- Australia

- /

- Hospitality

- /

- ASX:FLT

Emerald Resources And Two ASX Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The Australian market recently experienced a mixed day, with the ASX200 closing down by 0.75% primarily due to declines in the mining sector, while discretionary and IT sectors showed resilience with modest gains. In such a fluctuating environment, stocks with high insider ownership can often be appealing as they suggest that those who know the company best are confident in its future prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.7% |

| Biome Australia (ASX:BIO) | 34.5% | 114.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 59.5% |

| Ora Banda Mining (ASX:OBM) | 10.2% | 94.3% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 76.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| SiteMinder (ASX:SDR) | 11.3% | 74.7% |

Let's explore several standout options from the results in the screener.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.51 billion.

Operations: The primary revenue segment for the company is derived from mine operations, generating A$339.32 million.

Insider Ownership: 18.5%

Earnings Growth Forecast: 23.2% p.a.

Emerald Resources has demonstrated robust growth with a 53.4% increase in earnings over the past year. Despite some shareholder dilution, EMR is poised for significant expansion, with earnings expected to rise by 23.2% annually and revenue forecasted to grow at 18.6% per year, outpacing the Australian market average significantly. Additionally, its Return on Equity is projected to be high at 20.7%, indicating efficient management and potentially lucrative returns for investors prioritizing insider ownership and growth metrics.

- Navigate through the intricacies of Emerald Resources with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Emerald Resources' current price could be inflated.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

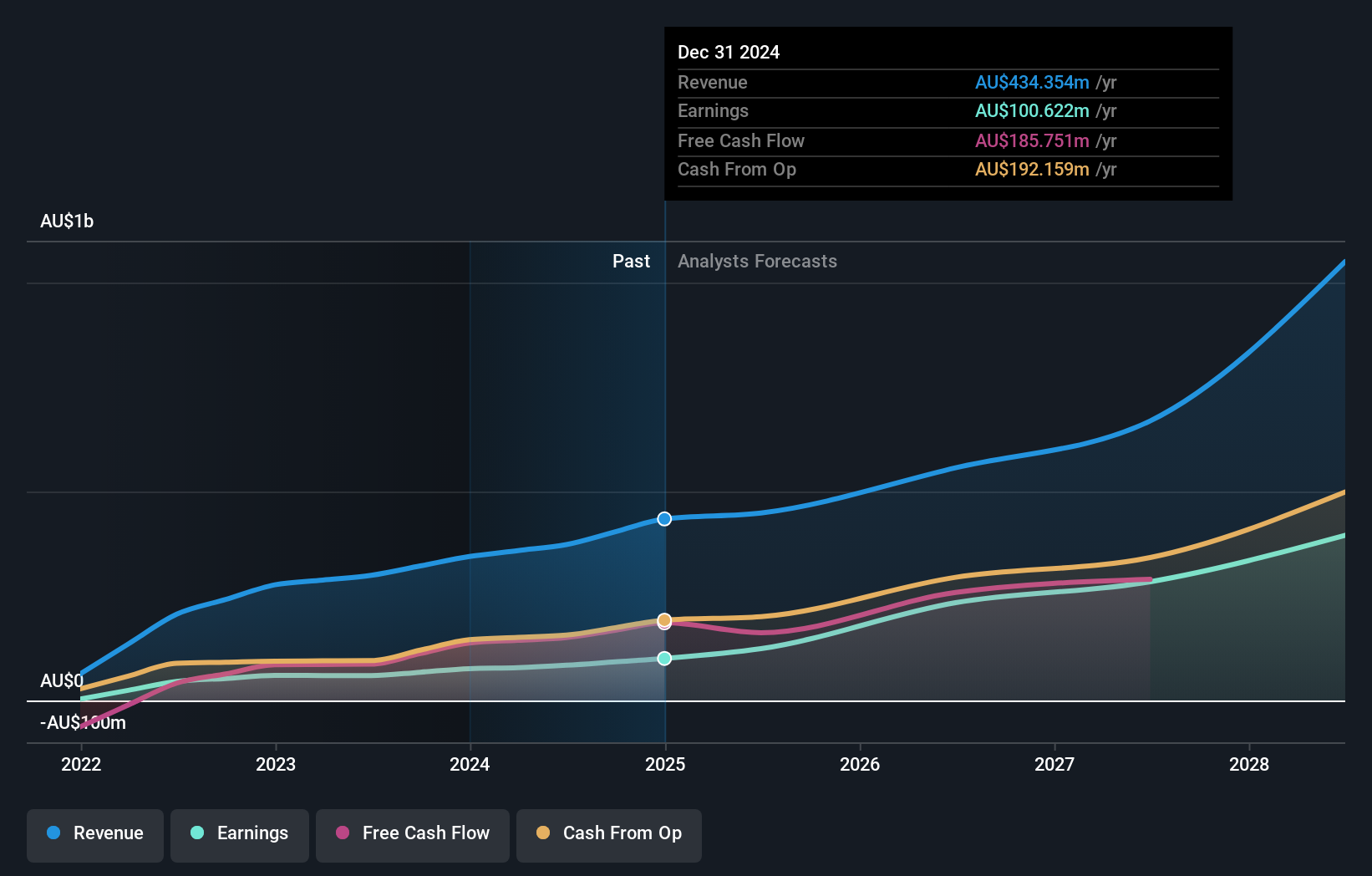

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market cap of A$4.70 billion.

