- Australia

- /

- Metals and Mining

- /

- ASX:LTR

Liontown Resources (ASX:LTR) Is Up 11.4% After Ford Deal Revision and $336m Raise – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- In recent days, Liontown Resources announced revised agreements with Ford Motor Company, improving liquidity and allowing for reduced spodumene concentrate deliveries from 2027, which provides added marketing flexibility for its Kathleen Valley lithium project. Additionally, the company completed a capital raise of up to A$336 million to strengthen its balance sheet and support ongoing operational growth at Kathleen Valley following significant production and sales increases.

- An interesting aspect of these developments is the enhanced financial position and operational flexibility Liontown Resources is gaining just as its flagship lithium project ramps up production and sales momentum.

- We’ll now explore how Liontown’s improved terms with Ford and recent capital raise may shape its investment narrative going forward.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Liontown Resources Investment Narrative Recap

To be a shareholder in Liontown Resources right now, you would need to believe the company can convert its ramping lithium production and sales into sustainable profitability as operations at Kathleen Valley expand. The recent agreement revision with Ford and capital raise improve liquidity, but near-term performance still hinges on whether increased output and sales are matched by cost control, particularly as operational costs and lithium prices remain volatile. These liquidity updates do help reduce immediate financial risk, but do not meaningfully change the importance of efficient execution in mining and processing as the core short-term catalyst and challenge for the business.

The most relevant recent announcement for these developments is Liontown’s completed capital raise of up to A$336 million, which directly boosts the company’s financial flexibility just as production at Kathleen Valley increases. This move shores up the balance sheet, and, paired with the revised Ford agreement, positions Liontown to maintain momentum if it can contain operating costs and avoid further dilution of existing shareholders. Together, these steps support Liontown’s ability to sustain ongoing investment in production and marketing as the project scales, touching on the company’s biggest catalyst: efficient underground ramp-up and improved ore recovery driving operational gains.

But on the other hand, investors should be aware that cost guidance is trending toward the upper end, so if operational costs rise faster than anticipated...

Read the full narrative on Liontown Resources (it's free!)

Liontown Resources' outlook anticipates A$725.1 million in revenue and A$62.7 million in earnings by 2028. This scenario is based on an annual revenue growth rate of 93.1% and an earnings turnaround from A$-49.1 million today, representing an A$111.8 million increase.

Uncover how Liontown Resources' forecasts yield a A$0.701 fair value, a 43% downside to its current price.

Exploring Other Perspectives

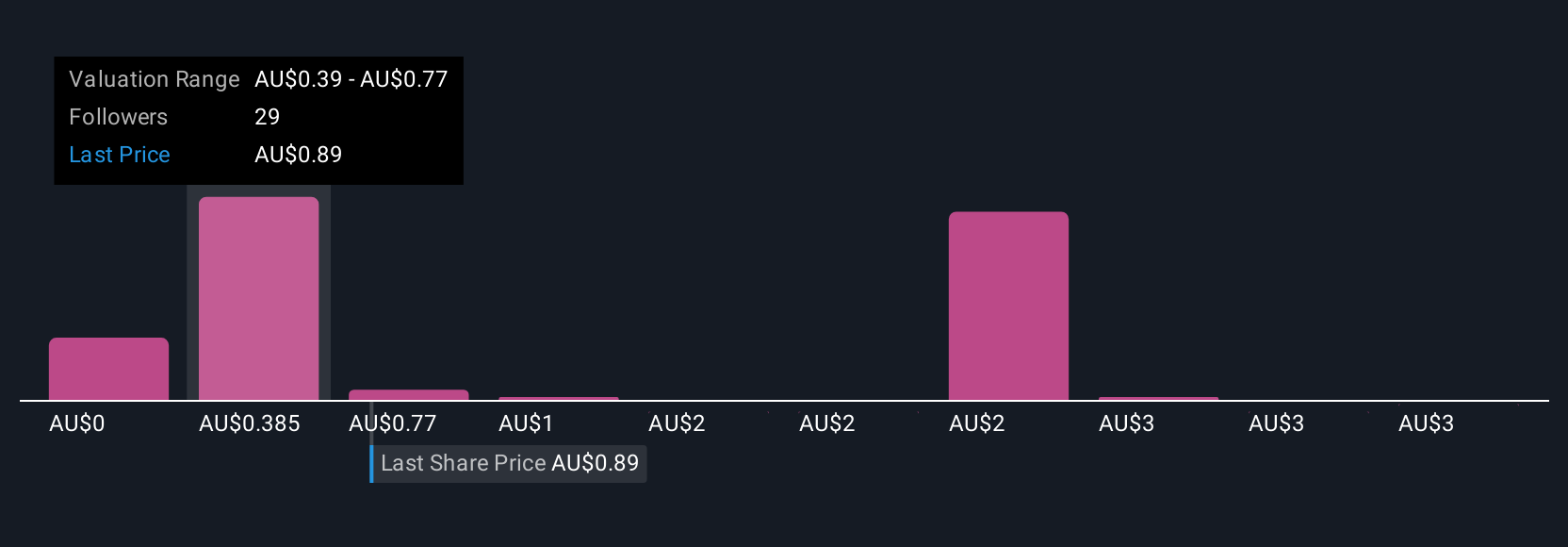

Seventeen Simply Wall St Community members estimate Liontown’s fair value anywhere between A$0.30 and A$3 per share, reflecting broad disagreement about its future. This diversity comes as focus intensifies on the company’s ability to manage operational costs during the underground ramp-up, which will be crucial for achieving profitable growth.

Explore 17 other fair value estimates on Liontown Resources - why the stock might be worth over 2x more than the current price!

Build Your Own Liontown Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liontown Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Liontown Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liontown Resources' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives