- Australia

- /

- Metals and Mining

- /

- ASX:LTR

Liontown Resources (ASX:LTR): Assessing Valuation After Major Deal Updates and $336m Capital Raise

Reviewed by Simply Wall St

Liontown Resources (ASX:LTR) has been in the spotlight after reaching new highs, following updated agreements with Ford and a substantial A$336 million capital raise. These moves boost both its financial flexibility and the outlook for its Kathleen Valley lithium project.

See our latest analysis for Liontown Resources.

After a year of strong momentum, Liontown Resources’ share price has soared 114% year-to-date. A 30-day climb of 30% suggests confidence is building around its strategic moves and the growth narrative at Kathleen Valley. The five-year total shareholder return of 408% also highlights how investors have been rewarded for their patience, even if one-year total returns, at 37%, trail some of the most recent gains.

If this kind of market-moving news has you thinking bigger, it could be the right time to broaden your search and discover fast growing stocks with high insider ownership.

With the share price hitting all-time highs after a sustained rally, the pressing question is whether Liontown Resources remains undervalued or if investor optimism has already factored in the company's future growth potential. Could there still be a buying opportunity?

Most Popular Narrative: 74.1% Overvalued

With Liontown Resources last closing at A$1.22 and a narrative fair value of A$0.70 per share, market enthusiasm appears much higher than the outlook suggested by the most popular narrative. This sets the stage for closer inspection into what is actually driving the gap in expectations.

The analysts have a consensus price target of A$0.626 for Liontown Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.15, and the most bearish reporting a price target of just A$0.35.

Want to see what’s behind this big disconnect? One aggressive assumption, a bold profit margin forecast and a revenue ramp that could rival industry leaders are just a few of the surprises that drive the narrative’s fair value. Wondering how all of these moving parts are expected to play out for Liontown? Dive into the full narrative to see the projections that set this target.

Result: Fair Value of $0.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as rising operational costs or a prolonged dip in lithium prices could quickly dampen analyst optimism and shift the outlook for Liontown.

Find out about the key risks to this Liontown Resources narrative.

Another View: Discounted Cash Flow Points to Opportunity

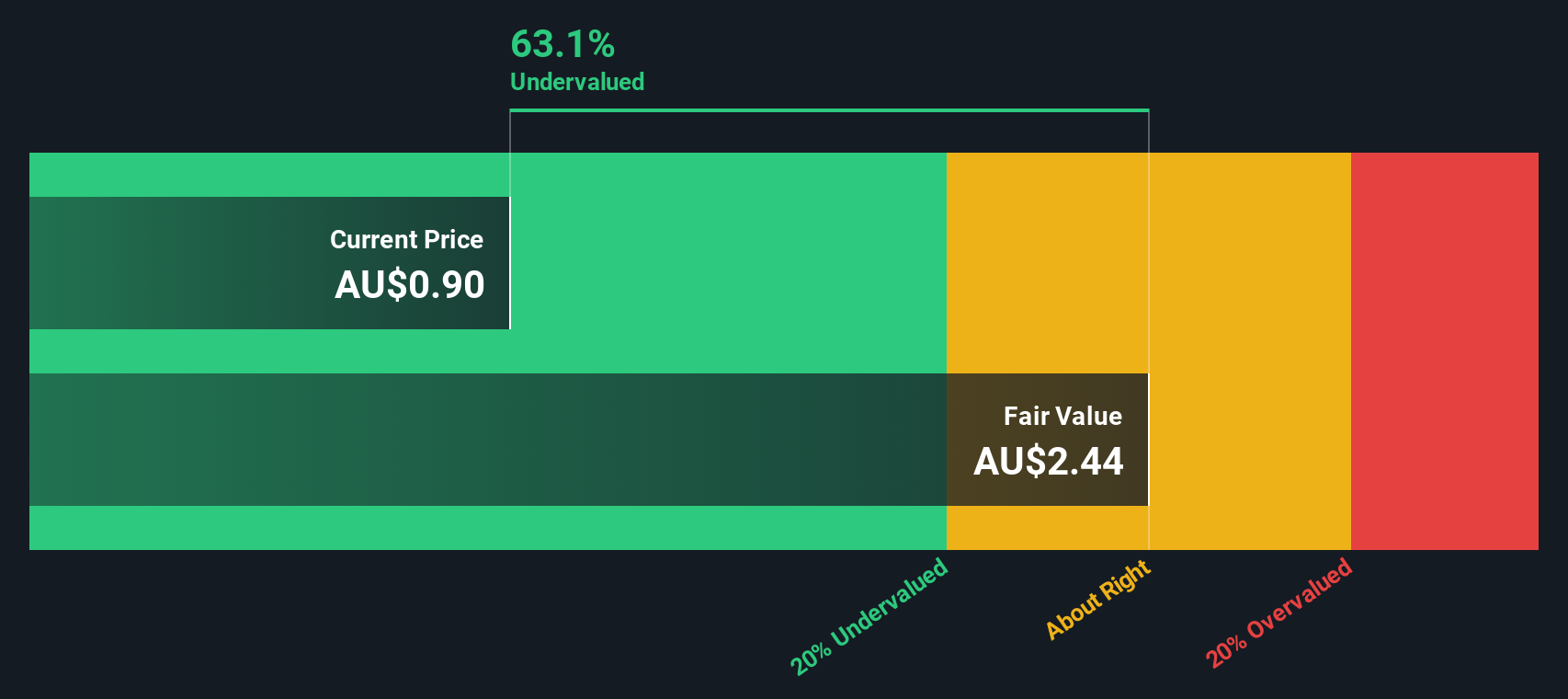

While the narrative-based fair value suggests Liontown Resources is overvalued, the SWS DCF model paints a different picture. According to our DCF analysis, the stock is actually trading below its estimated fair value. This indicates there may be more potential upside than consensus expects. Which scenario should investors give more weight?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Liontown Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Liontown Resources Narrative

If you think there’s more to the story or want to test your own assumptions, building a narrative from scratch is quick and easy. See for yourself: Do it your way.

A great starting point for your Liontown Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to one story when you could be tapping into the next big opportunity. Now is your chance to act and harness unique market trends shaping the future.

- Secure your share of future gains by targeting rising cash flows and value potential with these 876 undervalued stocks based on cash flows before the crowd catches on.

- Capitalize on the AI wave transforming industries by spotting innovation leaders among these 27 AI penny stocks driving remarkable growth.

- Boost your passive income by uncovering companies offering reliable returns through these 17 dividend stocks with yields > 3% and robust yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives