- Australia

- /

- Commercial Services

- /

- ASX:SPZ

ASX Insights On Electro Optic Systems Holdings And 2 Other Stocks Priced Below Estimated Value

Reviewed by Simply Wall St

As the Australian market navigates a period of mixed performance, with the ASX ending flat midweek and US futures showing unreliable signals, investors are keenly observing sectors that might offer hidden value. In such an environment, identifying undervalued stocks like Electro Optic Systems Holdings can be crucial for those looking to capitalize on discrepancies between current prices and estimated intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$3.14 | A$5.67 | 44.6% |

| Smart Parking (ASX:SPZ) | A$1.155 | A$2.30 | 49.8% |

| Resimac Group (ASX:RMC) | A$1.21 | A$2.17 | 44.3% |

| Reckon (ASX:RKN) | A$0.63 | A$1.19 | 46.9% |

| NRW Holdings (ASX:NWH) | A$4.76 | A$8.61 | 44.7% |

| James Hardie Industries (ASX:JHX) | A$33.24 | A$64.83 | 48.7% |

| Elders (ASX:ELD) | A$7.33 | A$14.04 | 47.8% |

| Cynata Therapeutics (ASX:CYP) | A$0.23 | A$0.44 | 47.7% |

| CleanSpace Holdings (ASX:CSX) | A$0.72 | A$1.41 | 48.8% |

| Airtasker (ASX:ART) | A$0.39 | A$0.72 | 45.5% |

Underneath we present a selection of stocks filtered out by our screen.

Electro Optic Systems Holdings (ASX:EOS)

Overview: Electro Optic Systems Holdings Limited develops, manufactures, and sells telescopes and dome enclosures, laser satellite tracking systems, and remote weapon systems with a market cap of A$1.59 billion.

Operations: The company's revenue is derived from its Space segment, generating A$11.99 million, and its Defence segment, contributing A$103.13 million.

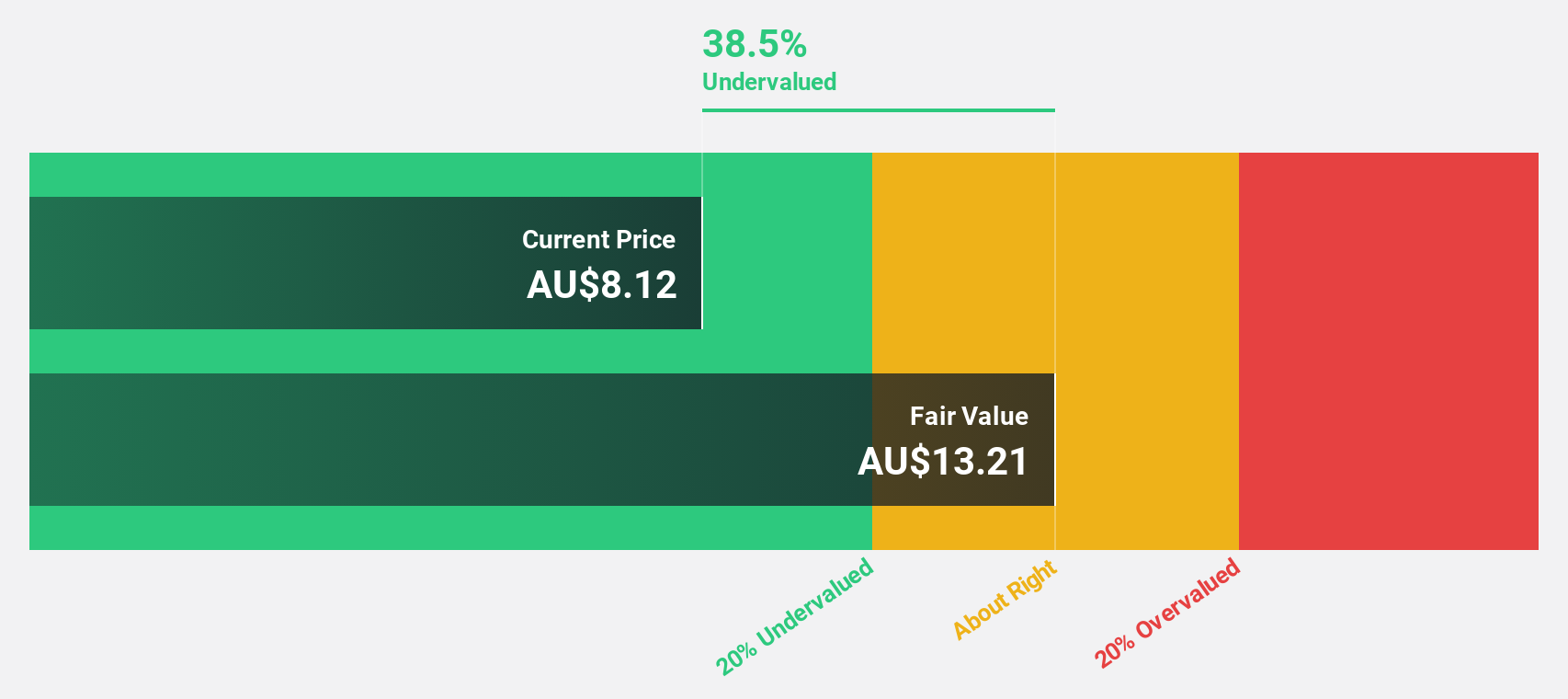

Estimated Discount To Fair Value: 37.7%

Electro Optic Systems Holdings appears undervalued, trading 37.7% below its estimated fair value of A$13.26, with a current price of A$8.26. Despite recent volatility and a low return on equity forecast, the company's earnings are expected to grow significantly at over 109% annually, with revenue growth projected at 35.5% per year—outpacing the Australian market average of 5.8%. Recent additions to key indices may enhance visibility and investor interest.

- Our comprehensive growth report raises the possibility that Electro Optic Systems Holdings is poised for substantial financial growth.

- Dive into the specifics of Electro Optic Systems Holdings here with our thorough financial health report.

James Hardie Industries (ASX:JHX)

Overview: James Hardie Industries plc manufactures and sells fiber cement, fiber gypsum, and cement bonded boards across the United States, Australia, Europe, and New Zealand with a market cap of A$19.25 billion.

Operations: The company's revenue segments include $2.78 billion from North America Fiber Cement, $506.20 million from Asia Pacific Fiber Cement, and $503.50 million from Europe Building Products.

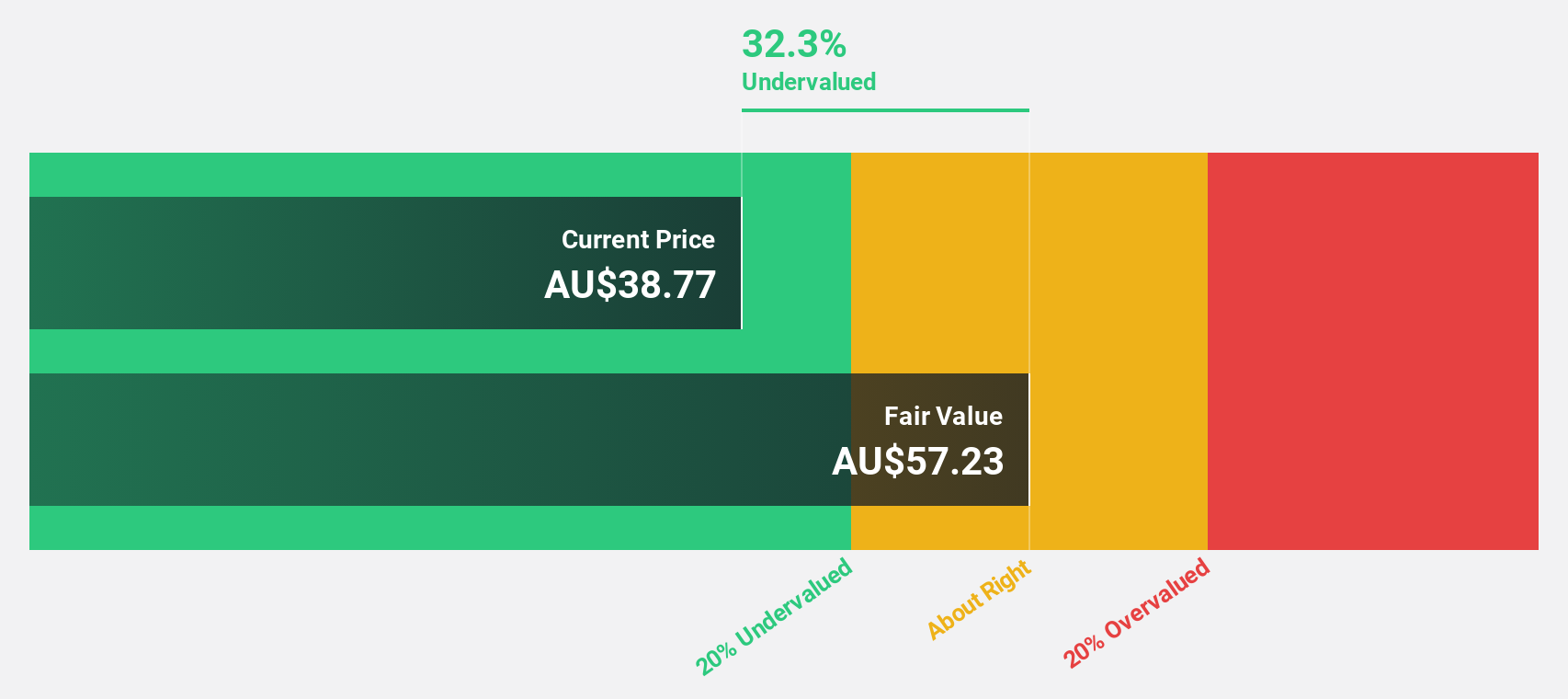

Estimated Discount To Fair Value: 48.7%

James Hardie Industries is trading at A$33.24, significantly below its estimated fair value of A$64.83, presenting a potential undervaluation based on discounted cash flows. Despite high debt levels and recent shareholder dilution, the company forecasts strong earnings growth at 23% annually over the next three years, outpacing the Australian market's average. Recent executive changes include appointing Samara Toole as CMO to drive brand growth across its portfolio.

- Our earnings growth report unveils the potential for significant increases in James Hardie Industries' future results.

- Click to explore a detailed breakdown of our findings in James Hardie Industries' balance sheet health report.

Smart Parking (ASX:SPZ)

Overview: Smart Parking Limited designs, develops, and manages parking management solutions across New Zealand, Australia, Denmark, Germany, and the United Kingdom with a market cap of A$471.63 million.

Operations: The company's revenue segments include A$5.27 million from the Technology Division and A$75.52 million from Parking Management across Denmark, Germany, Australia, New Zealand, the United States, and the United Kingdom.

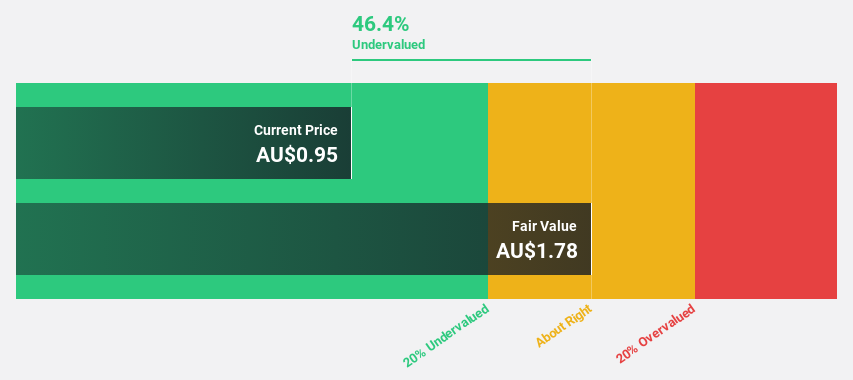

Estimated Discount To Fair Value: 49.8%

Smart Parking, trading at A$1.16, is significantly undervalued against its estimated fair value of A$2.3 based on discounted cash flow analysis. The company reported robust earnings growth of 46.8% last year and expects annual profit growth to outpace the Australian market over the next three years. Recent inclusion in the S&P Global BMI Index and strategic plans for acquisitions underscore its potential for enhanced cash flows and scalability despite past shareholder dilution concerns.

- Upon reviewing our latest growth report, Smart Parking's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Smart Parking with our comprehensive financial health report here.

Turning Ideas Into Actions

- Explore the 31 names from our Undervalued ASX Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SPZ

Smart Parking

Engages in the design, development, and management of parking management solutions in New Zealand, Australia, Denmark, Germany, and the United Kingdom.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.