- Australia

- /

- Metals and Mining

- /

- ASX:MAH

ASX Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

As the Australian market experiences a mix of sector performances, with energy leading gains and real estate facing declines, investors are exploring diverse opportunities. Penny stocks, often representing smaller or newer companies, remain an intriguing area for those looking to uncover hidden potential in the market. Despite being considered a somewhat outdated term, these stocks can offer unique growth prospects when backed by solid financials and fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.63 | A$124.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.80 | A$1.02B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$71M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.46 | A$380.05M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$126.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.13 | A$151.37M | ✅ 3 ⚠️ 2 View Analysis > |

| NobleOak Life (ASX:NOL) | A$1.405 | A$130.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.37 | A$872.03M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.80 | A$1.29B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.39 | A$45.17M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 980 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Bathurst Resources (ASX:BRL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bathurst Resources Limited is involved in the exploration, development, and production of coal in New Zealand with a market capitalization of A$148.75 million.

Operations: The company's revenue is derived from two main segments: Export, contributing NZ$281.15 million, and Domestic, generating NZ$139.50 million.

Market Cap: A$148.75M

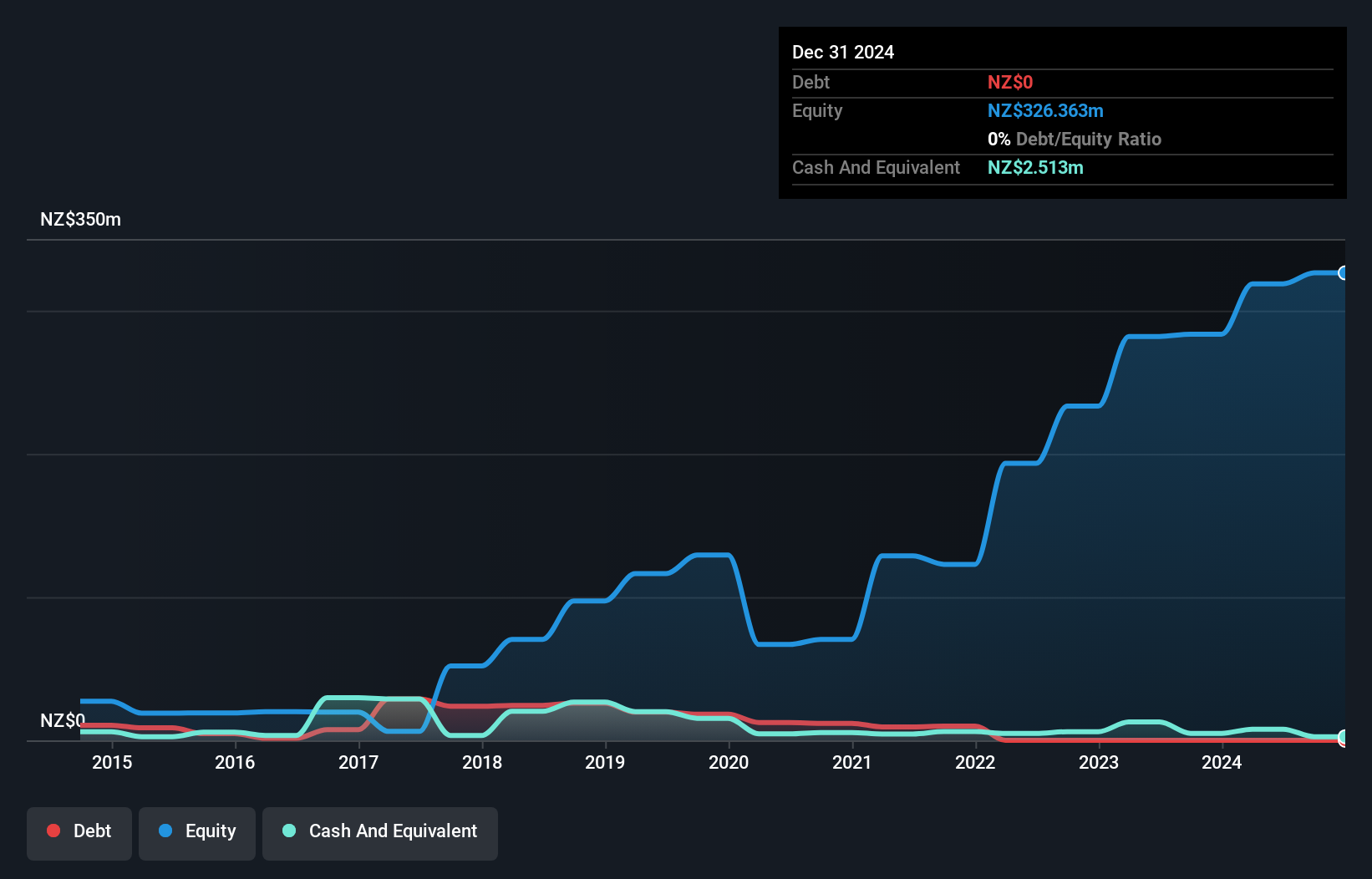

Bathurst Resources, with a market cap of A$148.75 million, has stable weekly volatility and is debt-free, enhancing its appeal among penny stocks. Despite high-quality past earnings and experienced management, recent performance shows challenges with negative earnings growth (-29.7%) over the past year and lower net profit margins (87.8%). The company recently completed follow-on equity offerings totaling approximately A$37 million but was dropped from the S&P/ASX All Ordinaries Index in March 2025. Its price-to-earnings ratio of 4.5x suggests good value relative to the broader Australian market average of 17.6x.

- Click here to discover the nuances of Bathurst Resources with our detailed analytical financial health report.

- Gain insights into Bathurst Resources' historical outcomes by reviewing our past performance report.

Macmahon Holdings (ASX:MAH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Macmahon Holdings Limited offers surface and underground mining services, along with mining support and civil infrastructure, to clients in Australia and Southeast Asia, with a market cap of A$559.55 million.

Operations: The company's revenue is derived from providing mining services and civil infrastructure solutions in Australia and Southeast Asia, totaling A$2.24 billion.

Market Cap: A$559.55M

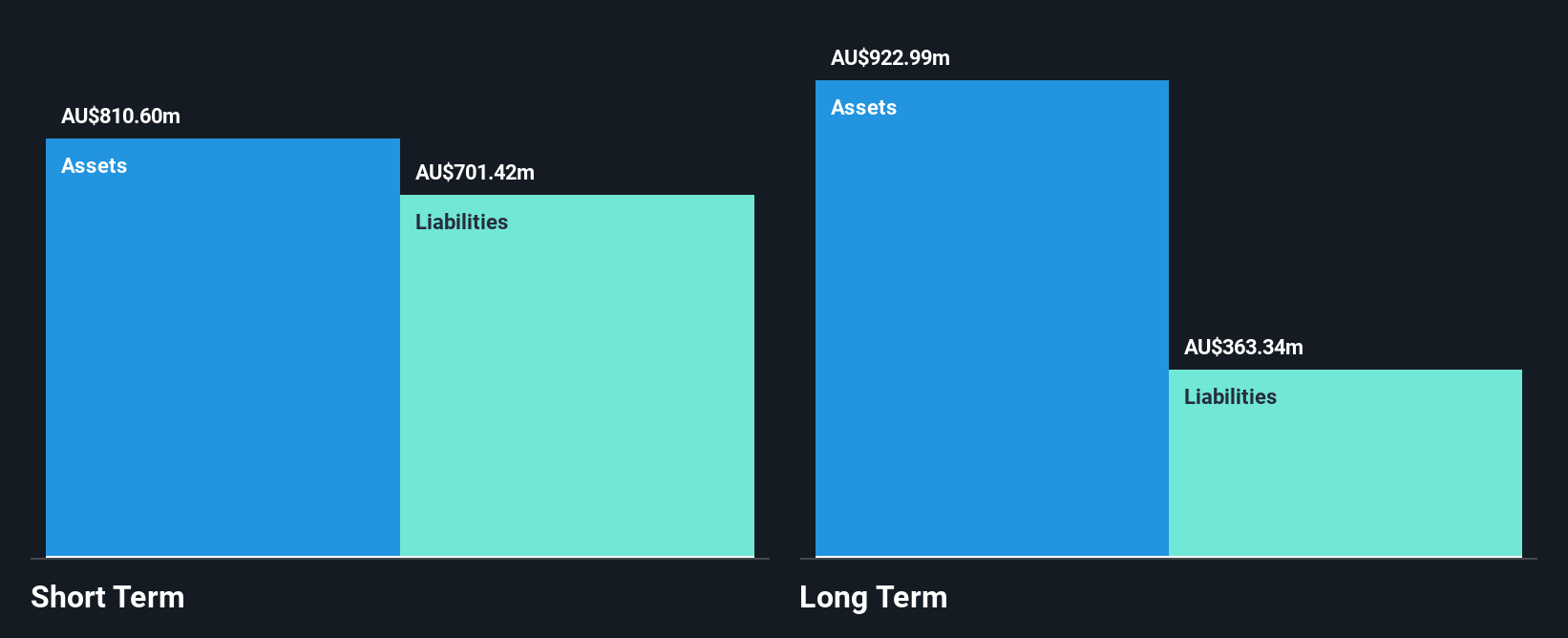

Macmahon Holdings, with a market cap of A$559.55 million, presents a mixed picture for penny stock investors. The company's revenue is robust at A$2.24 billion, but its earnings growth has been negative over the past year. Despite satisfactory debt levels and strong asset coverage for liabilities, net profit margins have declined to 2.1%. Recent developments include being dropped from the S&P/ASX Emerging Companies Index and reaffirming fiscal year 2025 revenue guidance between A$2.4 billion and A$2.5 billion, with an increased interim dividend reflecting a stable payout policy amidst fluctuating earnings performance.

- Dive into the specifics of Macmahon Holdings here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Macmahon Holdings' future.

Mastermyne Group (ASX:MYE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mastermyne Group Limited operates in Australia, offering mine operation, contracting, training, and related services within the mining and supporting industries, with a market cap of A$51.03 million.

Operations: The company generates revenue of A$266.24 million from its operations in Australia, focusing on mine operation, contracting, training, and related services within the mining sector.

Market Cap: A$51.03M

Mastermyne Group, with a market cap of A$51.03 million, offers potential yet comes with challenges for penny stock investors. Its revenue stands at A$266.24 million, but recent earnings have declined significantly compared to the previous year. The company has initiated a share buyback program aimed at reducing administrative costs and improving shareholder value. While its debt is well-managed and covered by operating cash flow, concerns remain over its low return on equity and unstable dividend track record. Despite these issues, Mastermyne's short-term assets comfortably cover both short- and long-term liabilities, indicating financial stability amidst operational hurdles.

- Click here and access our complete financial health analysis report to understand the dynamics of Mastermyne Group.

- Gain insights into Mastermyne Group's past trends and performance with our report on the company's historical track record.

Next Steps

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 977 more companies for you to explore.Click here to unveil our expertly curated list of 980 ASX Penny Stocks.

- Ready For A Different Approach? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAH

Macmahon Holdings

Provides surface mining, underground mining and mining support, and civil infrastructure services to mining companies in Australia and Southeast Asia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives