- Australia

- /

- Oil and Gas

- /

- ASX:PCL

ASX Penny Stocks To Watch With At Least A$100M Market Cap

Reviewed by Simply Wall St

As the Australian market opens relatively flat following an all-time high, attention shifts to how global economic pressures and local developments might influence investment strategies. Penny stocks, though a term from earlier trading days, continue to capture interest as they often represent smaller or emerging companies that can provide unique opportunities for growth. By focusing on those with strong financial foundations and potential for expansion, investors can uncover valuable prospects in this often-overlooked segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.37 | A$106.04M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.42 | A$114.16M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.15M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.85 | A$439.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.765 | A$466.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.68 | A$867.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.69 | A$828.23M | ✅ 5 ⚠️ 3 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.57 | A$169.4M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.755 | A$141.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 474 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Biome Australia (ASX:BIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Biome Australia Limited focuses on the development, commercialization, and marketing of live biotherapeutics and complementary medicines both in Australia and internationally, with a market cap of A$111.85 million.

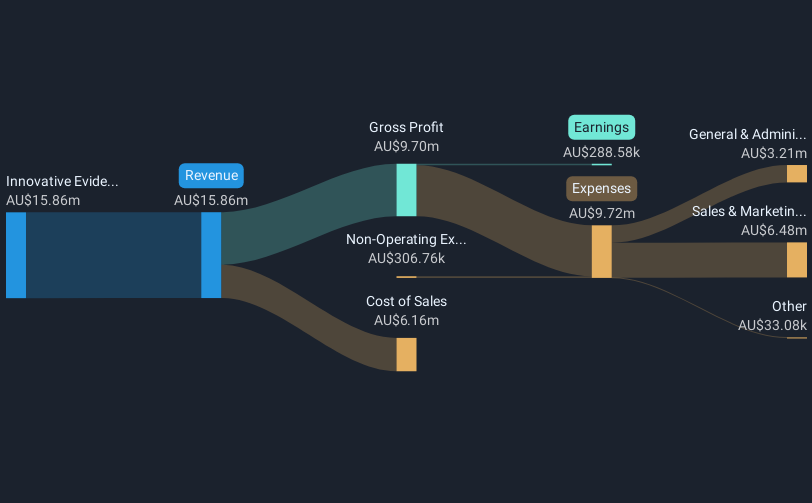

Operations: The company generates revenue of A$15.86 million from its innovative evidence-based products that connect gut health with overall human health.

Market Cap: A$111.85M

Biome Australia has recently turned profitable, marking a significant milestone for the company. Despite its positive revenue of A$15.86 million and a market cap of A$111.85 million, challenges remain as its operating cash flow is negative, indicating debt coverage issues. However, Biome's short-term assets comfortably cover both short- and long-term liabilities, and the company holds more cash than total debt. The board is experienced with an average tenure of 3.9 years, providing stability in governance amidst this growth phase. Trading significantly below estimated fair value suggests potential for revaluation if profitability trends continue positively.

- Dive into the specifics of Biome Australia here with our thorough balance sheet health report.

- Gain insights into Biome Australia's future direction by reviewing our growth report.

Jupiter Mines (ASX:JMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jupiter Mines Limited is an independent mining company based in Australia with a market capitalization of A$392.21 million.

Operations: The company generates revenue primarily from its manganese operations in South Africa, totaling A$9.49 million.

Market Cap: A$392.21M

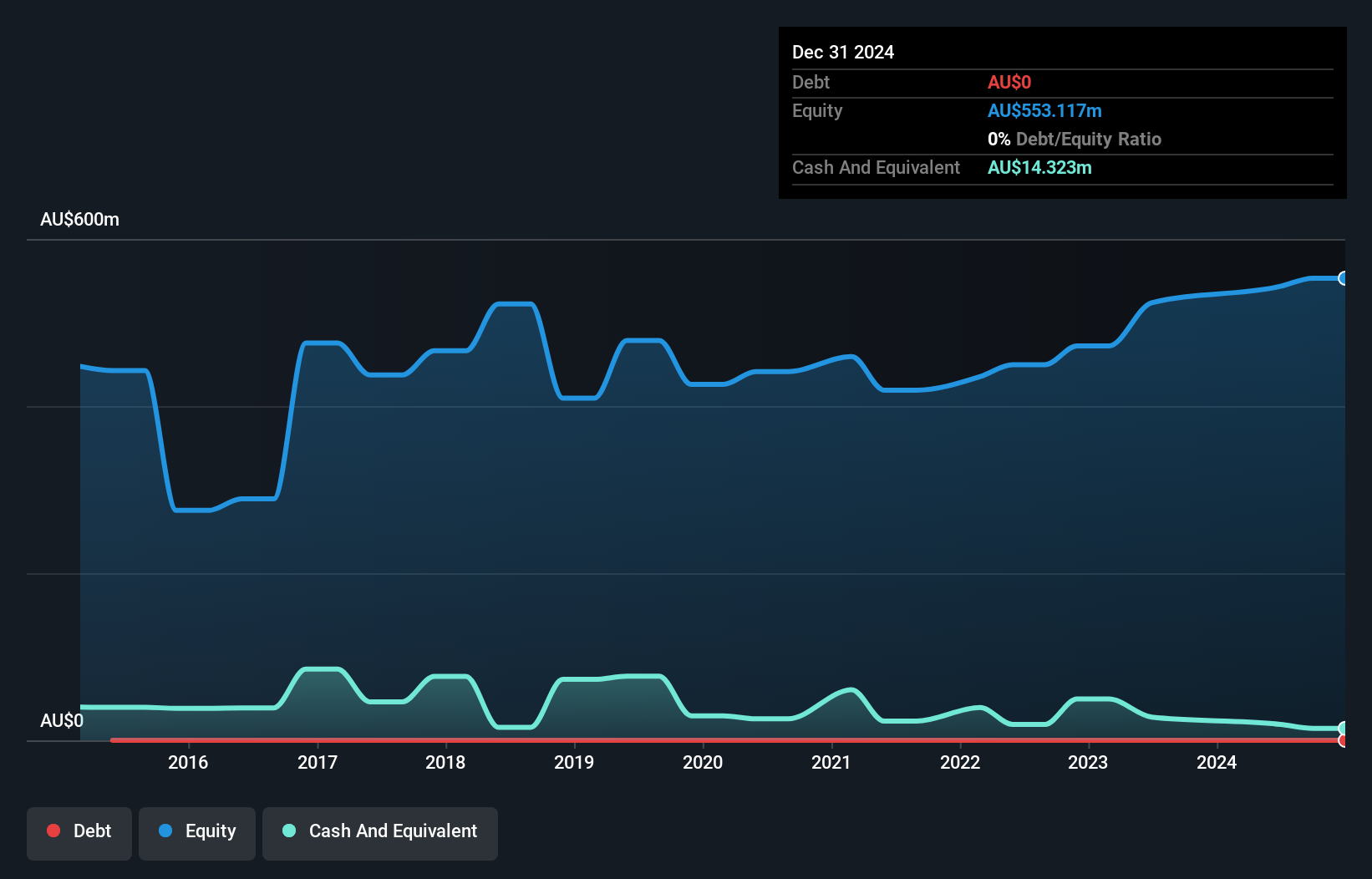

Jupiter Mines Limited, with a market cap of A$392.21 million, faces challenges as its earnings declined by 11.6% annually over the past five years and it has experienced negative growth recently. The management and board are relatively inexperienced, with average tenures of 1.7 and 2.9 years respectively. Despite these hurdles, the company maintains financial stability with short-term assets exceeding both short- and long-term liabilities, while being debt-free eliminates interest coverage concerns. Trading at a discount to estimated fair value may indicate potential upside if operational improvements materialize alongside its stable dividend yield of 6.25%.

- Take a closer look at Jupiter Mines' potential here in our financial health report.

- Examine Jupiter Mines' past performance report to understand how it has performed in prior years.

Pancontinental Energy (ASX:PCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pancontinental Energy NL is involved in the exploration of oil and gas properties in Namibia and Australia, with a market cap of A$105.78 million.

Operations: Pancontinental Energy NL does not currently report any revenue segments.

