funds Management, which contributed A$178.63 million, with an additional A$6.35 million coming from Investments and Other activities.

Market Cap: A$386.71M

Platinum Investment Management Limited, with a market cap of A$386.71 million, primarily generates revenue from funds management totaling A$178.63 million. Despite being debt-free and trading below its estimated fair value, the company faces challenges such as declining earnings growth and lower profit margins compared to last year. The experienced management team contrasts with an inexperienced board, indicating recent changes in leadership. Recent events include a special dividend announcement and ongoing M&A discussions involving potential takeover bids from multiple investment firms, highlighting significant strategic interest in the company’s future direction.

- Take a closer look at Platinum Investment Management's potential here in our financial health report.

- Explore Platinum Investment Management's analyst forecasts in our growth report.

Next Steps

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,028 more companies for you to explore.Click here to unveil our expertly curated list of 1,031 ASX Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ABB

Aussie Broadband

Provides telecommunications and technology services in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives