- Australia

- /

- Metals and Mining

- /

- ASX:NAG

Nagambie Resources Limited (ASX:NAG): Time For A Financial Health Check

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

Investors are always looking for growth in small-cap stocks like Nagambie Resources Limited (ASX:NAG), with a market cap of AU$29m. However, an important fact which most ignore is: how financially healthy is the business? Since NAG is loss-making right now, it’s crucial to evaluate the current state of its operations and pathway to profitability. Here are few basic financial health checks you should consider before taking the plunge. However, given that I have not delve into the company-specifics, I’d encourage you to dig deeper yourself into NAG here.

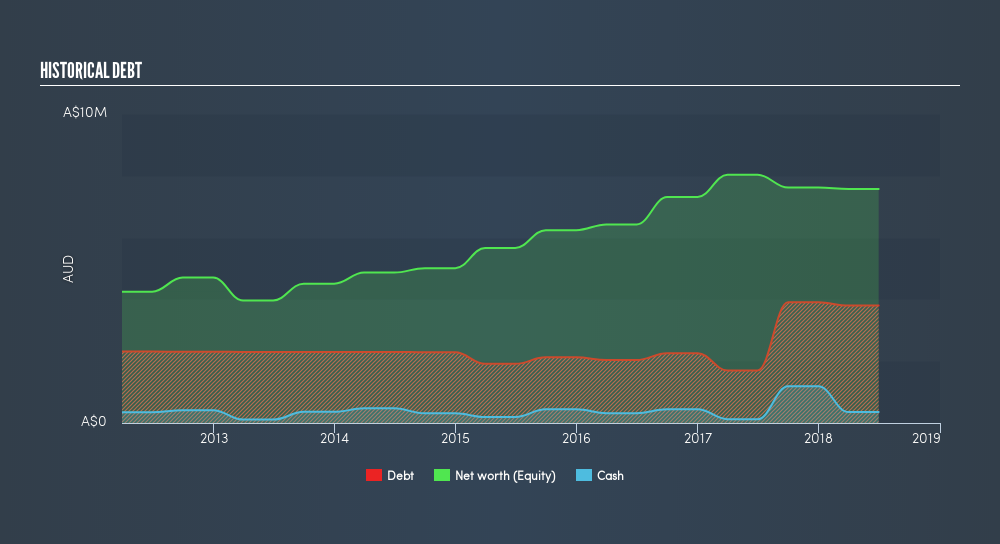

Does NAG produce enough cash relative to debt?

Over the past year, NAG has ramped up its debt from AU$1.7m to AU$3.8m – this includes long-term debt. With this rise in debt, the current cash and short-term investment levels stands at AU$352k , ready to deploy into the business. Moving onto cash from operations, its small level of operating cash flow means calculating cash-to-debt wouldn't be too useful, though these low levels of cash means that operational efficiency is worth a look. For this article’s sake, I won’t be looking at this today, but you can examine some of NAG’s operating efficiency ratios such as ROA here.

Can NAG meet its short-term obligations with the cash in hand?

With current liabilities at AU$493k, the company has maintained a safe level of current assets to meet its obligations, with the current ratio last standing at 1.05x. Generally, for Metals and Mining companies, this is a reasonable ratio since there is a bit of a cash buffer without leaving too much capital in a low-return environment.

Does NAG face the risk of succumbing to its debt-load?

With a debt-to-equity ratio of 50%, NAG can be considered as an above-average leveraged company. This is not unusual for small-caps as debt tends to be a cheaper and faster source of funding for some businesses. But since NAG is presently loss-making, there’s a question of sustainability of its current operations. Maintaining a high level of debt, while revenues are still below costs, can be dangerous as liquidity tends to dry up in unexpected downturns.

Next Steps:

NAG’s high cash coverage means that, although its debt levels are high, the company is able to utilise its borrowings efficiently in order to generate cash flow. Since there is also no concerns around NAG's liquidity needs, this may be its optimal capital structure for the time being. Keep in mind I haven't considered other factors such as how NAG has been performing in the past. I recommend you continue to research Nagambie Resources to get a better picture of the small-cap by looking at:

- Historical Performance: What has NAG's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:NAG

Nagambie Resources

Explores for and develops gold and related minerals, and construction materials in Australia.

Moderate with imperfect balance sheet.

Market Insights

Community Narratives