Operations: The company generates A$1.28 billion from its leisure segment and A$1.06 billion from corporate travel services.

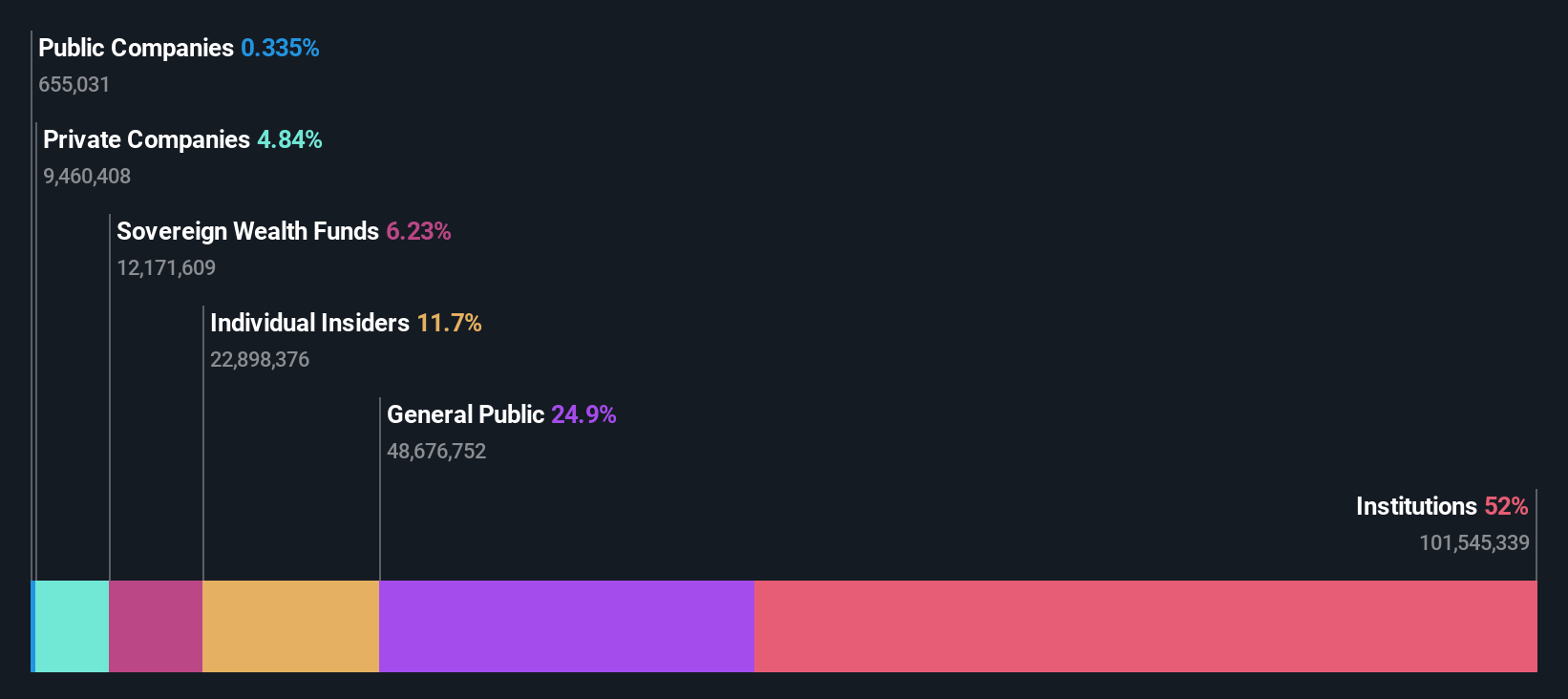

Insider Ownership: 13.3%

Earnings Growth Forecast: 18.8% p.a.

Flight Centre Travel Group has recently transitioned to profitability and is poised for continued growth, with earnings expected to rise by 18.81% annually. This rate outstrips the Australian market's average, pegged at 13.1% per year. Additionally, its revenue growth forecast at 9.7% annually also exceeds the national market average of 5.3%. The company's Return on Equity is predicted to be robust at 21.8% in three years, underscoring efficient capital management despite not having significant insider trading activity recently.

- Click here and access our complete growth analysis report to understand the dynamics of Flight Centre Travel Group.

- Upon reviewing our latest valuation report, Flight Centre Travel Group's share price might be too pessimistic.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mineral Resources Limited is a diversified mining services company operating in Australia, Asia, and internationally, with a market capitalization of approximately A$11.02 billion.

Operations: The company generates revenue from lithium (A$1.60 billion), iron ore (A$2.50 billion), and mining services (A$2.82 billion).

Insider Ownership: 11.6%

Earnings Growth Forecast: 27.5% p.a.

Mineral Resources, trading at a substantial discount to its estimated fair value, shows promise with its high-quality earnings and absence of recent insider selling. While its revenue growth forecast of 12.1% per year is below the high-growth benchmark of 20%, it still surpasses the Australian market average. The company's earnings are expected to increase by 27.5% annually over the next three years, outperforming the market projection of 13.1%. However, concerns include lower profit margins compared to last year and poor coverage of interest payments by earnings.

- Delve into the full analysis future growth report here for a deeper understanding of Mineral Resources.

- In light of our recent valuation report, it seems possible that Mineral Resources is trading beyond its estimated value.

Taking Advantage

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 91 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Solid track record with excellent balance sheet.