- Australia

- /

- Specialty Stores

- /

- ASX:CTT

ASX Growth Companies With High Insider Ownership In October 2024

Reviewed by Simply Wall St

As the ASX200 experiences modest gains, with sectors like Materials leading the charge, investor sentiment remains cautious amid concerns over China's market reactions to recent stimulus announcements. In this mixed economic landscape, identifying growth companies with high insider ownership can be particularly appealing as these firms often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Catalyst Metals (ASX:CYL) | 17% | 45.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Liontown Resources (ASX:LTR) | 14.7% | 61% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 71.3% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Here we highlight a subset of our preferred stocks from the screener.

Cettire (ASX:CTT)

Simply Wall St Growth Rating: ★★★★★☆

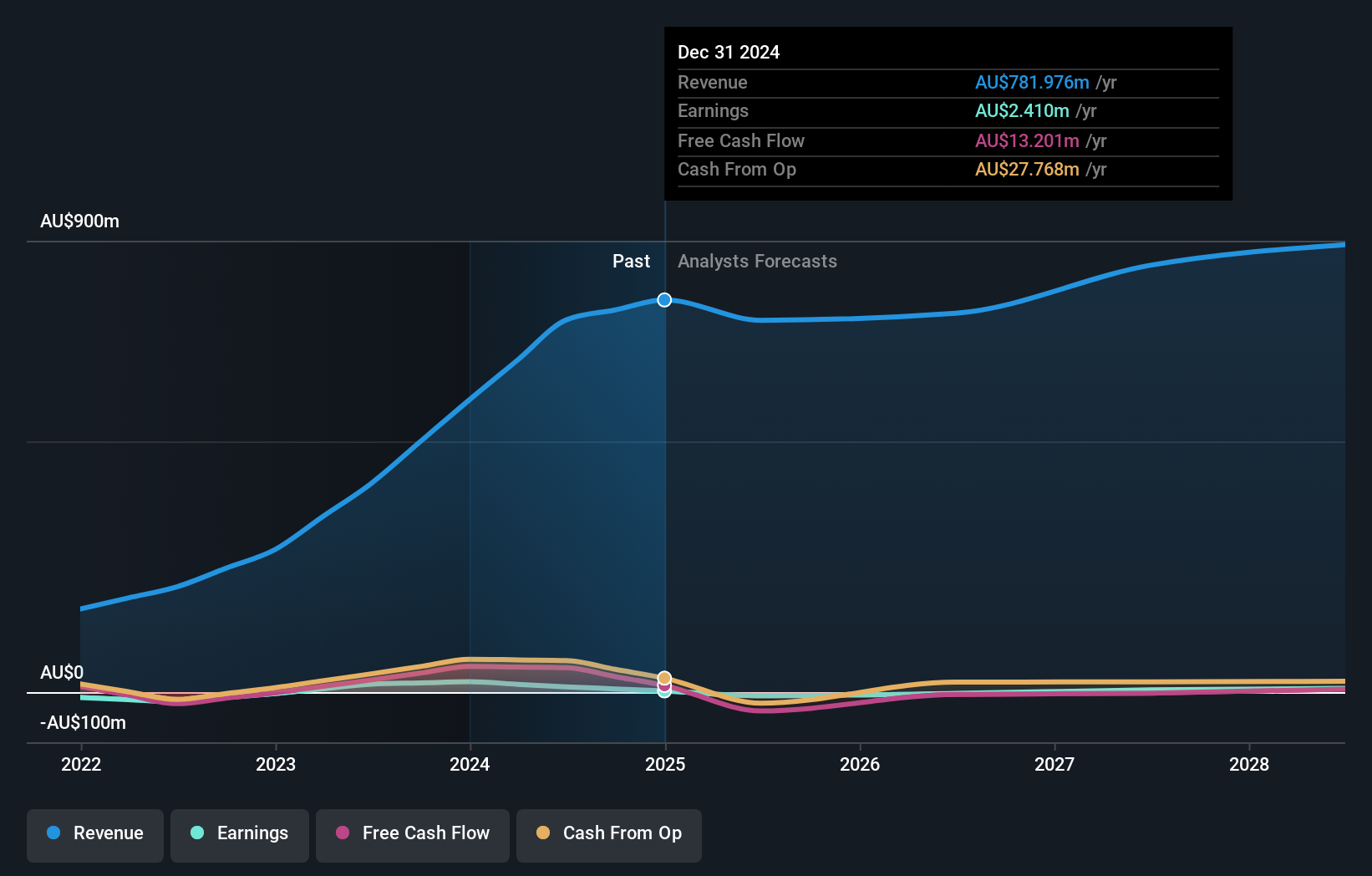

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally with a market cap of A$865.41 million.

Operations: The company's revenue primarily stems from online retail sales, amounting to A$742.26 million.

Insider Ownership: 33.5%

Revenue Growth Forecast: 16.1% p.a.

Cettire demonstrates strong growth potential with earnings forecasted to increase significantly at 29% annually, outpacing the Australian market's 12.2%. Despite a volatile share price, insider confidence is evident with substantial buying activity and no major sales in recent months. However, profit margins have decreased from last year. Recent executive changes include Caroline Elliott joining as an Independent Non-Executive Director, potentially strengthening governance as the company anticipates continued revenue growth.

- Click here and access our complete growth analysis report to understand the dynamics of Cettire.

- Our valuation report unveils the possibility Cettire's shares may be trading at a premium.

Liontown Resources (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★★

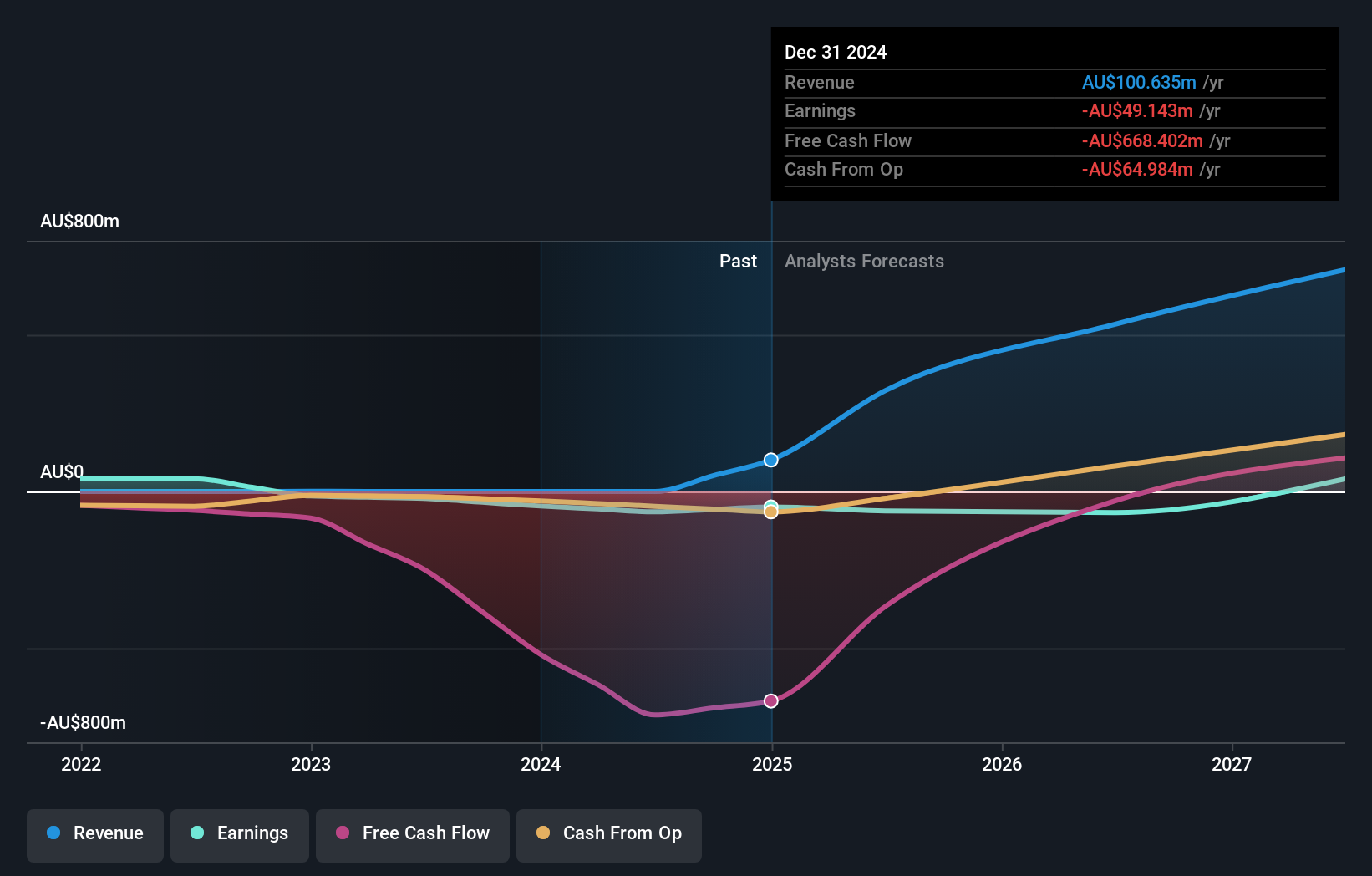

Overview: Liontown Resources Limited focuses on the exploration, evaluation, and development of mineral properties in Australia with a market cap of A$2.02 billion.

Operations: Liontown Resources Limited does not currently report any revenue segments.

Insider Ownership: 14.7%

Revenue Growth Forecast: 40.3% p.a.

Liontown Resources anticipates significant revenue growth of 40.3% annually, surpassing the Australian market's 5.5%. Despite reporting a net loss of A$64.92 million for the year ending June 2024, insider buying activity suggests confidence in future prospects, with no substantial sales in recent months. Governance improvements are highlighted by Ian Wells' appointment as Lead Independent Director. The company's return on equity is forecasted to be high at 23.1% in three years, indicating potential profitability ahead.

- Click to explore a detailed breakdown of our findings in Liontown Resources' earnings growth report.

- In light of our recent valuation report, it seems possible that Liontown Resources is trading behind its estimated value.

Pinnacle Investment Management Group (ASX:PNI)

Simply Wall St Growth Rating: ★★★★☆☆

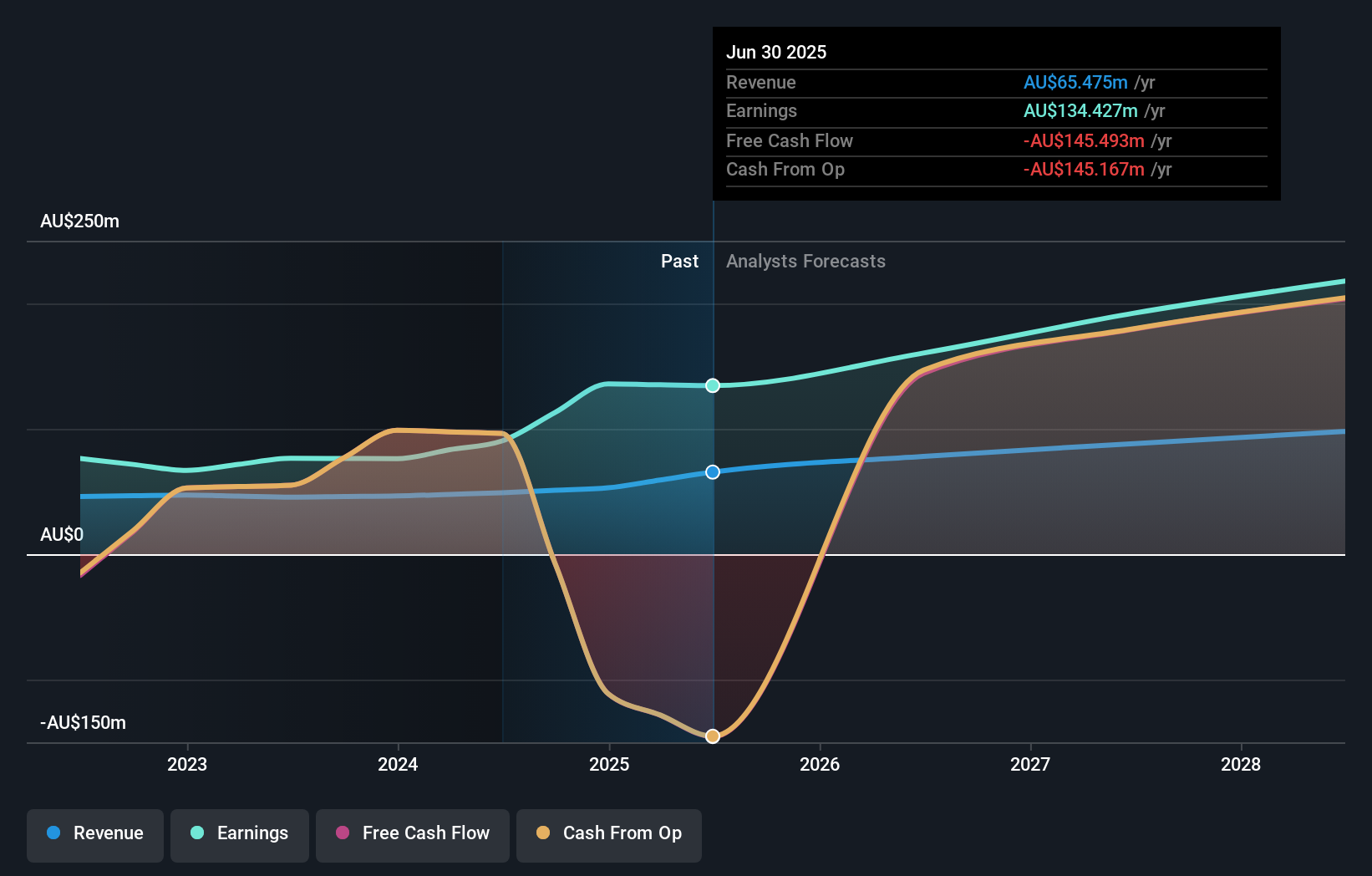

Overview: Pinnacle Investment Management Group Limited is an investment management company based in Australia with a market cap of A$3.78 billion.

Operations: The company generates revenue primarily from its Funds Management Operations, amounting to A$48.99 million.

Insider Ownership: 31.5%

Revenue Growth Forecast: 13.6% p.a.

Pinnacle Investment Management Group is experiencing moderate growth, with earnings forecasted to grow at 14.4% annually, outpacing the Australian market's 12.2%. Revenue growth is expected at 13.6% per year, also above the market average. Recent results show increased net income of A$90.35 million from A$76.47 million last year, reflecting solid performance despite slower revenue expansion compared to some peers. Christina Lenard's appointment as Director may enhance governance and strategic direction moving forward.

- Dive into the specifics of Pinnacle Investment Management Group here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Pinnacle Investment Management Group is priced higher than what may be justified by its financials.

Taking Advantage

- Navigate through the entire inventory of 99 Fast Growing ASX Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTT

Cettire

Engages in the online luxury goods retailing business in Australia, the United States, and internationally.

Flawless balance sheet with high growth potential.