- Australia

- /

- Metals and Mining

- /

- ASX:JMS

Cettire Leads The Pack Of 3 Must-Know ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market has seen mixed performances, with the ASX200 closing slightly down at 8,436 points and sectors like Materials and IT showing strength, while Real Estate lagged. In such a fluctuating landscape, identifying stocks with strong financial health is crucial for investors seeking growth opportunities. Penny stocks, though often considered niche investments today, can still offer potential when they combine affordability with robust balance sheets; let's explore three such promising options on the ASX.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$66.23M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.05 | A$324.01M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.79 | A$231.32M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$337.98M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.53 | A$119.5M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.69 | A$825.78M | ★★★★★☆ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$69.71M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.01 | A$115.29M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.86 | A$491.35M | ★★★★☆☆ |

Click here to see the full list of 1,046 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Cettire (ASX:CTT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally with a market capitalization of A$459.39 million.

Operations: The company's revenue primarily comes from online retail sales, amounting to A$742.26 million.

Market Cap: A$459.39M

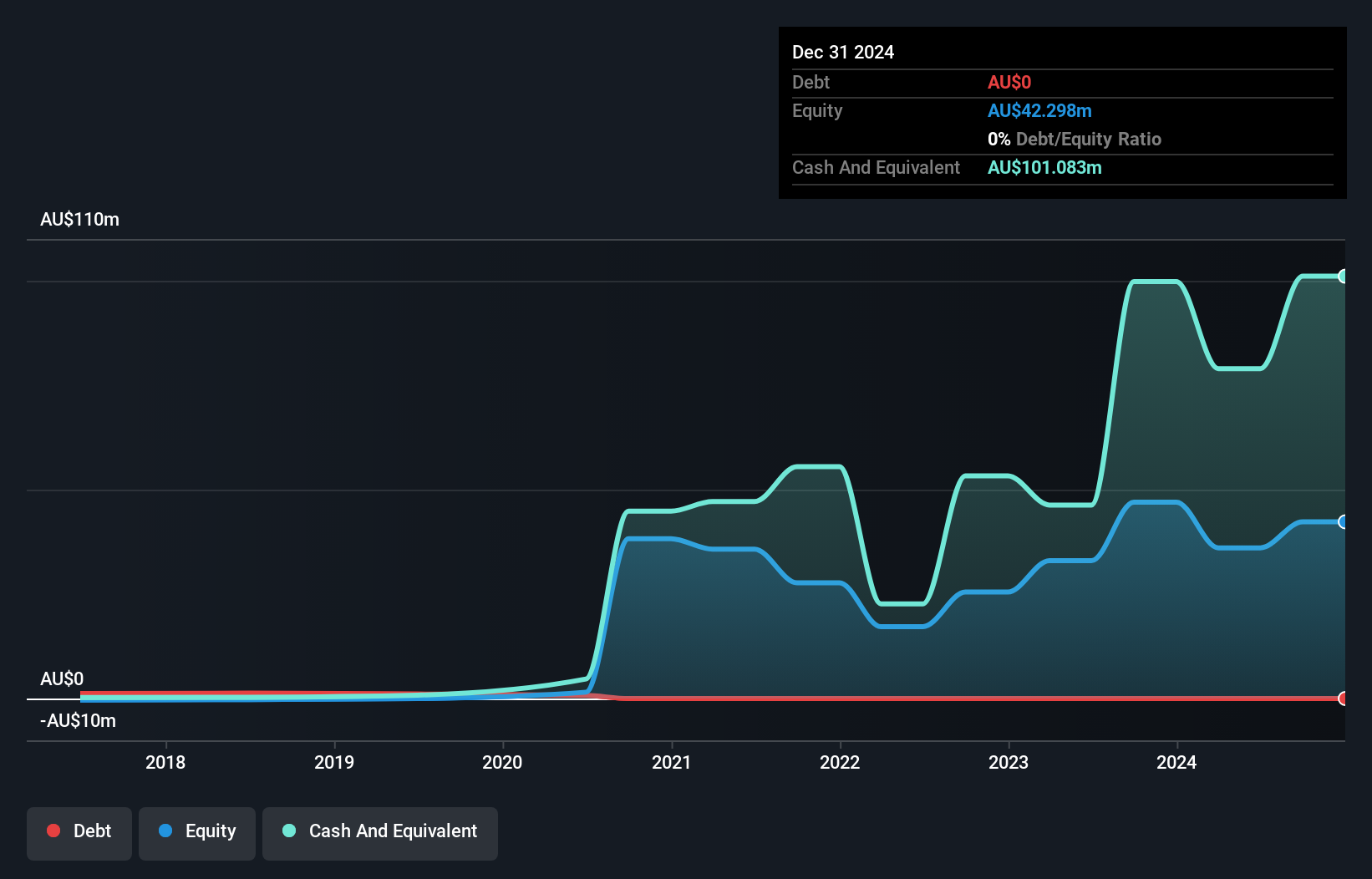

Cettire Limited, with a market capitalization of A$459.39 million, is an online luxury goods retailer experiencing significant volatility in its share price over the past three months. Despite negative earnings growth of -34.4% last year, Cettire's earnings have grown significantly by 40.5% annually over the past five years and are forecasted to grow further at 31.99% per year. The company is debt-free and trades at 60.4% below its estimated fair value, which may appeal to investors seeking undervalued opportunities in penny stocks with potential upside amidst high volatility and fluctuating profit margins currently at 1.4%.

- Click to explore a detailed breakdown of our findings in Cettire's financial health report.

- Evaluate Cettire's prospects by accessing our earnings growth report.

Caravel Minerals (ASX:CVV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Caravel Minerals Limited, with a market cap of A$103.13 million, explores for mineral tenements in Western Australia through its subsidiaries.

Operations: Caravel Minerals Limited does not report any specific revenue segments.

Market Cap: A$103.13M

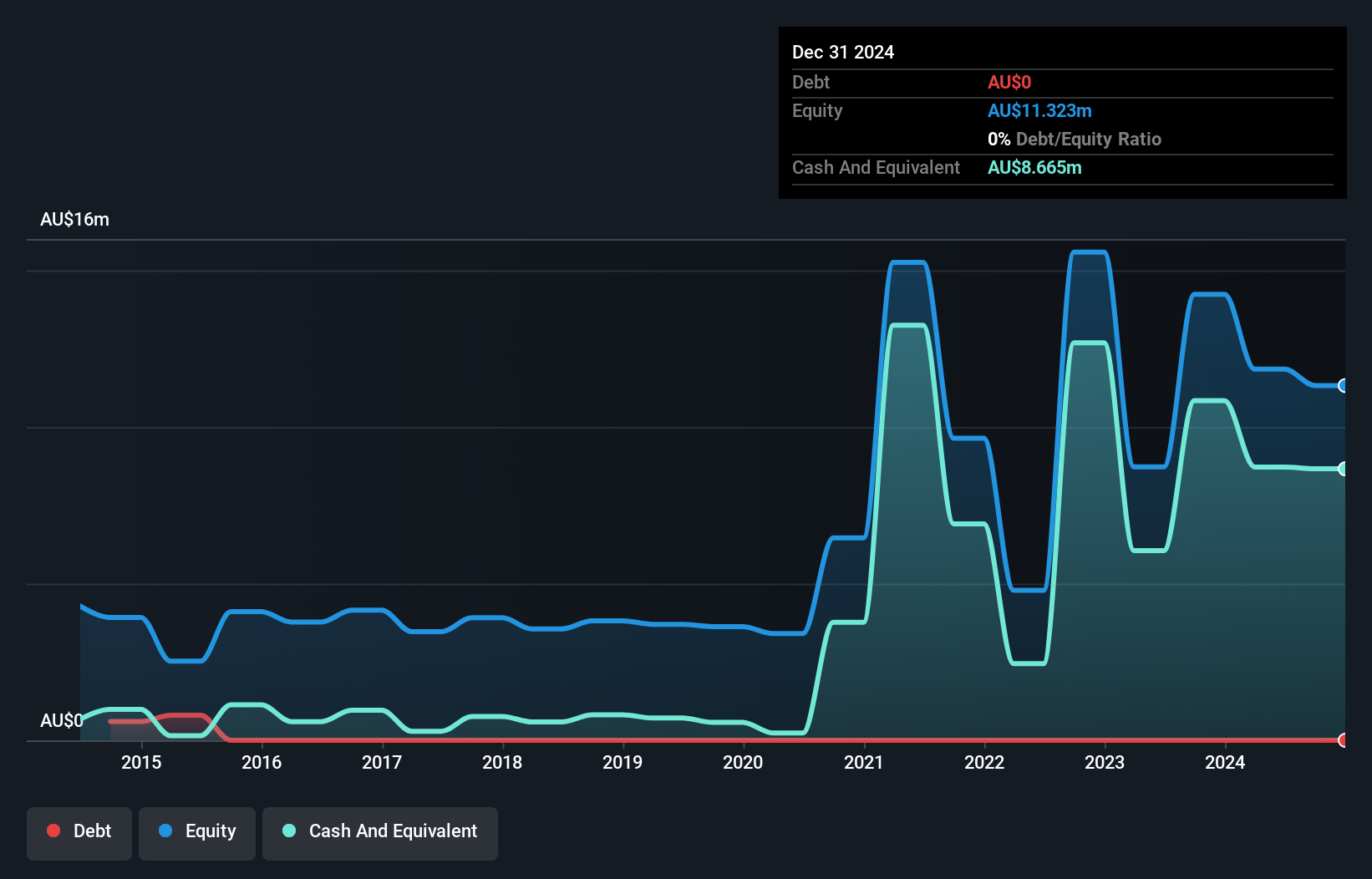

Caravel Minerals Limited, with a market cap of A$103.13 million, is a pre-revenue company focused on mineral exploration in Western Australia. Despite being debt-free and having experienced management and board teams, the company faces financial challenges highlighted by its recent net loss of A$6.41 million for the year ending June 30, 2024. Shareholders have experienced dilution due to a follow-on equity offering raising A$5 million at a discount. Auditor BDO LLP expressed doubt about Caravel's ability to continue as a going concern, although it maintains sufficient cash runway for more than ten months based on current estimates.

- Get an in-depth perspective on Caravel Minerals' performance by reading our balance sheet health report here.

- Learn about Caravel Minerals' future growth trajectory here.

Jupiter Mines (ASX:JMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jupiter Mines Limited is an independent mining company based in Australia, with a market cap of A$284.20 million.

Operations: The company generates revenue from its manganese operations in South Africa, totaling A$8.07 million.

Market Cap: A$284.2M

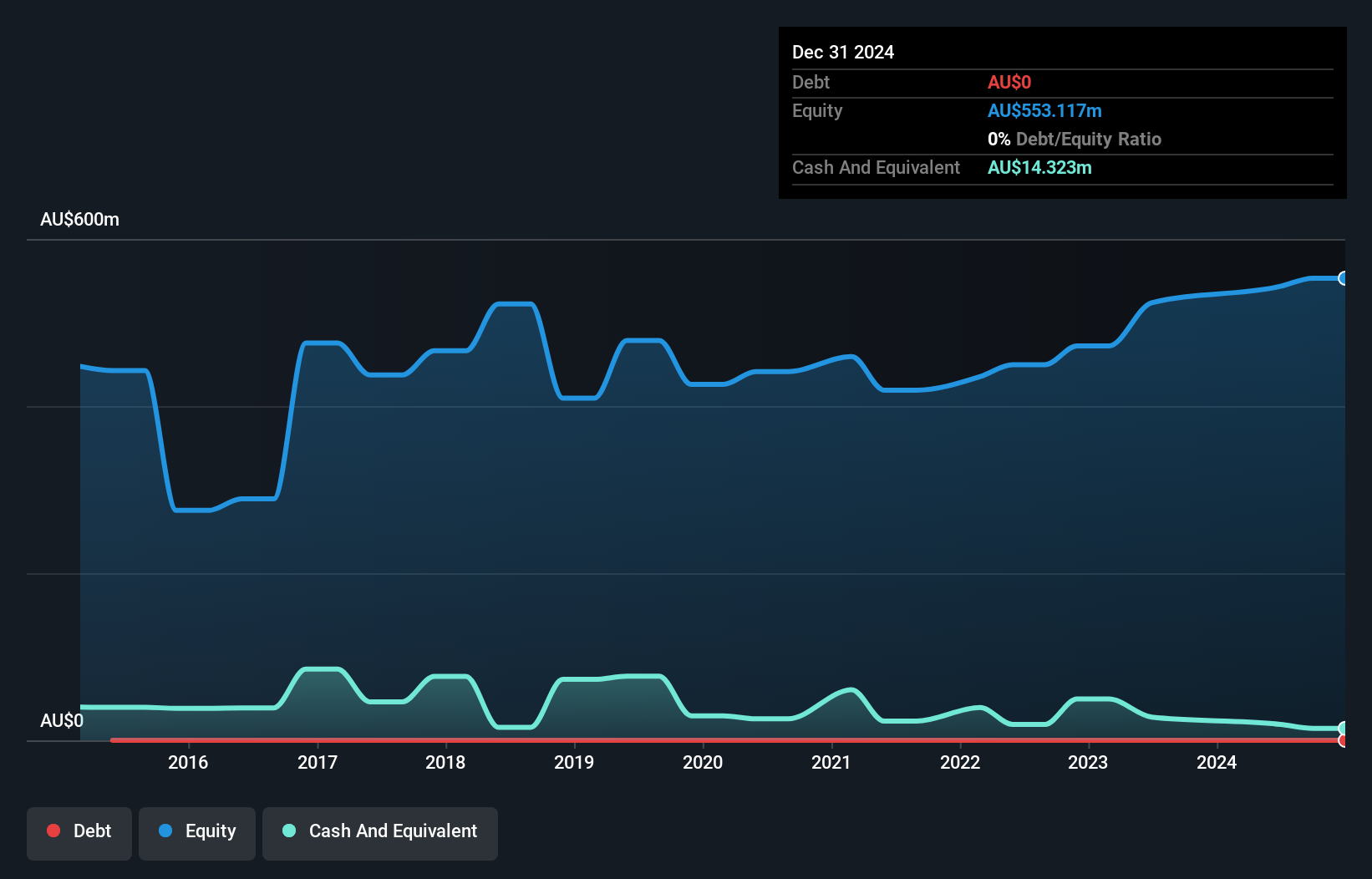

Jupiter Mines Limited, with a market cap of A$284.20 million, operates debt-free and has high-quality earnings from its manganese operations in South Africa. However, the company faces challenges with declining earnings, which have decreased by 15.5% annually over the past five years. Despite trading below estimated fair value and having adequate short-term asset coverage for liabilities, the dividend yield of 8.33% is not well supported by free cash flows. Recent board changes include Sally Langer's appointment as an Independent Non-Executive Director following Patrick Murphy's retirement and Peter North's decision not to seek re-election at the AGM.

- Click here to discover the nuances of Jupiter Mines with our detailed analytical financial health report.

- Gain insights into Jupiter Mines' historical outcomes by reviewing our past performance report.

Make It Happen

- Explore the 1,046 names from our ASX Penny Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JMS

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives