- Australia

- /

- Metals and Mining

- /

- ASX:LCY

3 Promising ASX Penny Stocks With Over A$80M Market Cap

Reviewed by Simply Wall St

As the Australian market experiences a turbulent period, with tech indices notably down and every sector in the red, investors are searching for opportunities amidst the volatility. Penny stocks, though an outdated term, still represent a segment of smaller or newer companies that can offer potential growth when backed by solid financials. In this article, we explore three such penny stocks on the ASX that combine balance sheet strength with promising potential for long-term gains.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.45 | A$128.96M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.825 | A$51.37M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.88 | A$442.63M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.62 | A$267.18M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Bravura Solutions (ASX:BVS) | A$2.32 | A$1.04B | ✅ 3 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.785 | A$375.56M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.20 | A$1.35B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.57 | A$237.93M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.40 | A$629.76M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 411 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Legacy Iron Ore (ASX:LCY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Legacy Iron Ore Limited is an Australian company focused on the exploration, evaluation, and development of mineral properties, with a market cap of A$87.86 million.

Operations: The company generates revenue from its gold segment, amounting to A$56.16 million.

Market Cap: A$87.86M

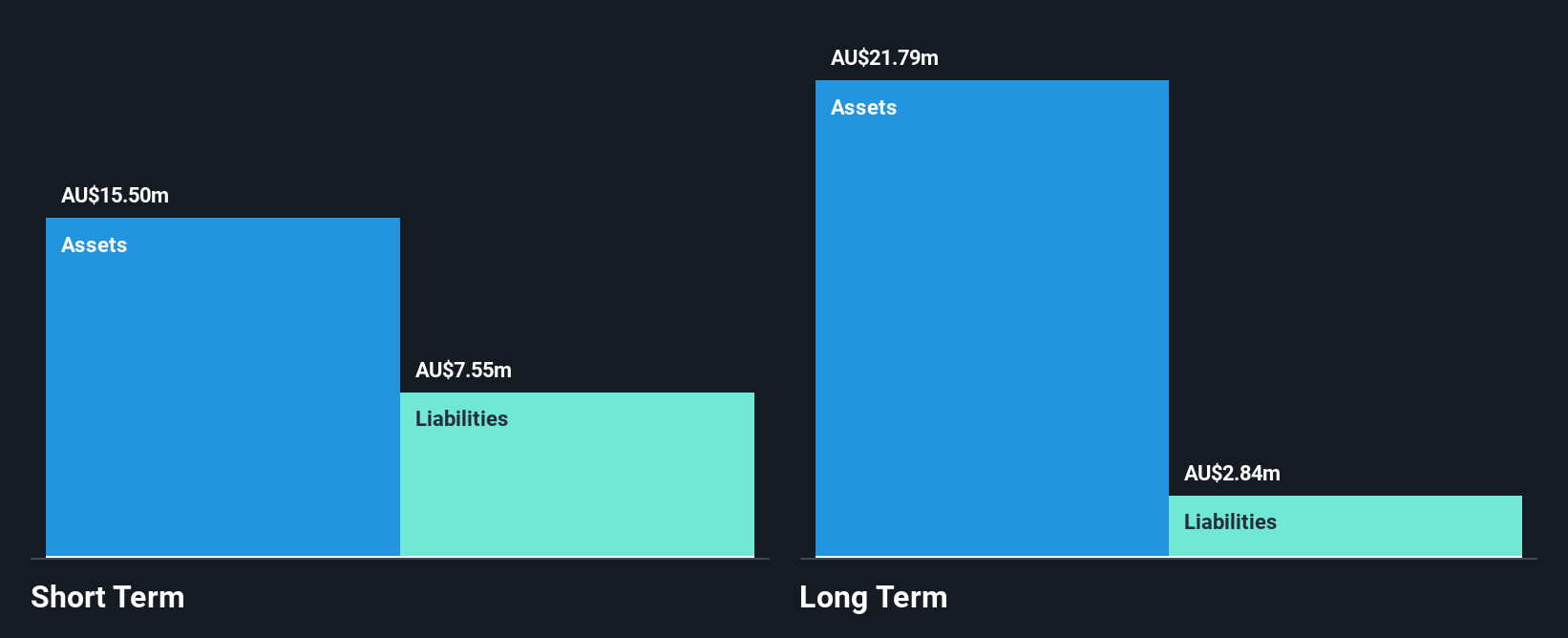

Legacy Iron Ore Limited, with a market cap of A$87.86 million, remains pre-revenue despite generating A$56.16 million from its gold segment. The company is unprofitable and has seen losses increase by 66.9% annually over five years. Despite a stable management team with an average tenure of seven years, the board is relatively new with an average tenure of 1.2 years. Legacy Iron Ore's short-term assets exceed both its long-term and short-term liabilities, but it faces high volatility and less than a year of cash runway based on current free cash flow trends without any debt burden to manage.

- Unlock comprehensive insights into our analysis of Legacy Iron Ore stock in this financial health report.

- Examine Legacy Iron Ore's past performance report to understand how it has performed in prior years.

OFX Group (ASX:OFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OFX Group Limited operates as a provider of international payments and foreign exchange services across the Asia Pacific, North America, Europe, the Middle East, and Africa with a market cap of A$137.87 million.

Operations: The company's revenue is primarily derived from the Asia Pacific with A$85.98 million, followed by North America at A$83.29 million, Europe contributing A$34.10 million, and Treasury operations generating A$13.15 million.

Market Cap: A$137.87M

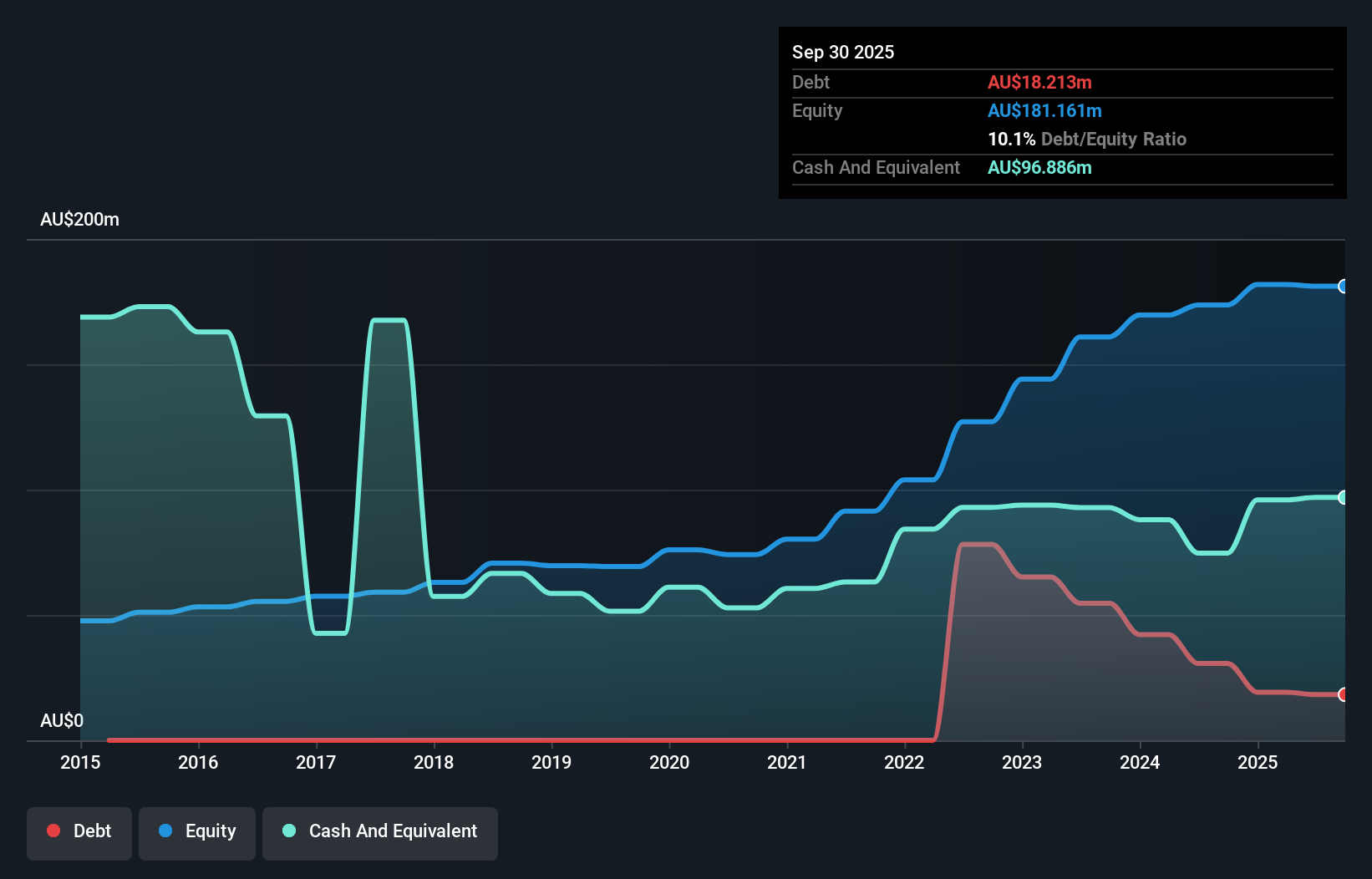

OFX Group, with a market cap of A$137.87 million, faces challenges with declining net income and earnings per share compared to the previous year. Despite this, its financials show resilience through strong cash flow covering debt and short-term assets exceeding liabilities. The company has experienced management and board teams but recently dropped from key indices like S&P/ASX 300. OFX's strategic expansion into the U.S. and select APAC markets highlights growth potential in international payments and FX services, supported by partnerships enhancing its service offerings amidst a competitive landscape for penny stocks in Australia.

- Click here to discover the nuances of OFX Group with our detailed analytical financial health report.

- Evaluate OFX Group's prospects by accessing our earnings growth report.

United Overseas Australia (ASX:UOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, along with its subsidiaries, is involved in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia, with a market cap of A$1.17 billion.

Operations: The company's revenue is primarily derived from its land development and resale segment, which generated A$438.18 million, complemented by investment activities contributing A$257.51 million.

Market Cap: A$1.17B

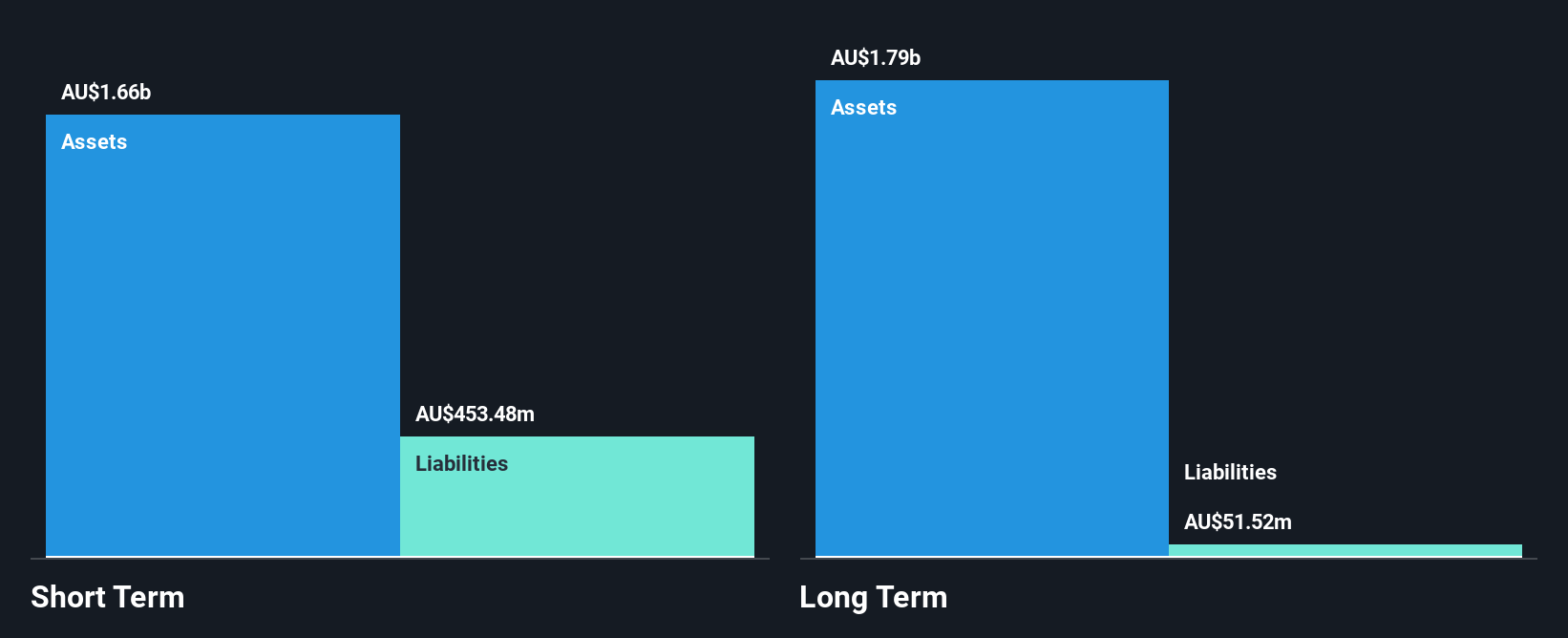

United Overseas Australia Ltd's financial profile is marked by a strong balance sheet, with short-term assets of A$1.7 billion comfortably covering both short and long-term liabilities. The company has maintained high-quality earnings, evidenced by recent net income of A$44.61 million for the half-year ending June 2025, up from A$33.92 million the previous year. Despite an increased debt-to-equity ratio over five years, its cash reserves surpass total debt, ensuring financial stability. However, its return on equity remains low at 5%, and dividend sustainability is uncertain due to an unstable track record in payouts.

- Click here and access our complete financial health analysis report to understand the dynamics of United Overseas Australia.

- Learn about United Overseas Australia's historical performance here.

Where To Now?

- Jump into our full catalog of 411 ASX Penny Stocks here.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LCY

Legacy Iron Ore

Engages in the exploration, evaluation, and development of mineral properties in Australia.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives