- Australia

- /

- Metals and Mining

- /

- ASX:LYC

Lynas Rare Earths (ASX:LYC) Is Down 12.4% After Revenue Jump Misses Estimates – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In late October 2025, Lynas Rare Earths reported first-quarter results showing a 66% increase in revenue to A$200.2 million, fueled by higher demand for rare earths and enhanced production capacity, though the result came in below analyst estimates.

- The company advanced its global supply chain presence by signing new offtake agreements, accelerating heavy rare earth output, and securing capital for growth, as Western nations sought alternatives to China's supply dominance.

- We'll explore how Lynas's push to diversify global supply chains shapes its future investment narrative and competitive positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Lynas Rare Earths Investment Narrative Recap

The core investment case for Lynas Rare Earths centers on the ongoing shift by Western countries to establish independent, secure rare earth supply chains, supported by policy and industrial demand for critical minerals. The latest result, a sharp revenue increase but a miss on consensus estimates, brought attention to both robust demand and the persistent operational, cost, and regulatory risks that may impact short-term margin execution; however, the news does not materially alter the central catalyst of large-scale supply chain diversification.

One recent and highly relevant announcement is Lynas's A$750 million capital raise to fund its “Towards 2030” strategy, supporting expansion of downstream processing and magnet manufacturing capacities. This move aligns with ongoing customer and offtake agreements and underpins Lynas’s ambition to capture premium pricing, although success will depend on flawless execution of capacity ramp-up and management of regulatory or cost challenges.

But for investors, it is equally important to consider the risks if ramp-up setbacks or local opposition were to...

Read the full narrative on Lynas Rare Earths (it's free!)

Lynas Rare Earths' outlook anticipates A$1.9 billion in revenue and A$732.6 million in earnings by 2028. This implies a 50.1% annual revenue growth rate and an earnings increase of about A$724.6 million from its current earnings of A$8.0 million.

Uncover how Lynas Rare Earths' forecasts yield a A$15.69 fair value, a 13% upside to its current price.

Exploring Other Perspectives

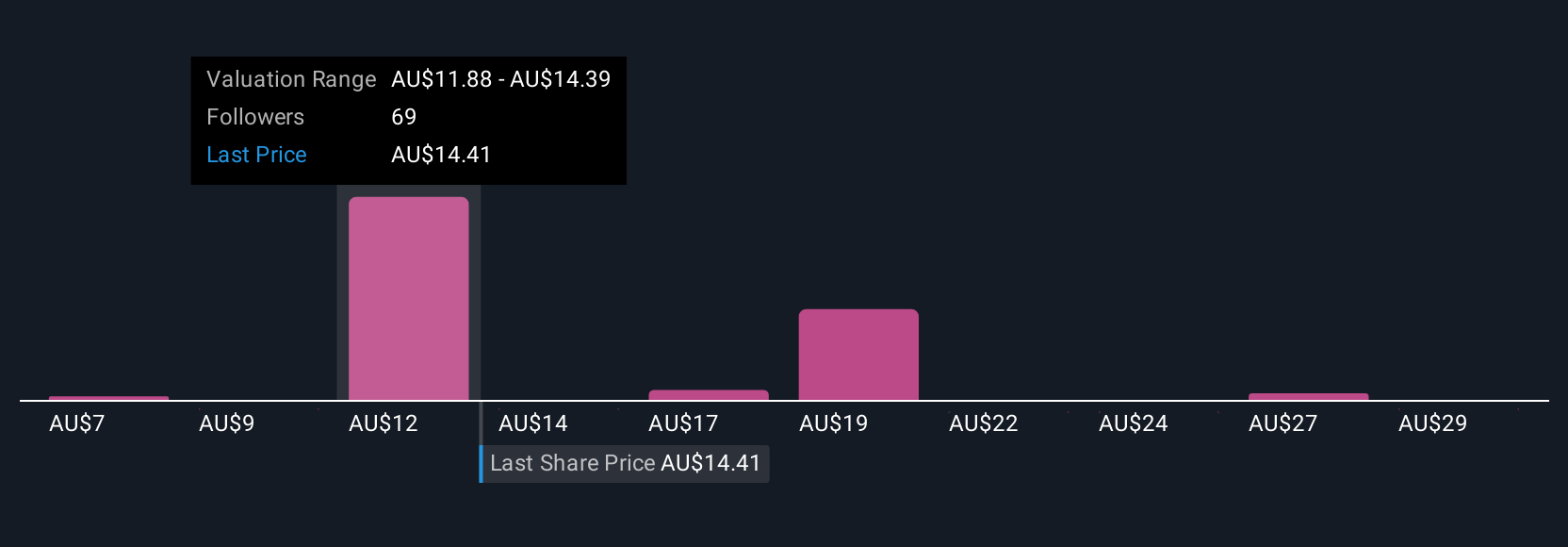

Simply Wall St Community members provided 19 independent fair value estimates for Lynas, ranging from A$8.90 to A$35.02 per share. While many anticipate strong revenue expansion, diverse opinions highlight how expectations around execution and policy support could meaningfully affect future outcomes.

Explore 19 other fair value estimates on Lynas Rare Earths - why the stock might be worth 36% less than the current price!

Build Your Own Lynas Rare Earths Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lynas Rare Earths research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lynas Rare Earths research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lynas Rare Earths' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYC

Lynas Rare Earths

Engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives