Stock Analysis

- Australia

- /

- Oil and Gas

- /

- ASX:VEA

ASX Stocks Estimated To Be Below Intrinsic Value In June 2024

Reviewed by Simply Wall St

As the Australian market shows modest gains with the ASX200 closing up 0.1% this week, investor focus may shift towards sectors that have underperformed or outperformed, such as Materials and IT respectively. In such a mixed economic landscape, identifying stocks that are potentially undervalued becomes crucial, especially when considering long-term growth prospects in fluctuating markets.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Charter Hall Group (ASX:CHC) | A$11.18 | A$22.20 | 49.6% |

| COSOL (ASX:COS) | A$1.255 | A$2.43 | 48.3% |

| Count (ASX:CUP) | A$0.57 | A$1.10 | 48.3% |

| ReadyTech Holdings (ASX:RDY) | A$3.25 | A$5.91 | 45% |

| hipages Group Holdings (ASX:HPG) | A$1.03 | A$1.94 | 47% |

| Regal Partners (ASX:RPL) | A$3.21 | A$6.18 | 48% |

| IPH (ASX:IPH) | A$6.27 | A$11.37 | 44.9% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| SiteMinder (ASX:SDR) | A$5.09 | A$9.04 | 43.7% |

| Coast Entertainment Holdings (ASX:CEH) | A$0.46 | A$0.84 | 45.1% |

Let's uncover some gems from our specialized screener

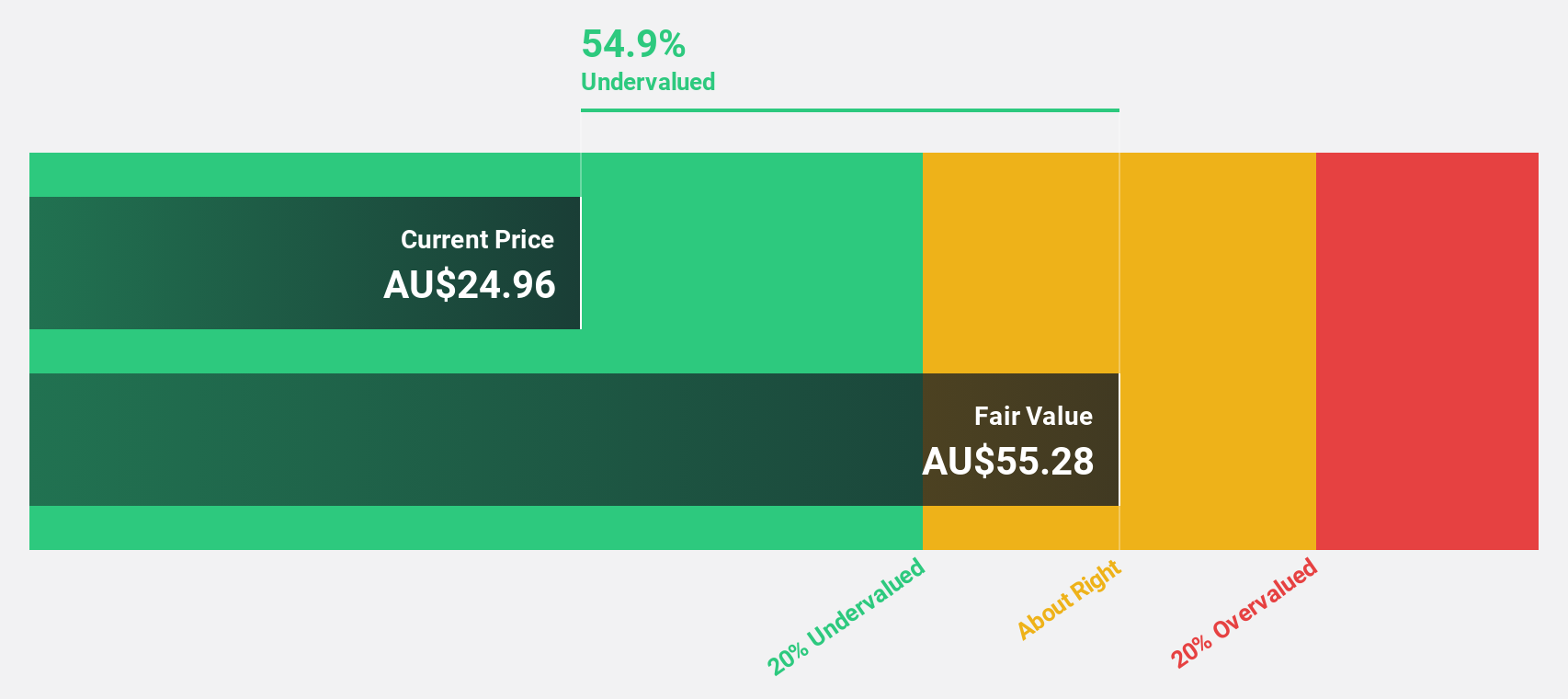

Mineral Resources (ASX:MIN)

Overview: Mineral Resources Limited is a mining services company operating in Australia, Asia, and internationally, with a market capitalization of approximately A$10.52 billion.

Operations: The company generates revenue from lithium (A$1.60 billion), iron ore (A$2.50 billion), and mining services (A$2.82 billion).

Estimated Discount To Fair Value: 19%

Mineral Resources Limited, priced at A$53.92, is currently trading 19% below our calculated fair value of A$66.53. This discrepancy suggests the stock might be undervalued based on discounted cash flows. The company's earnings are expected to increase by 27.42% annually, outpacing the Australian market projection of 13.8%. Despite this growth potential and a forecasted high return on equity of 25.8%, concerns arise from its profit margins dropping to 7.9% from last year’s 16.3%, coupled with inadequate coverage of interest payments by earnings.

- Our growth report here indicates Mineral Resources may be poised for an improving outlook.

- Dive into the specifics of Mineral Resources here with our thorough financial health report.

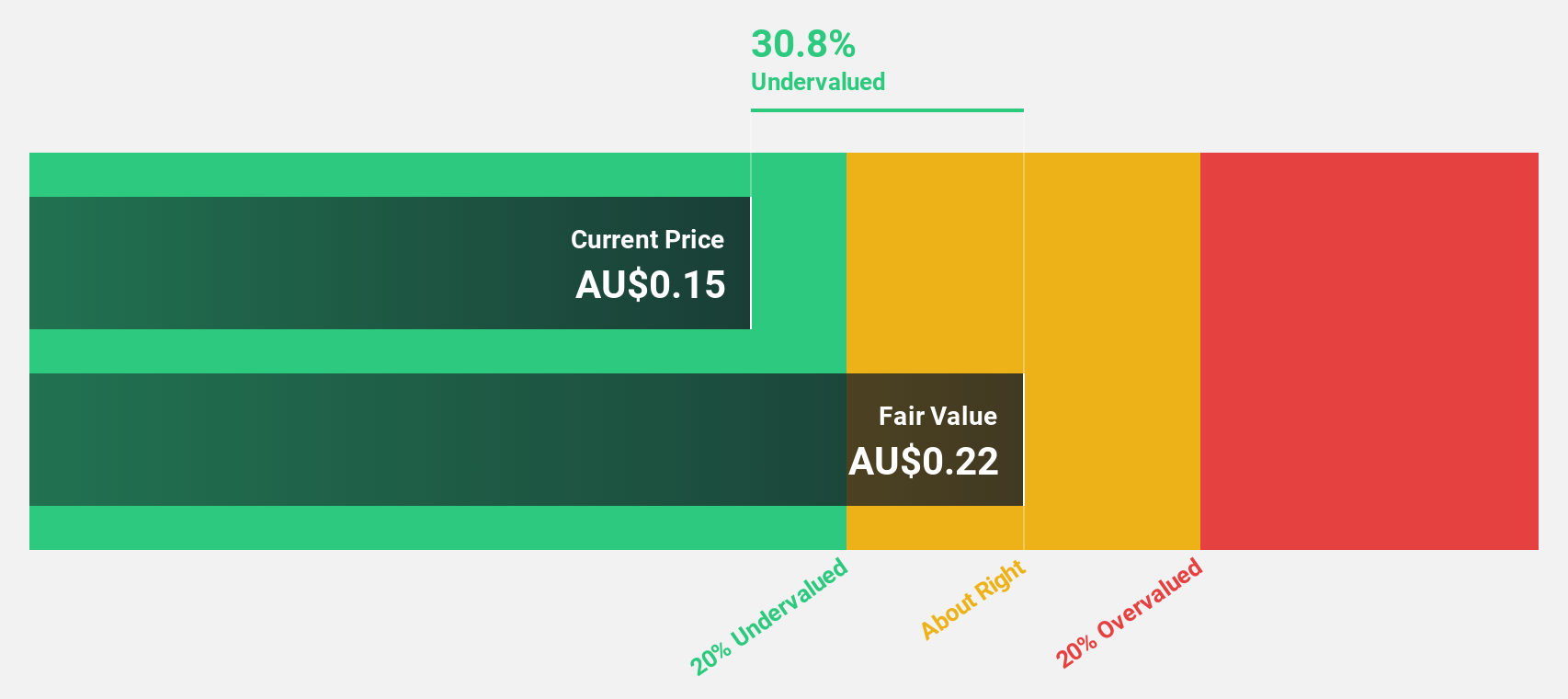

Strike Energy (ASX:STX)

Overview: Strike Energy Limited is an Australian company engaged in the exploration and development of oil and gas resources, with a market capitalization of approximately A$801.02 million.

Operations: The company primarily focuses on the exploration and development of oil and gas resources in Australia.

Estimated Discount To Fair Value: 29.9%

Strike Energy, with a current price of A$0.28, appears undervalued by over 20% according to discounted cash flow analysis, suggesting potential for investors seeking value based on financial metrics. The company's revenue and earnings are expected to grow at 37.8% and 36.69% per year respectively, significantly outperforming the Australian market averages of 5.4% and 13.8%. However, investor caution may be warranted due to recent significant insider selling and shareholder dilution over the past year.

- According our earnings growth report, there's an indication that Strike Energy might be ready to expand.

- Take a closer look at Strike Energy's balance sheet health here in our report.

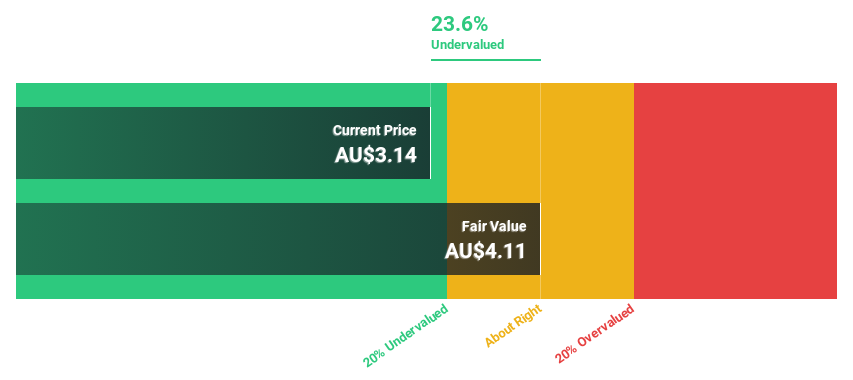

Viva Energy Group (ASX:VEA)

Overview: Viva Energy Group Limited is an energy company operating in Australia, Singapore, and Papua New Guinea with a market capitalization of approximately A$5.00 billion.

Operations: The company generates revenue through three primary segments: Convenience & Mobility at A$10.10 billion, Commercial & Industrial at A$16.64 billion, and Energy & Infrastructure at A$7.32 billion.

Estimated Discount To Fair Value: 17.1%

Viva Energy Group, priced at A$3.15, is considered undervalued by 17.1%, with a fair value estimated at A$3.8 based on discounted cash flow analysis. Despite recent index changes and not being covered well by earnings or cash flows, its dividend stands at 4.51%. Expected to outperform with an earnings growth forecast of 29.76% annually, it contrasts with slower revenue growth projections of 3.2% per year against the market's 5.4%.

- In light of our recent growth report, it seems possible that Viva Energy Group's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Viva Energy Group.

Summing It All Up

- Click this link to deep-dive into the 47 companies within our Undervalued ASX Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Viva Energy Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VEA

Viva Energy Group

Operates as an energy company in Australia, Singapore, and Papua New Guinea.

Very undervalued with reasonable growth potential.