Environmental Group And 2 Other ASX Penny Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, but it is up 18% over the past year with earnings forecast to grow by 13% annually. In light of these conditions, exploring stocks that combine growth potential with solid financial health can be a wise strategy. Penny stocks may be a somewhat outdated term, yet they continue to represent opportunities in smaller or newer companies that could offer growth at attractive price points.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$325.58M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.50 | A$111.06M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.77 | A$229.66M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.64 | A$803.73M | ★★★★★☆ |

| Atlas Pearls (ASX:ATP) | A$0.15 | A$65.35M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.075 | A$116.81M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,045 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Environmental Group (ASX:EGL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Environmental Group Limited designs, applies, and services gas, vapor, and dust emission control systems as well as inlet and exhaust systems for gas turbines in Australia and internationally with a market cap of A$104.64 million.

Operations: The company's revenue is derived from several segments, including EGL Waste (A$0.85 million), EGL Energy (A$37.86 million), Egl Clean Air Tapc (A$17.40 million), Egl Clean Air Airtight (A$15.54 million), and EGL Turbine Enhancement (A$27.13 million).

Market Cap: A$104.64M

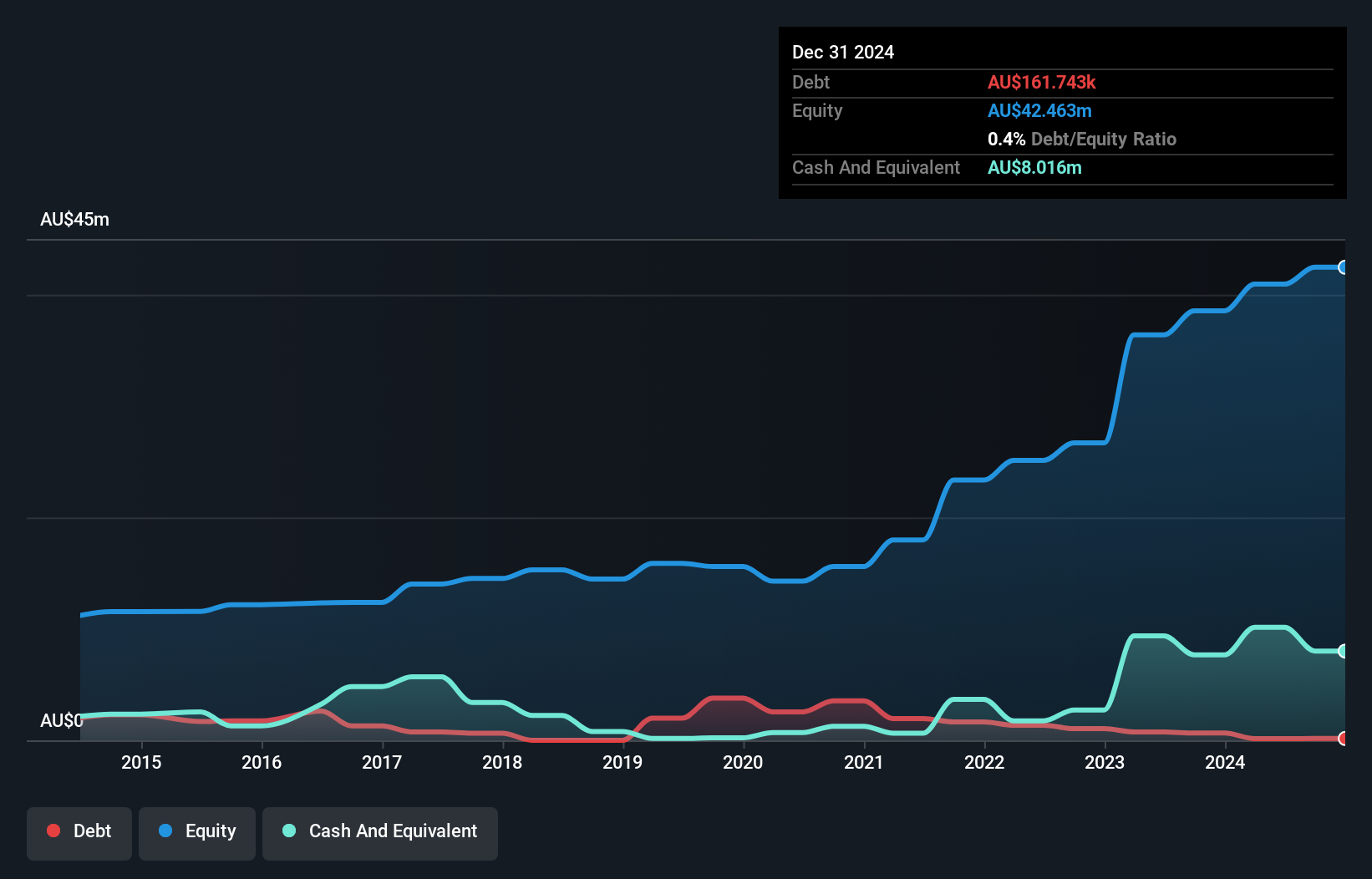

Environmental Group Limited demonstrates a robust financial position with earnings growth of 68% over the past year, outpacing its five-year average and the broader Machinery industry. The company maintains high-quality earnings, supported by a strong balance sheet where cash exceeds total debt. Despite having an inexperienced board with an average tenure of 2.5 years, management's experience averages at 3.8 years, providing stability. Its net profit margin has improved to 4.5%, and it trades below estimated fair value by 28.3%. Recent board changes include appointing Lucia Cade as an Independent Non-Executive Director, enhancing governance and strategic oversight ahead of upcoming earnings results on November 28, 2024.

- Click here and access our complete financial health analysis report to understand the dynamics of Environmental Group.

- Assess Environmental Group's future earnings estimates with our detailed growth reports.

Kairos Minerals (ASX:KAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kairos Minerals Limited is a resource exploration company operating in Australia, with a market capitalization of A$44.73 million.

Operations: Kairos Minerals Limited has not reported any specific revenue segments.

Market Cap: A$44.73M

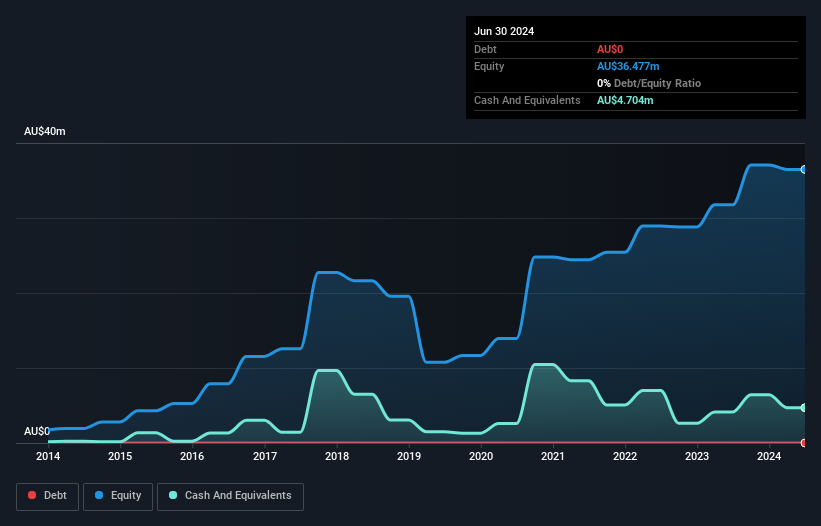

Kairos Minerals Limited, with a market cap of A$44.73 million, operates as a pre-revenue entity in the resource exploration sector. Despite being debt-free for five years and having short-term assets (A$4.8M) that cover both short-term (A$378.7K) and long-term liabilities (A$77.6K), the company faces challenges with less than a year of cash runway based on current free cash flow trends. While losses have decreased at an annual rate of 36% over five years, volatility remains high compared to 75% of Australian stocks, reflecting potential risks inherent in its operations and market position.

- Click here to discover the nuances of Kairos Minerals with our detailed analytical financial health report.

- Understand Kairos Minerals' track record by examining our performance history report.

Melbana Energy (ASX:MAY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Melbana Energy Limited is involved in oil and gas exploration activities in Cuba and Australia, with a market capitalization of approximately A$97.74 million.

Operations: Melbana Energy Limited does not report any specific revenue segments.

Market Cap: A$97.74M

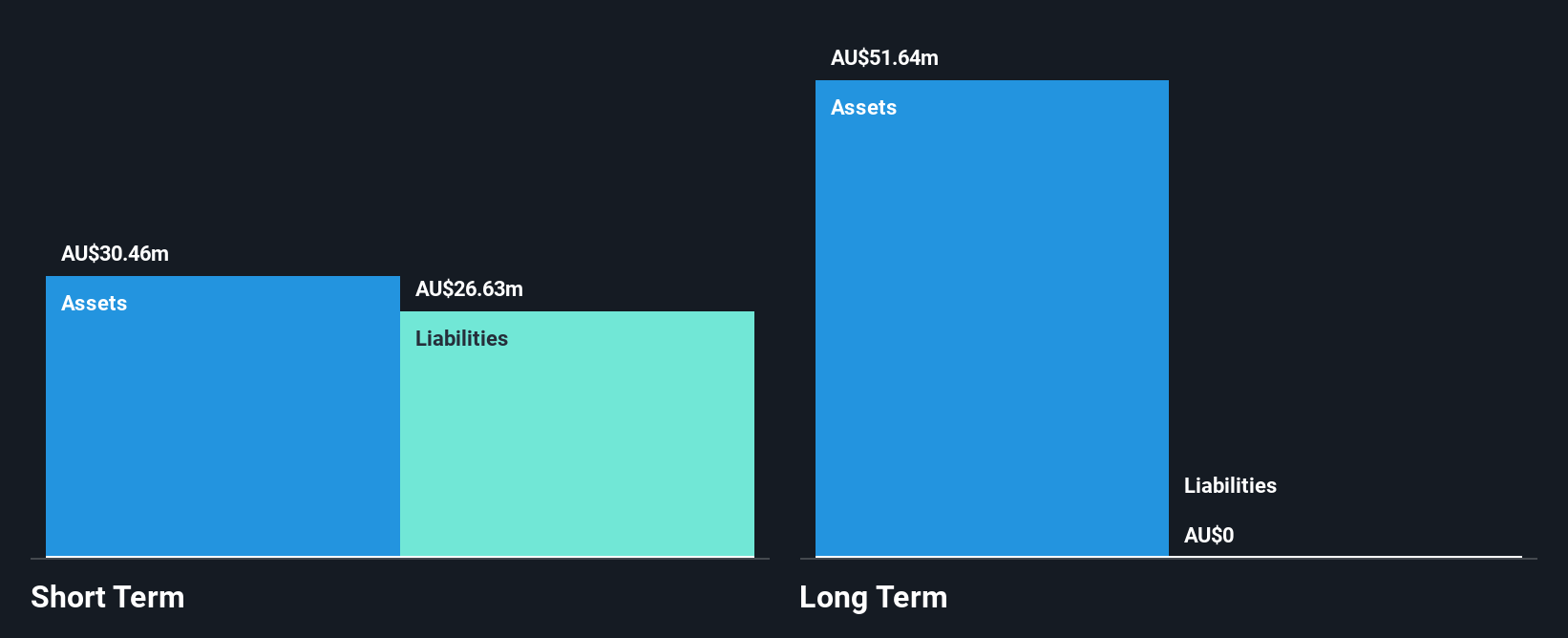

Melbana Energy Limited, with a market cap of A$97.74 million, is involved in oil and gas exploration in Cuba and Australia. Recently becoming profitable, the company reported a net income of A$3.26 million for the year ending June 2024, marking a turnaround from the previous year's loss. Despite high share price volatility over recent months, Melbana remains debt-free with short-term assets (A$51.3M) exceeding liabilities (A$40.4M), indicating strong financial health for its size. However, it was recently dropped from the S&P Global BMI Index, which could impact investor perception and stock liquidity negatively.

- Dive into the specifics of Melbana Energy here with our thorough balance sheet health report.

- Gain insights into Melbana Energy's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Embark on your investment journey to our 1,045 ASX Penny Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Environmental Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EGL

Environmental Group

Engages in the design, application, and servicing of gas, vapor, and dust emission control systems, and inlet and exhaust systems for gas turbines in Australia and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives