- Australia

- /

- Metals and Mining

- /

- ASX:MYE

Does Mastermyne Group (ASX:MYE) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Mastermyne Group (ASX:MYE), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Mastermyne Group

How Fast Is Mastermyne Group Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that Mastermyne Group grew its EPS from AU$0.012 to AU$0.069, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company.

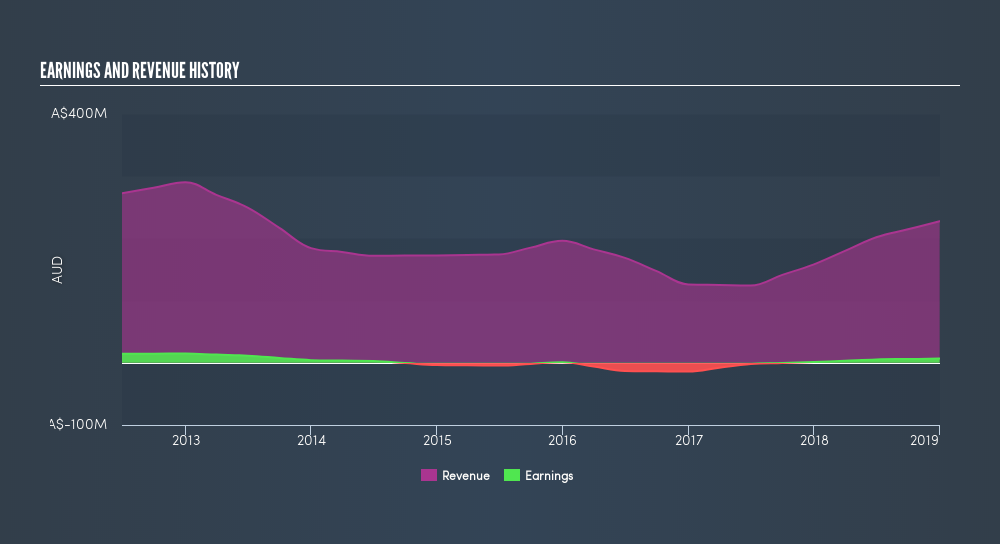

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Mastermyne Group shareholders can take confidence from the fact that EBIT margins are up from 2.0% to 4.7%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Mastermyne Group is no giant, with a market capitalization of AU$86m, so you should definitely check its cash and debtbefore getting too excited about its prospects.

Are Mastermyne Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Mastermyne Group shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Julie Whitcombe, the Independent Non-Executive Director of the company, paid AU$44k for shares at around AU$1.37 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Mastermyne Group insiders own more than a third of the company. In fact, they own 46% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. That means insiders have AU$39m invested in the business, using the current share price. That's nothing to sneeze at!

Does Mastermyne Group Deserve A Spot On Your Watchlist?

Mastermyne Group's earnings have taken off like any random crypto-currency did, back in 2017. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. For me, this situation certainly piques my interest. Of course, just because Mastermyne Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Mastermyne Group is not the only growth stock with insider buying. Here's a a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdictionWe aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:MYE

Mastermyne Group

Provides mine operation, contracting, training, and related services in the mining and supporting industries in Australia.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives