The Australian market is poised for a positive day, buoyed by gains in commodities and a recovery on Wall Street despite ongoing inflation concerns. In such an environment, identifying growth companies with high insider ownership can offer unique insights into potential investment opportunities, as these stocks often reflect strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 61.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

| Acrux (ASX:ACR) | 14.6% | 91.6% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.5% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Underneath we present a selection of stocks filtered out by our screen.

Alpha HPA (ASX:A4N)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alpha HPA Limited, with a market cap of A$1.02 billion, operates as a specialty metals and technology company.

Operations: The company's revenue segments include the HPA First Project, which generated A$0.04 million.

Insider Ownership: 17.3%

Earnings Growth Forecast: 44.7% p.a.

Alpha HPA is positioned for substantial growth with forecasted revenue increases of 96.8% per year, significantly outpacing the Australian market's 5.3% growth rate. Despite a net loss of A$24.98 million for the year ending June 2024, insider ownership remains high, indicating confidence in future profitability within three years. However, shareholders have faced dilution recently and current revenues are minimal at A$44K annually.

- Delve into the full analysis future growth report here for a deeper understanding of Alpha HPA.

- The analysis detailed in our Alpha HPA valuation report hints at an inflated share price compared to its estimated value.

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aussie Broadband Limited (ASX:ABB) provides telecommunications and technology services in Australia, with a market cap of A$1.13 billion.

Operations: Aussie Broadband Limited's revenue segments include Business (A$96.97 million), Wholesale (A$159.73 million), Residential (A$585.07 million), Symbio Group (A$69.93 million), and Enterprise and Government (A$88.04 million).

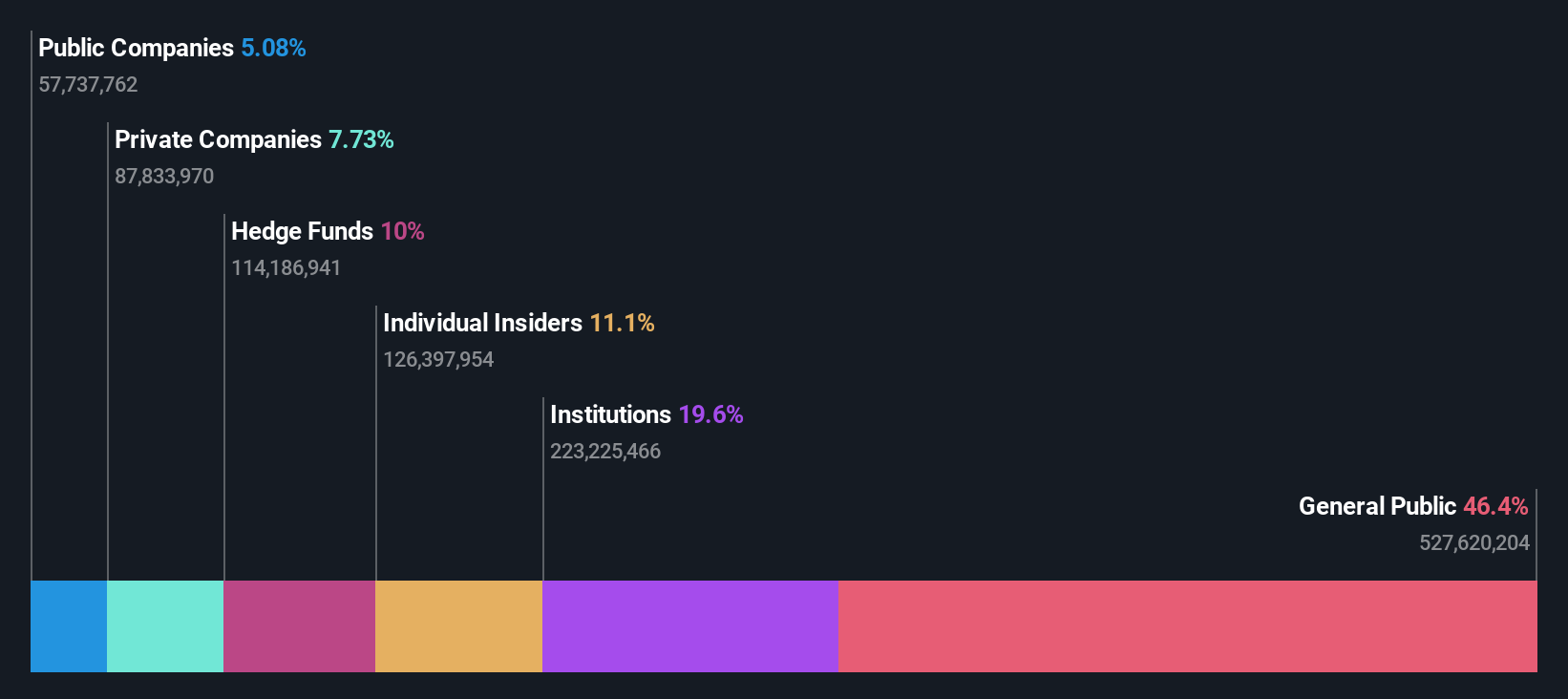

Insider Ownership: 10.8%

Earnings Growth Forecast: 27.3% p.a.

Aussie Broadband is experiencing robust earnings growth, with a 21.5% increase over the past year and forecasted annual profit growth of 27.3%, outpacing the Australian market's 12.2%. Despite recent shareholder dilution and an expected low return on equity (11.4%) in three years, insider ownership remains high, reflecting confidence in future performance. Recent executive changes include John Reisinger's retirement and Andy Giles Knopp's appointment as Group CFO, enhancing strategic leadership amidst strong financial results for FY2024.

- Click to explore a detailed breakdown of our findings in Aussie Broadband's earnings growth report.

- Our expertly prepared valuation report Aussie Broadband implies its share price may be too high.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mineral Resources Limited, with a market cap of A$5.91 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

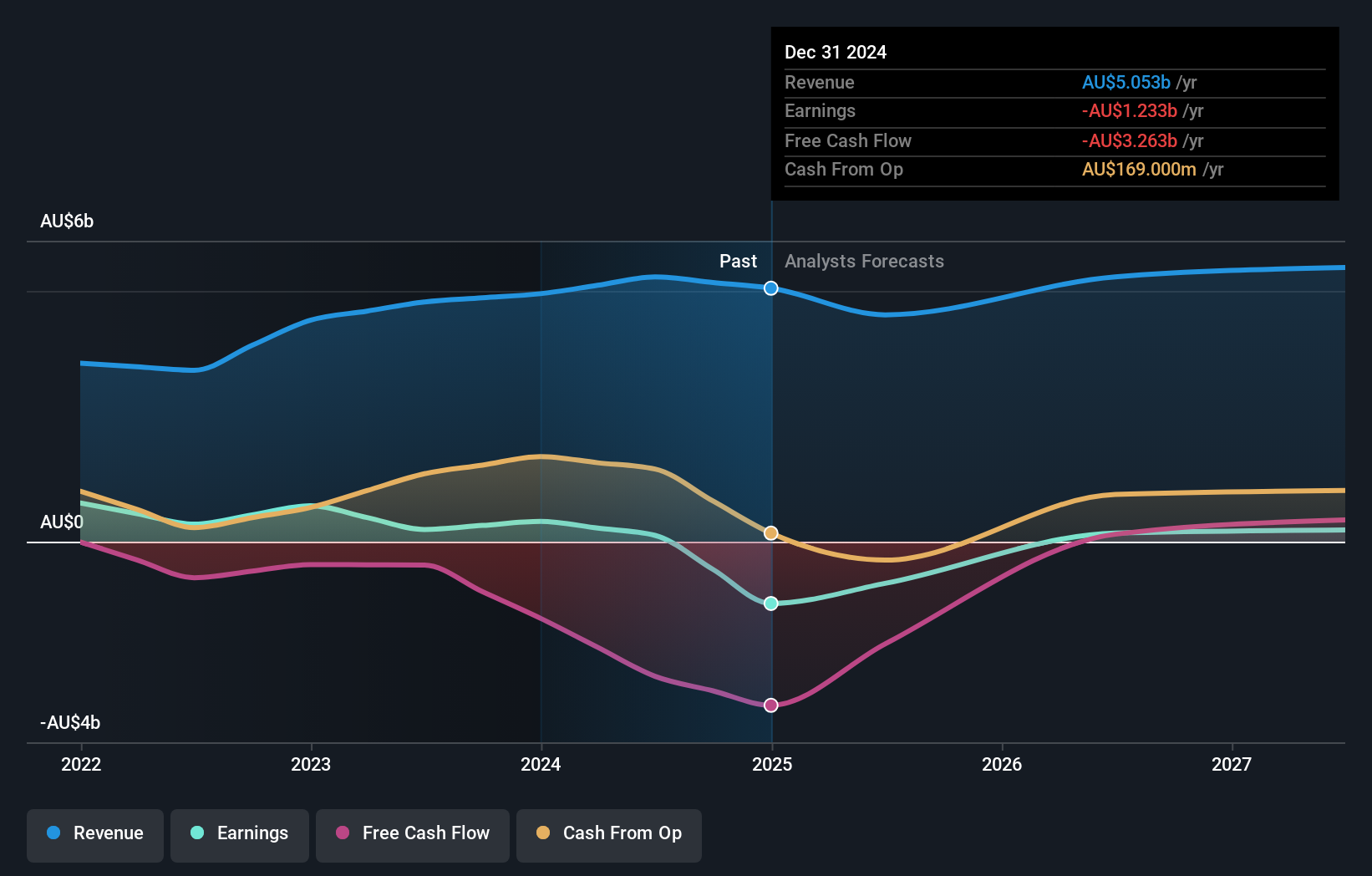

Operations: Revenue segments for Mineral Resources Limited include Energy (A$16 million), Lithium (A$1.41 billion), Iron Ore (A$2.58 billion), Mining Services (A$3.38 billion), and Other Commodities (A$19 million).

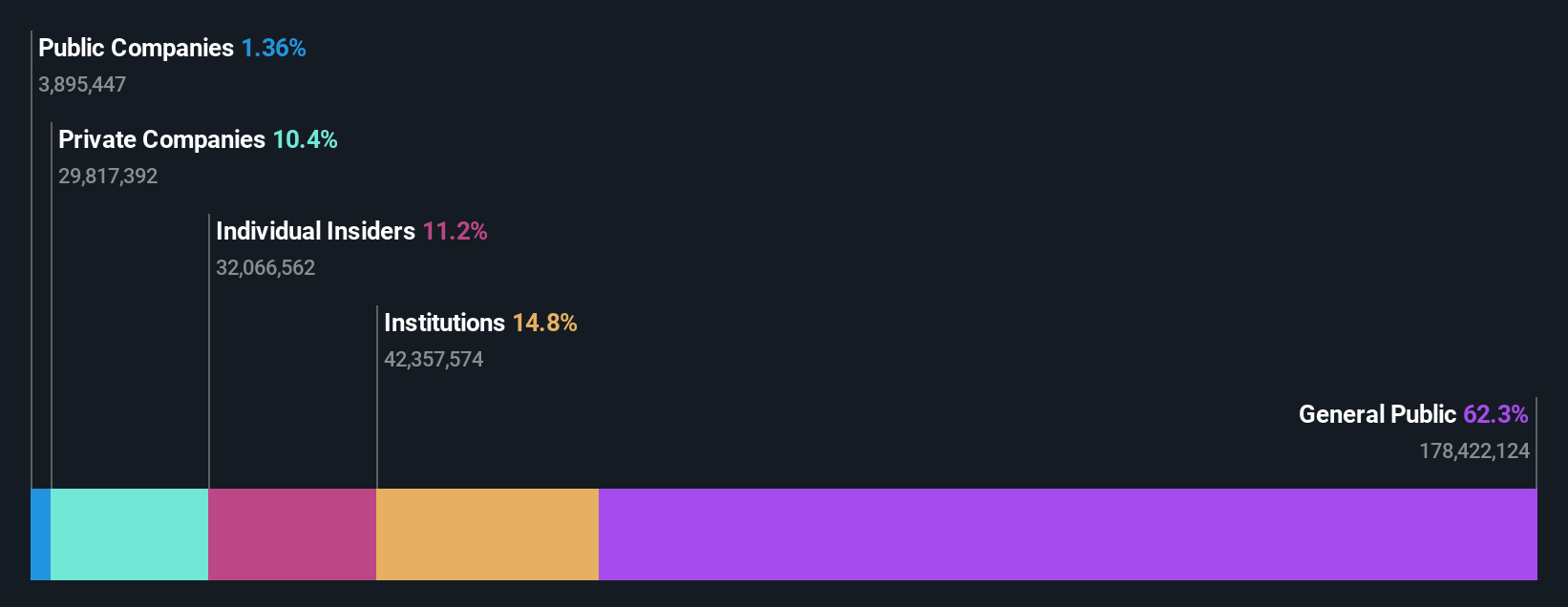

Insider Ownership: 11.7%

Earnings Growth Forecast: 40.3% p.a.

Mineral Resources is trading at 62.3% below its estimated fair value and has seen more insider buying than selling over the past three months, though not in substantial volumes. The company’s earnings are forecast to grow significantly at 40.28% per year, outpacing the Australian market's 12.2%. Despite high-quality non-cash earnings and a projected high return on equity (20.8%), profit margins have declined from 5.1% to 2.4%. Recent earnings reported sales of A$5.28 billion and net income of A$125 million, down from A$243 million last year, with diluted EPS dropping to A$0.6354 from A$1.2625.

- Click here to discover the nuances of Mineral Resources with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Mineral Resources shares in the market.

Taking Advantage

- Delve into our full catalog of 96 Fast Growing ASX Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:A4N

Alpha HPA

A specialty materials and technology company, focuses on the delivery and operation of the HPA First and Alpha Sapphire projects in Queensland.

Exceptional growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026