Market Cap: A$105.78M

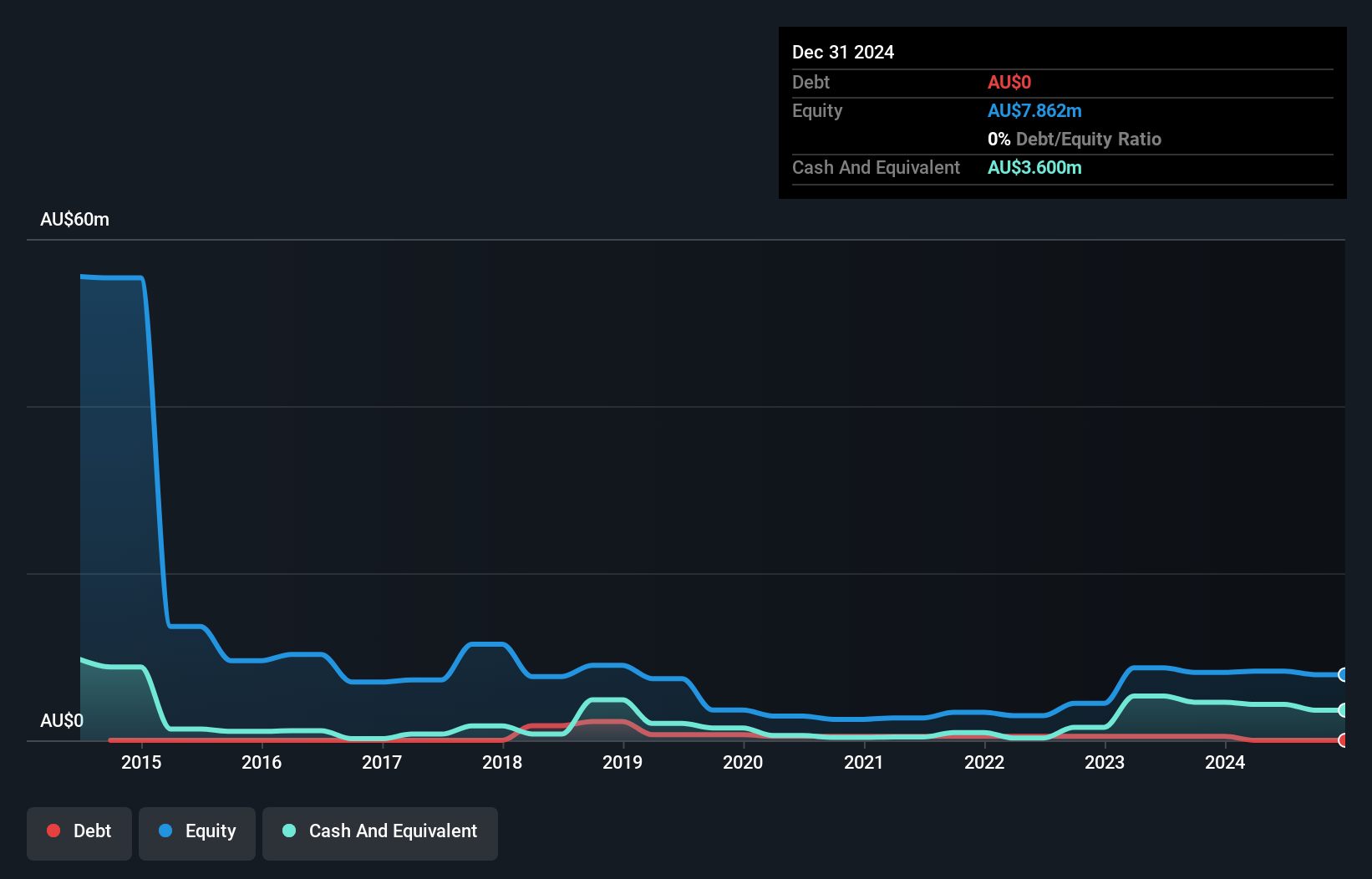

Pancontinental Energy, with a market cap of A$105.78 million, is pre-revenue and currently unprofitable. Despite this, its financial position is relatively stable with short-term assets of A$3.7 million exceeding both short- and long-term liabilities. The company is debt-free, which reduces financial risk, and it has not diluted shareholders over the past year. However, its share price has been highly volatile recently, reflecting increased weekly volatility from 20% to 30%. While Pancontinental's board boasts significant experience with an average tenure of 16.5 years, the management team's experience level remains unclear due to insufficient data.

- Click here to discover the nuances of Pancontinental Energy with our detailed analytical financial health report.

- Assess Pancontinental Energy's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Click this link to deep-dive into the 474 companies within our ASX Penny Stocks screener.

- Interested In Other Possibilities? Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PCL

Pancontinental Energy

Engages in the exploration of oil and gas properties in Namibia and Australia.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives