Unfortunately for shareholders, when Metro Mining Limited (ASX:MMI) reported results for the period to December 2020, its auditors, Ernst & Young LLP, expressed uncertainty about whether it can continue as a going concern. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

Given its situation, it may not be in a good position to raise capital on favorable terms. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

Check out our latest analysis for Metro Mining

How Much Debt Does Metro Mining Carry?

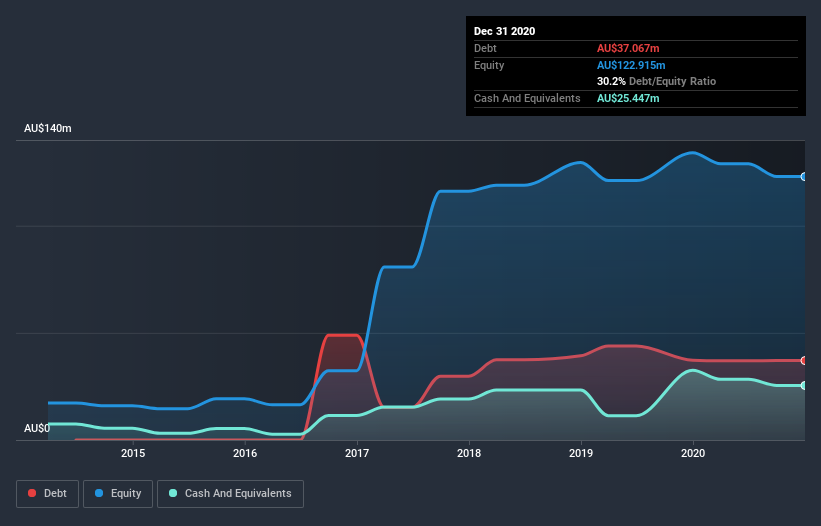

As you can see below, Metro Mining had AU$37.1m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of AU$25.4m, its net debt is less, at about AU$11.6m.

A Look At Metro Mining's Liabilities

Zooming in on the latest balance sheet data, we can see that Metro Mining had liabilities of AU$37.7m due within 12 months and liabilities of AU$41.4m due beyond that. On the other hand, it had cash of AU$25.4m and AU$228.0k worth of receivables due within a year. So it has liabilities totalling AU$53.4m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of AU$84.8m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Metro Mining can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Metro Mining made a loss at the EBIT level, and saw its revenue drop to AU$128m, which is a fall of 36%. To be frank that doesn't bode well.

Caveat Emptor

Not only did Metro Mining's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost AU$7.8m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through AU$2.7m of cash over the last year. So to be blunt we think it is risky. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for Metro Mining you should be aware of, and 1 of them doesn't sit too well with us.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Metro Mining or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MMI

Undervalued with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion