- Australia

- /

- Basic Materials

- /

- ASX:JHX

James Hardie Industries plc Just Beat Earnings Expectations: Here's What Analysts Think Will Happen Next

Shareholders of James Hardie Industries plc (ASX:JHX) will be pleased this week, given that the stock price is up 10% to AU$27.66 following its latest half-year results. It looks like a credible result overall - although revenues of US$660m were in line with what analysts predicted, James Hardie Industries surprised by delivering a profit of US$0.23 per share, a notable 14% above expectations. Following the result, analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest forecasts to see what analysts are expecting for next year.

View our latest analysis for James Hardie Industries

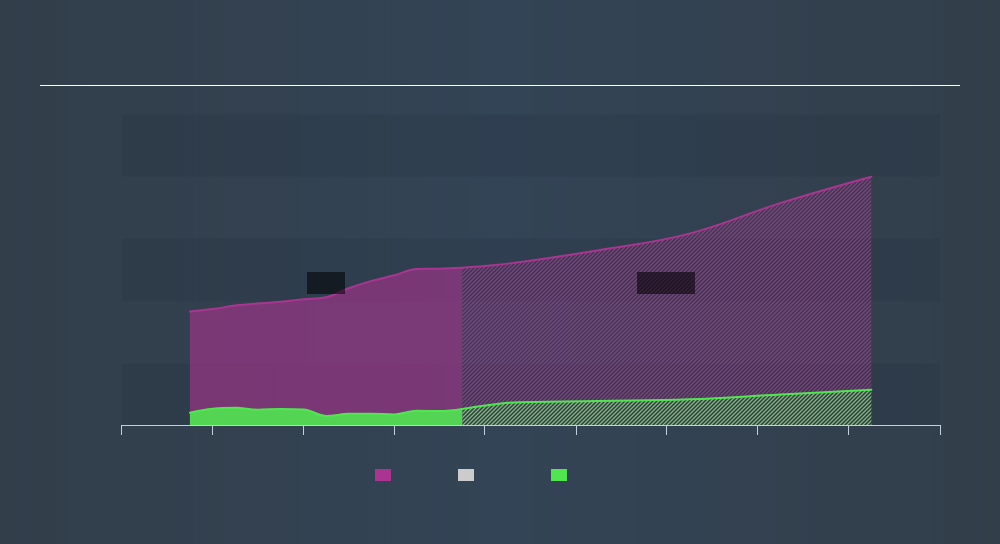

Taking into account the latest results, the current consensus from James Hardie Industries's nine analysts is for revenues of US$2.6b in 2020, which would reflect an okay 2.6% increase on its sales over the past 12 months. Earnings per share are expected to soar 33% to US$0.78. Before this earnings report, analysts had been forecasting revenues of US$2.6b and earnings per share (EPS) of US$0.75 in 2020. Analysts seem to have become more bullish on the business, judging by their new earnings per share estimates.

The consensus price target rose 10% to US$18.41, suggesting that higher earnings estimates flow through to the stock's valuation as well. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values James Hardie Industries at US$20.69 per share, while the most bearish prices it at US$13.78. This shows there is still quite a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that analysts expect James Hardie Industries's revenue growth will slow down substantially, with revenues next year expected to grow 2.6%, compared to a historical growth rate of 10% over the past five years. Compare this against other companies (with analyst forecasts) in the market, which are in aggregate expected to see revenue growth of 5.4% next year. Factoring in the forecast slowdown in growth, it seems obvious that analysts are also expecting James Hardie Industries to grow slower than the wider market.

The Bottom Line

The most important thing to take away from this is that analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards James Hardie Industries following these results. On the plus side, there were no major changes to revenue estimates; although analyst forecasts do imply revenues expected to perform worse than the wider market. There was also a nice increase in the price target, with analysts feeling that the intrinsic value of the business is improving.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for James Hardie Industries going out to 2024, and you can see them free on our platform here..

It might also be worth considering whether James Hardie Industries's debt load is appropriate, using our debt analysis tools on the Simply Wall St platform, here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:JHX

James Hardie Industries

Engages in the manufacture and sale of fiber cement, fiber gypsum, and cement bonded boards in the United States, Australia, Europe, and New Zealand.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives