- Australia

- /

- Capital Markets

- /

- ASX:BFG

ASX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The ASX200 has been down more than 2.2% to around 7,939 points as the market pulls back from yesterday’s record high, pushing us back below the 8000 level. Amid this volatility, identifying growth companies with high insider ownership can provide a measure of confidence for investors seeking stability and potential upside in their portfolios.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Telix Pharmaceuticals (ASX:TLX) | 16.1% | 38.1% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.5% |

| Catalyst Metals (ASX:CYL) | 17% | 75.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 49.4% |

| Ora Banda Mining (ASX:OBM) | 10.2% | 106.8% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 77.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Bell Financial Group (ASX:BFG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bell Financial Group Limited (ASX:BFG) offers broking, online broking, corporate finance, and financial advisory services to private, institutional, and corporate clients with a market cap of A$468.29 million.

Operations: Revenue segments (in millions of A$): Retail: A$103.58, Institutional: A$50.36, Products & Services: A$48.10, Technology & Platforms: A$26.20

Insider Ownership: 10.7%

Earnings Growth Forecast: 26.9% p.a.

Bell Financial Group is trading at 25.7% below its estimated fair value, presenting good relative value compared to peers and the industry. Despite a forecasted revenue growth of 5.6% per year, which is slower than desired for high-growth companies, its earnings are expected to grow significantly at 26.95% annually, outpacing the Australian market's average of 13.2%. However, its dividend yield of 4.79% is not well covered by earnings or free cash flows and Return on Equity is projected to be low at 16.3%.

- Click to explore a detailed breakdown of our findings in Bell Financial Group's earnings growth report.

- According our valuation report, there's an indication that Bell Financial Group's share price might be on the cheaper side.

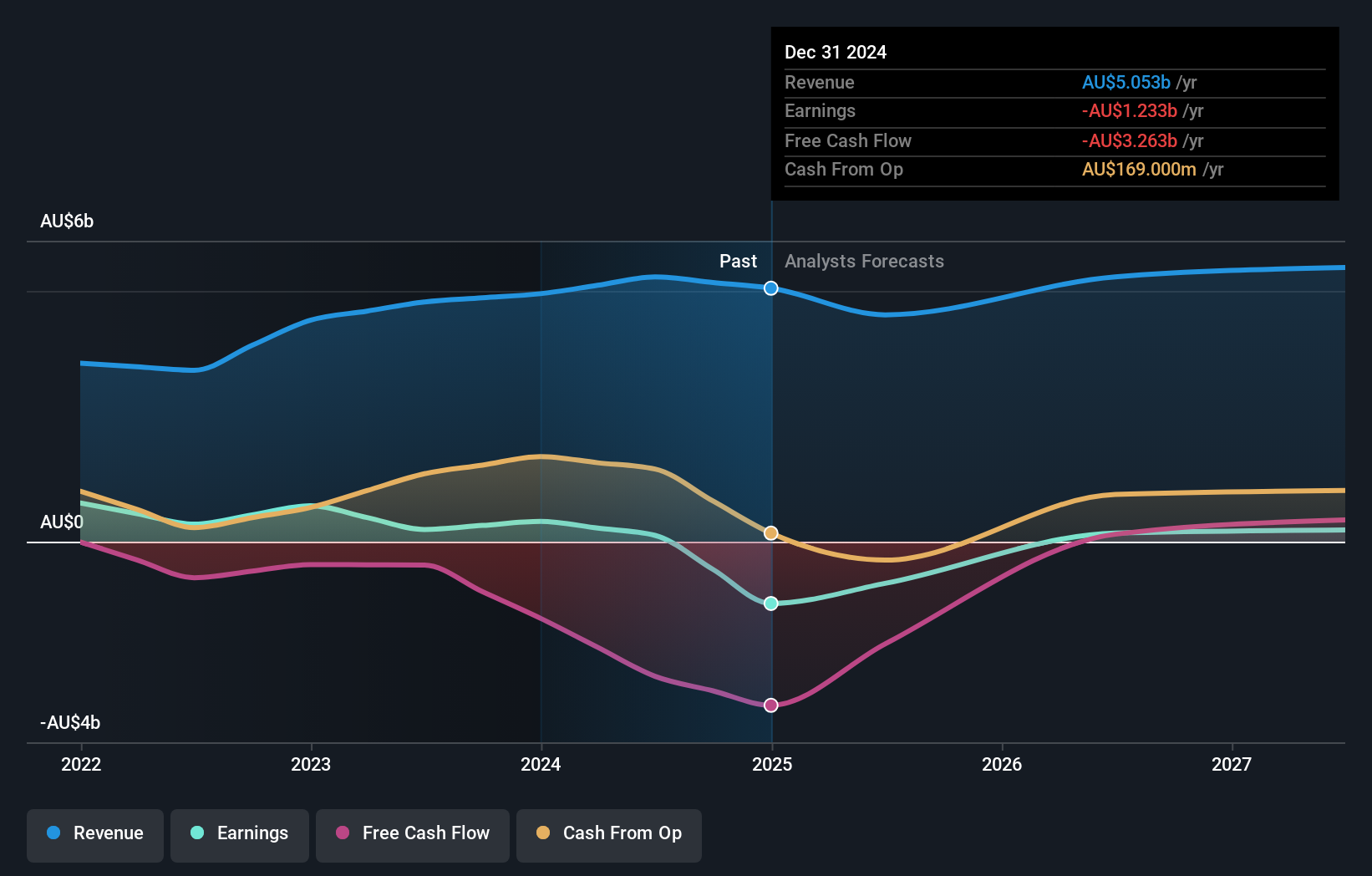

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$10.53 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: The company's revenue segments include A$1.60 billion from Lithium, A$2.50 billion from Iron Ore, and A$2.82 billion from Mining Services.

Insider Ownership: 11.6%

Earnings Growth Forecast: 19.3% p.a.

Mineral Resources, with substantial insider ownership, is forecasted to grow earnings at 19.3% annually, outpacing the Australian market's 13.2%. Revenue growth is expected at 10.2% per year, higher than the market's 5%. However, profit margins have declined from last year and interest payments are not well covered by earnings. Trading at a significant discount of 60.3% below estimated fair value suggests potential undervaluation despite mixed financial indicators and high non-cash earnings levels.

- Dive into the specifics of Mineral Resources here with our thorough growth forecast report.

- Our expertly prepared valuation report Mineral Resources implies its share price may be too high.

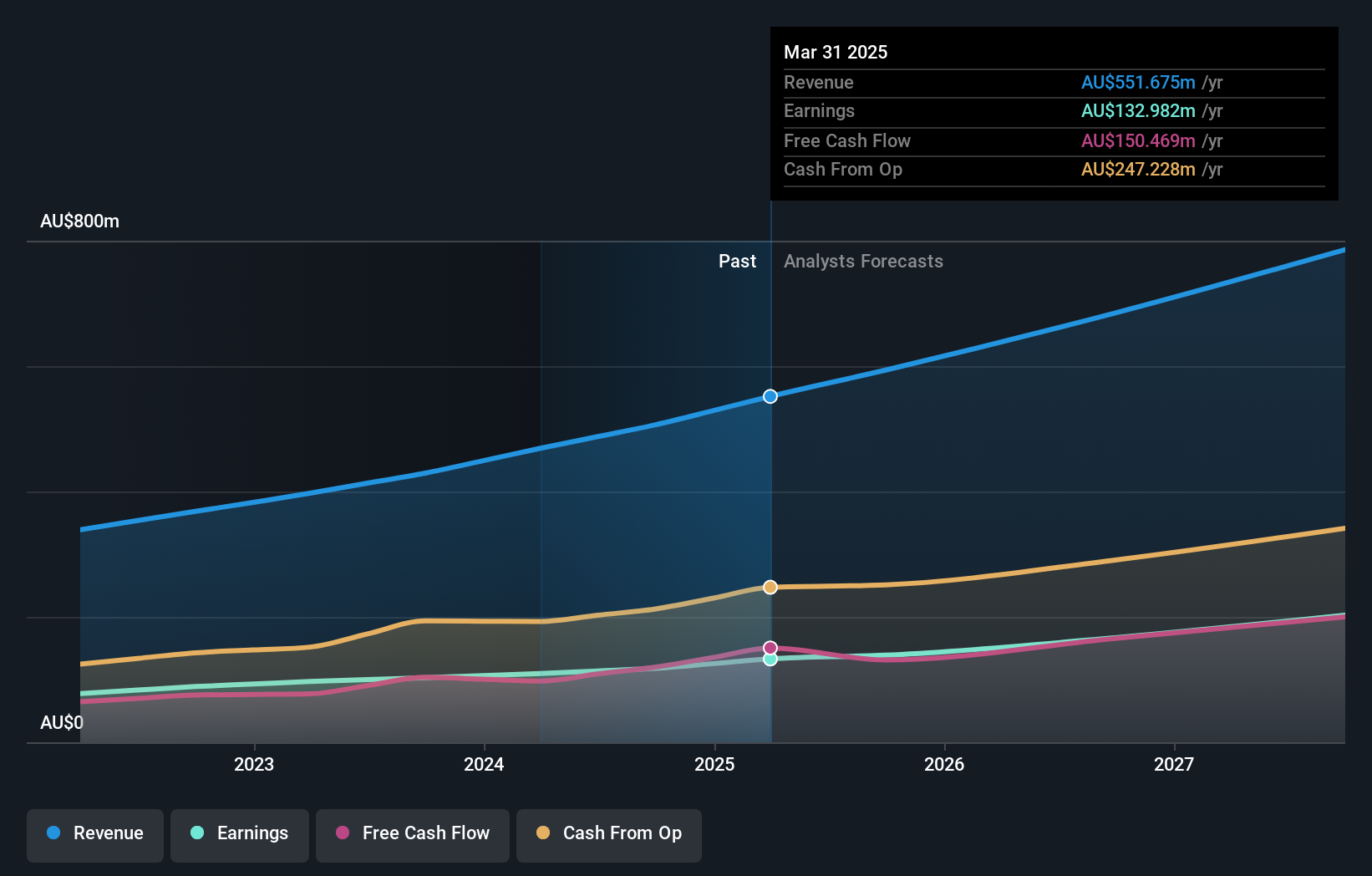

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$6.71 billion.

Operations: Revenue segments for Technology One Limited are as follows: Software: A$317.24 million, Corporate: A$83.83 million, and Consulting: A$68.13 million.

Insider Ownership: 12.3%

Earnings Growth Forecast: 14.8% p.a.

Technology One demonstrates strong growth potential with high insider ownership. Earnings are forecast to grow at 14.78% annually, outpacing the Australian market's 13.2%, while revenue is expected to increase by 11.5% per year, faster than the market's 5%. Recent appointments, such as Paul Robson as an independent Non-Executive Director, bolster its strategic transformation and operational efficiency efforts. Despite a high Price-To-Earnings ratio of 61.2x, it remains below the industry average of 63.5x.

- Get an in-depth perspective on Technology One's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Technology One is priced higher than what may be justified by its financials.

Make It Happen

- Dive into all 90 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Bell Financial Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bell Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BFG

Bell Financial Group

Engages in the provision of full-service broking, online broking, corporate finance, and financial advisory services to private, institutional, and corporate clients in Australia, the United States, the United Kingdom, Hong Kong, and Kuala Lumpur.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives