- Australia

- /

- Consumer Durables

- /

- ASX:SHM

ASX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the ASX200 closed up 0.77% at 8,349 points and traders increased their bets on a February rate cut, attention turns to sectors like Materials and Financials that have shown resilience amid fluctuating inflation rates. In this context, investors might find opportunities in penny stocks—small or newer companies that can offer unique growth potential despite being a niche market segment. While the term "penny stocks" may seem outdated, these investments still hold promise when backed by strong financial health and strategic positioning within their industries.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$237.13M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$328.68M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.915 | A$106.54M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$332.15M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$228.62M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.61 | A$796.38M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.08 | A$322.17M | ★★★★☆☆ |

| Servcorp (ASX:SRV) | A$4.93 | A$492.34M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Atlas Pearls (ASX:ATP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlas Pearls Limited is engaged in the production and sale of South Sea pearls in Australia and Indonesia, with a market cap of A$63.17 million.

Operations: The company's revenue segments consist of Loose Pearl sales generating A$39.77 million in Australia and A$25.03 million in Indonesia.

Market Cap: A$63.17M

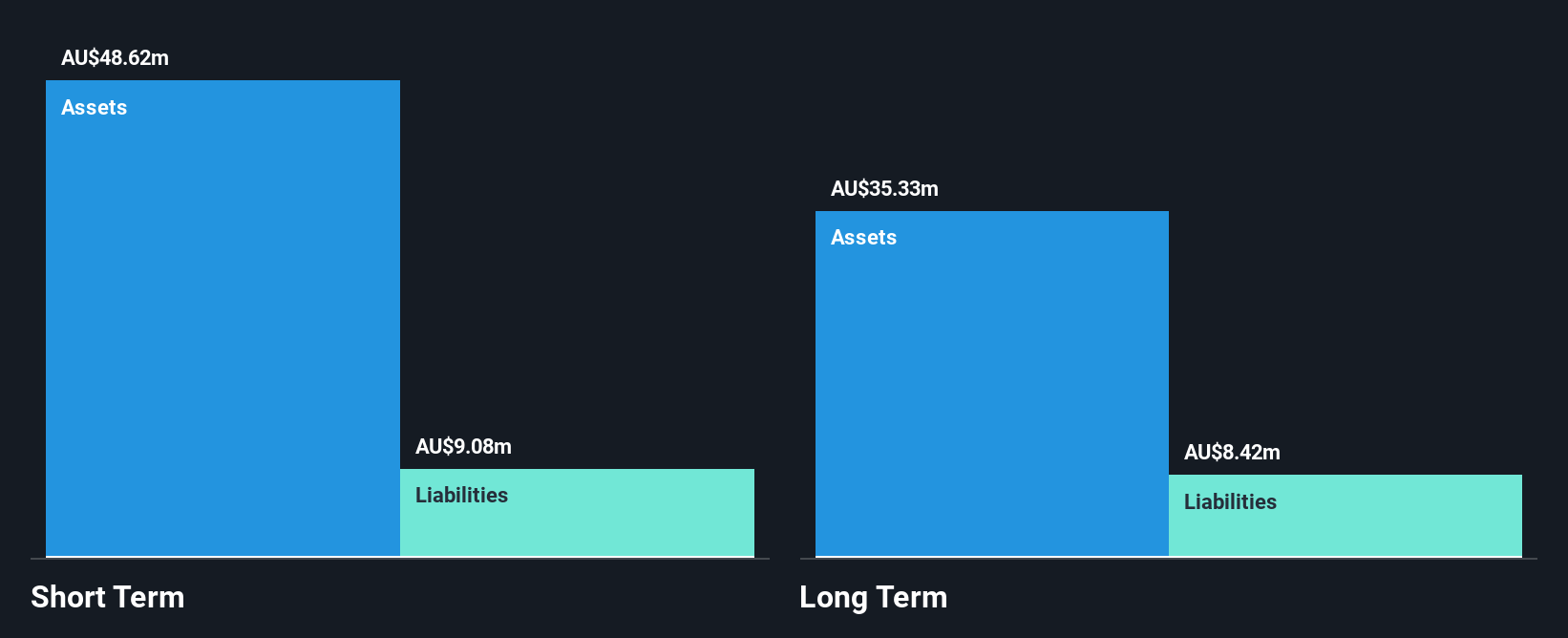

Atlas Pearls Limited, with a market cap of A$63.17 million, has demonstrated significant earnings growth of 246.3% over the past year, surpassing its five-year average and outperforming the luxury industry. The company benefits from a strong financial position with A$40.1 million in short-term assets covering both short and long-term liabilities, and it is debt-free. Despite shareholder dilution over the past year, Atlas Pearls maintains an outstanding return on equity of 56.7%. Its experienced board and management team contribute to stable operations while its high profit margins reflect improved profitability compared to last year.

- Dive into the specifics of Atlas Pearls here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Atlas Pearls' track record.

Magnum Mining and Exploration (ASX:MGU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Magnum Mining and Exploration Limited focuses on the exploration and evaluation of mineral properties in Australia, with a market cap of A$9.71 million.

Operations: The company currently does not report any specific revenue segments.

Market Cap: A$9.71M

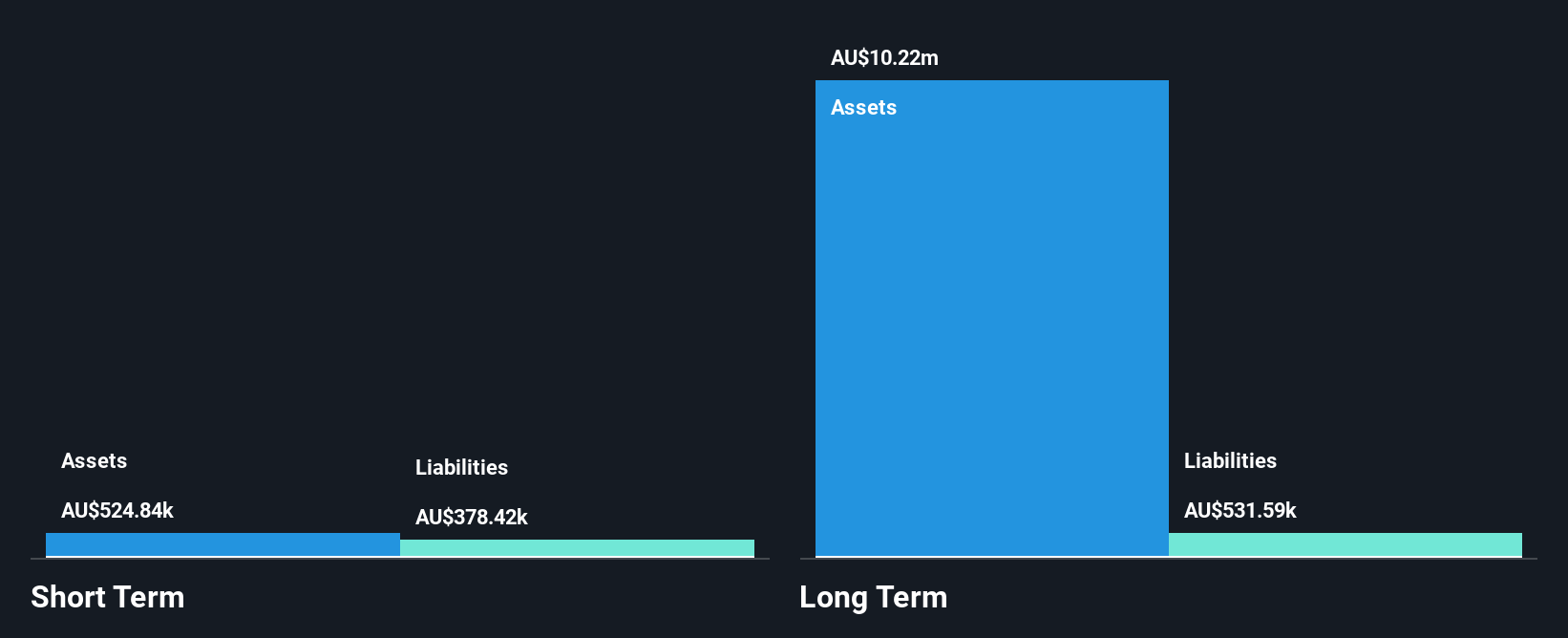

Magnum Mining and Exploration Limited, with a market cap of A$9.71 million, remains pre-revenue, highlighting its speculative nature typical of penny stocks. The company is debt-free, which marks an improvement from five years ago when it had a high debt to equity ratio. However, it faces challenges with less than one year of cash runway and increasing losses over the past five years at 17% annually. Although short-term assets exceed liabilities, the inexperienced board and volatile share price add uncertainty to its financial stability in the near term.

- Take a closer look at Magnum Mining and Exploration's potential here in our financial health report.

- Assess Magnum Mining and Exploration's previous results with our detailed historical performance reports.

Shriro Holdings (ASX:SHM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shriro Holdings Limited, with a market cap of A$75.20 million, manufactures, markets, and distributes consumer products in Australia, New Zealand, and internationally.

Operations: The company's revenue segments include Australia generating A$71.48 million, New Zealand contributing A$40.05 million, and the Rest of the World accounting for A$7.97 million.

Market Cap: A$75.2M

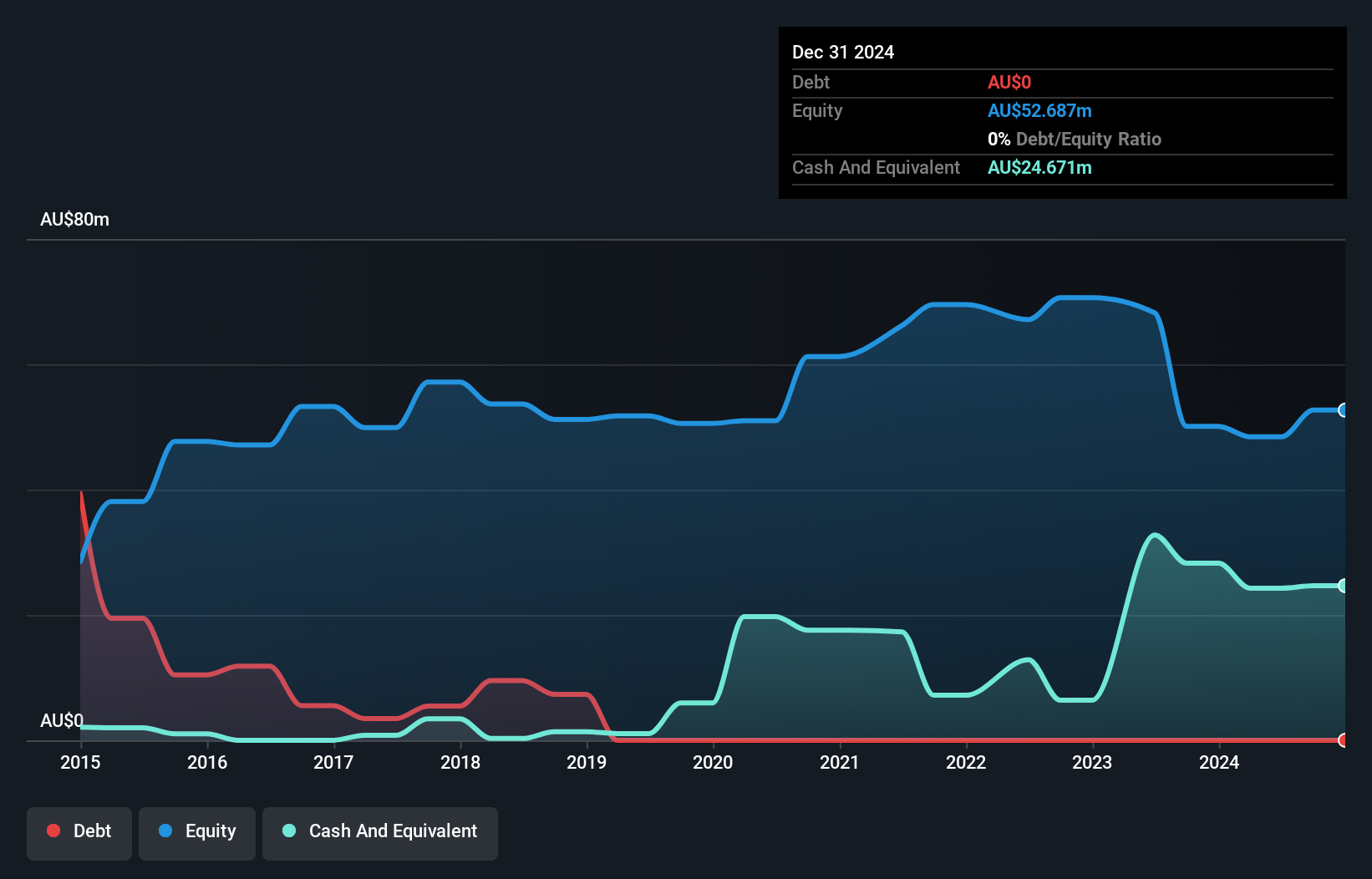

Shriro Holdings Limited, with a market cap of A$75.20 million, operates without debt, providing financial stability uncommon in penny stocks. Despite this strength, the company has experienced negative earnings growth over the past year and declining profit margins from 7.9% to 6.1%. Its management team and board are seasoned, contributing to governance stability. Trading significantly below its estimated fair value suggests potential undervaluation; however, its unstable dividend track record may concern income-focused investors. Recent executive changes include Duncan Glasgow assuming joint Company Secretary duties during Kerry Smith's maternity leave, indicating continuity in corporate governance amidst personnel shifts.

- Click to explore a detailed breakdown of our findings in Shriro Holdings' financial health report.

- Gain insights into Shriro Holdings' past trends and performance with our report on the company's historical track record.

Make It Happen

- Investigate our full lineup of 1,051 ASX Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SHM

Shriro Holdings

Manufactures, markets, and distributes consumer products in Australia, New Zealand, the United States, China, and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)