- Australia

- /

- Metals and Mining

- /

- ASX:KRM

What Do The Returns At Kingsrose Mining (ASX:KRM) Mean Going Forward?

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So on that note, Kingsrose Mining (ASX:KRM) looks quite promising in regards to its trends of return on capital.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Kingsrose Mining, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

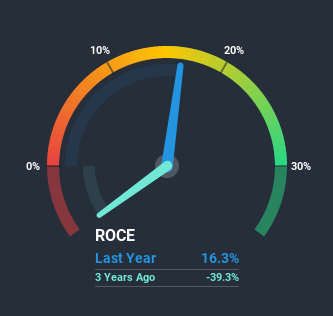

0.16 = AU$8.7m ÷ (AU$55m - AU$2.0m) (Based on the trailing twelve months to December 2020).

Thus, Kingsrose Mining has an ROCE of 16%. In absolute terms, that's a satisfactory return, but compared to the Metals and Mining industry average of 11% it's much better.

See our latest analysis for Kingsrose Mining

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Kingsrose Mining's past further, check out this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Kingsrose Mining Tell Us?

Kingsrose Mining has not disappointed in regards to ROCE growth. The figures show that over the last five years, returns on capital have grown by 6,088%. The company is now earning AU$0.2 per dollar of capital employed. Interestingly, the business may be becoming more efficient because it's applying 44% less capital than it was five years ago. A business that's shrinking its asset base like this isn't usually typical of a soon to be multi-bagger company.

The Bottom Line

In the end, Kingsrose Mining has proven it's capital allocation skills are good with those higher returns from less amount of capital. Although the company may be facing some issues elsewhere since the stock has plunged 80% in the last five years. Still, it's worth doing some further research to see if the trends will continue into the future.

If you want to continue researching Kingsrose Mining, you might be interested to know about the 3 warning signs that our analysis has discovered.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade Kingsrose Mining, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kingsrose Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:KRM

Kingsrose Mining

Operates as a mineral exploration company in Norway and Finland.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion