This article will reflect on the compensation paid to Rick Yeates who has served as CEO of Middle Island Resources Limited (ASX:MDI) since 2010. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Middle Island Resources

Comparing Middle Island Resources Limited's CEO Compensation With the industry

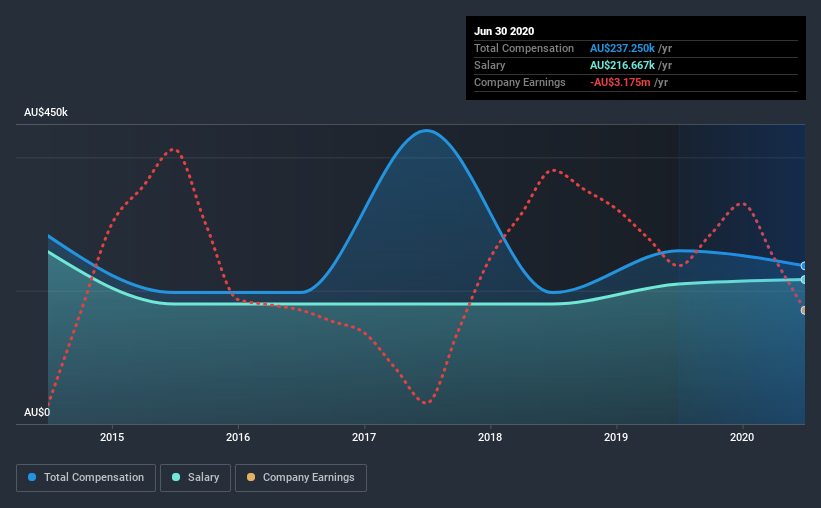

At the time of writing, our data shows that Middle Island Resources Limited has a market capitalization of AU$28m, and reported total annual CEO compensation of AU$237k for the year to June 2020. We note that's a decrease of 8.7% compared to last year. In particular, the salary of AU$216.7k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$251m, we found that the median total CEO compensation was AU$307k. From this we gather that Rick Yeates is paid around the median for CEOs in the industry. What's more, Rick Yeates holds AU$931k worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$217k | AU$210k | 91% |

| Other | AU$21k | AU$50k | 9% |

| Total Compensation | AU$237k | AU$260k | 100% |

On an industry level, around 68% of total compensation represents salary and 32% is other remuneration. It's interesting to note that Middle Island Resources pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Middle Island Resources Limited's Growth Numbers

Over the past three years, Middle Island Resources Limited has seen its earnings per share (EPS) grow by 42% per year. In the last year, its revenue is down 61%.

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Middle Island Resources Limited Been A Good Investment?

Since shareholders would have lost about 52% over three years, some Middle Island Resources Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As previously discussed, Rick is compensated close to the median for companies of its size, and which belong to the same industry. On the other hand, the company has logged negative shareholder returns over the previous three years. But on the bright side, EPS growth is positive over the same period. Overall, we wouldn't say Rick is paid an unjustified compensation, but shareholders might not favor a raise before shareholder returns show a positive trend.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 4 warning signs (and 2 which make us uncomfortable) in Middle Island Resources we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Middle Island Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MDI

Middle Island Resources

Engages in the identification, acquisition, and exploration of mineral assets in Australia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives