- Australia

- /

- Consumer Services

- /

- ASX:PFP

ASX Standouts: DevEx Resources And 2 Other Prominent Penny Stocks

Reviewed by Simply Wall St

The Australian market has shown signs of awakening, with most sectors closing in the green after a series of record sessions in the US. For investors eyeing smaller or newer companies, penny stocks—though an older term—remain relevant as they can offer unique growth opportunities. When these stocks are backed by strong financial health, they can provide a mix of affordability and potential for long-term growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.50 | A$143.29M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.20 | A$103.78M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.79 | A$49.19M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.69 | A$415.34M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.35 | A$247.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.044 | A$51.47M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.072 | A$37.28M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.755 | A$360.67M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.32 | A$1.42B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 425 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

DevEx Resources (ASX:DEV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DevEx Resources Limited, with a market cap of A$53.00 million, is involved in the exploration and evaluation of mineral properties in Australia through its subsidiaries.

Operations: The company's revenue segment is solely derived from its exploration and evaluation activities, amounting to A$0.36 million.

Market Cap: A$53M

DevEx Resources Limited, with a market cap of A$53 million, remains pre-revenue and unprofitable, reporting a net loss of A$9.11 million for the year ended June 30, 2025. Despite having no debt and short-term assets exceeding liabilities by A$6.1 million, the company faces financial uncertainty as highlighted by its auditor's going concern doubts. The management team is experienced with an average tenure of 3.4 years; however, cash runway concerns persist due to declining free cash flow. Recent presentations have focused on their uranium exploration prospects in Australia's McArthur Basin amidst ongoing operational challenges.

- Get an in-depth perspective on DevEx Resources' performance by reading our balance sheet health report here.

- Assess DevEx Resources' previous results with our detailed historical performance reports.

Investigator Resources (ASX:IVR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Investigator Resources Limited, with a market cap of A$67.58 million, is involved in the exploration of mineral properties in Australia through its subsidiaries.

Operations: Investigator Resources Limited does not report any specific revenue segments.

Market Cap: A$67.58M

Investigator Resources Limited, with a market cap of A$67.58 million, has recently transitioned to profitability, reporting net income of A$0.23 million for the year ended June 30, 2025. The company is pre-revenue with minimal earnings but benefits from being debt-free and having strong asset coverage over liabilities. Recent capital raising efforts brought in A$4.3 million without significant shareholder dilution. Despite low return on equity at 0.6%, Investigator Resources' seasoned management team and stable weekly volatility position it as a potentially resilient entity within the penny stock landscape in Australia’s mining sector.

- Navigate through the intricacies of Investigator Resources with our comprehensive balance sheet health report here.

- Gain insights into Investigator Resources' historical outcomes by reviewing our past performance report.

Propel Funeral Partners (ASX:PFP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Propel Funeral Partners Limited operates in the death care services industry across Australia and New Zealand, with a market cap of A$680.21 million.

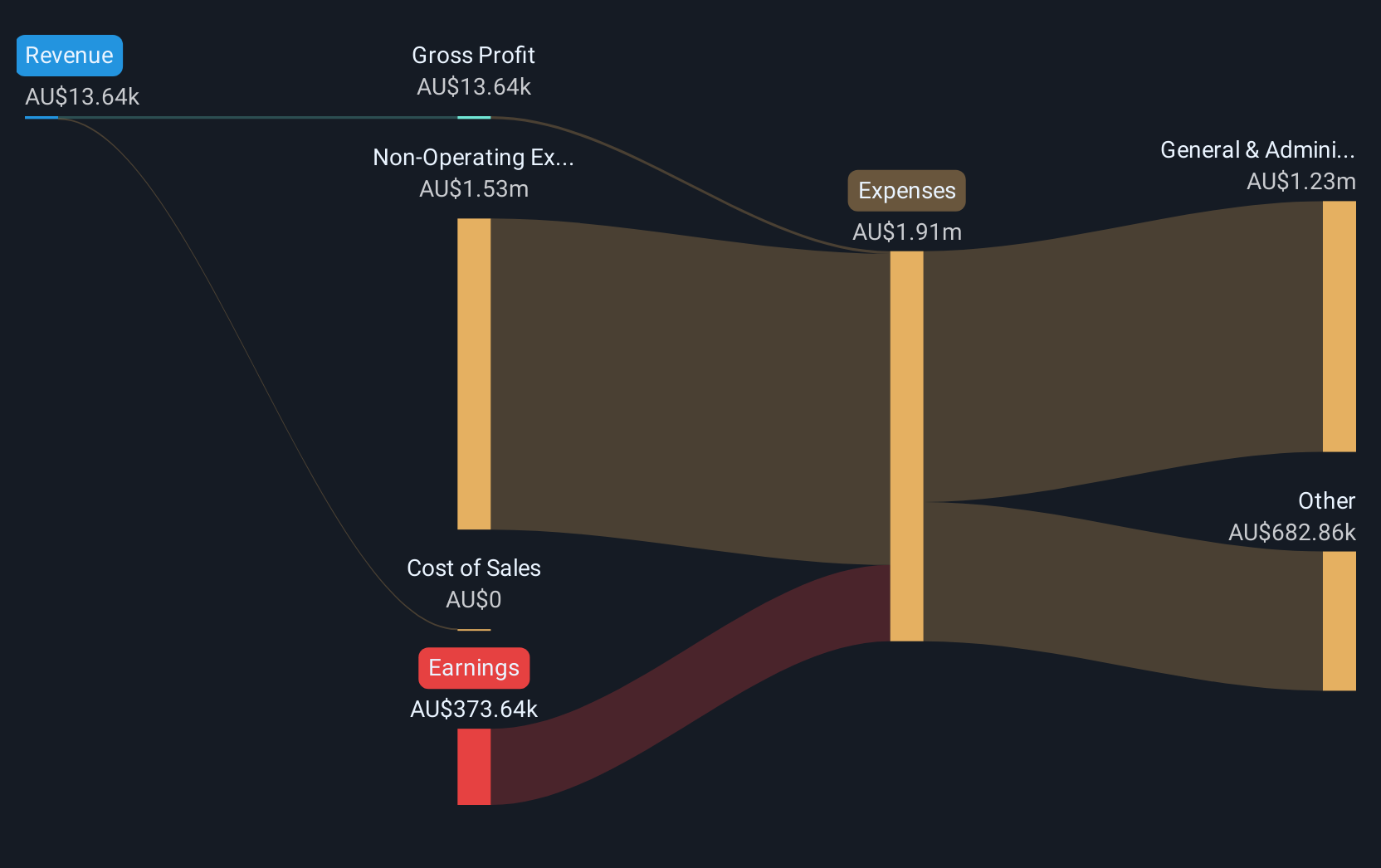

Operations: The company generates revenue of A$225.83 million from its death care related services across Australia and New Zealand.

Market Cap: A$680.21M

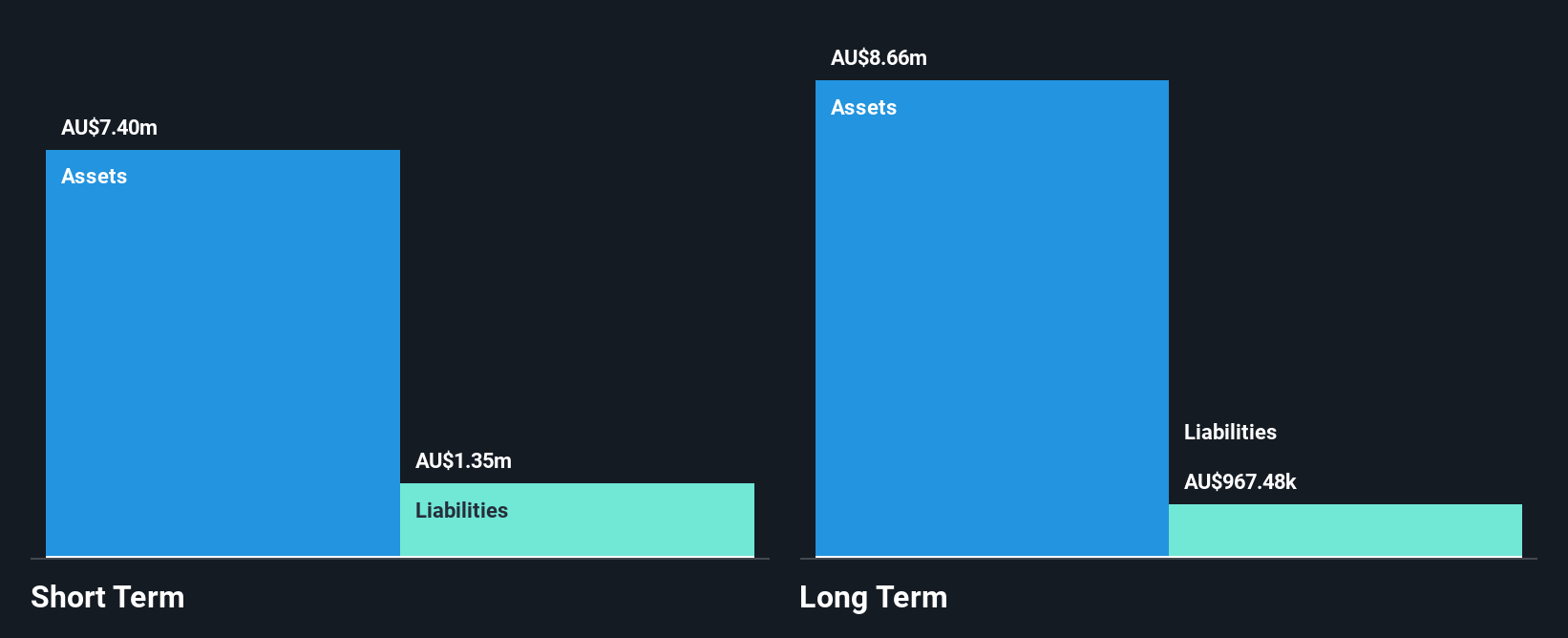

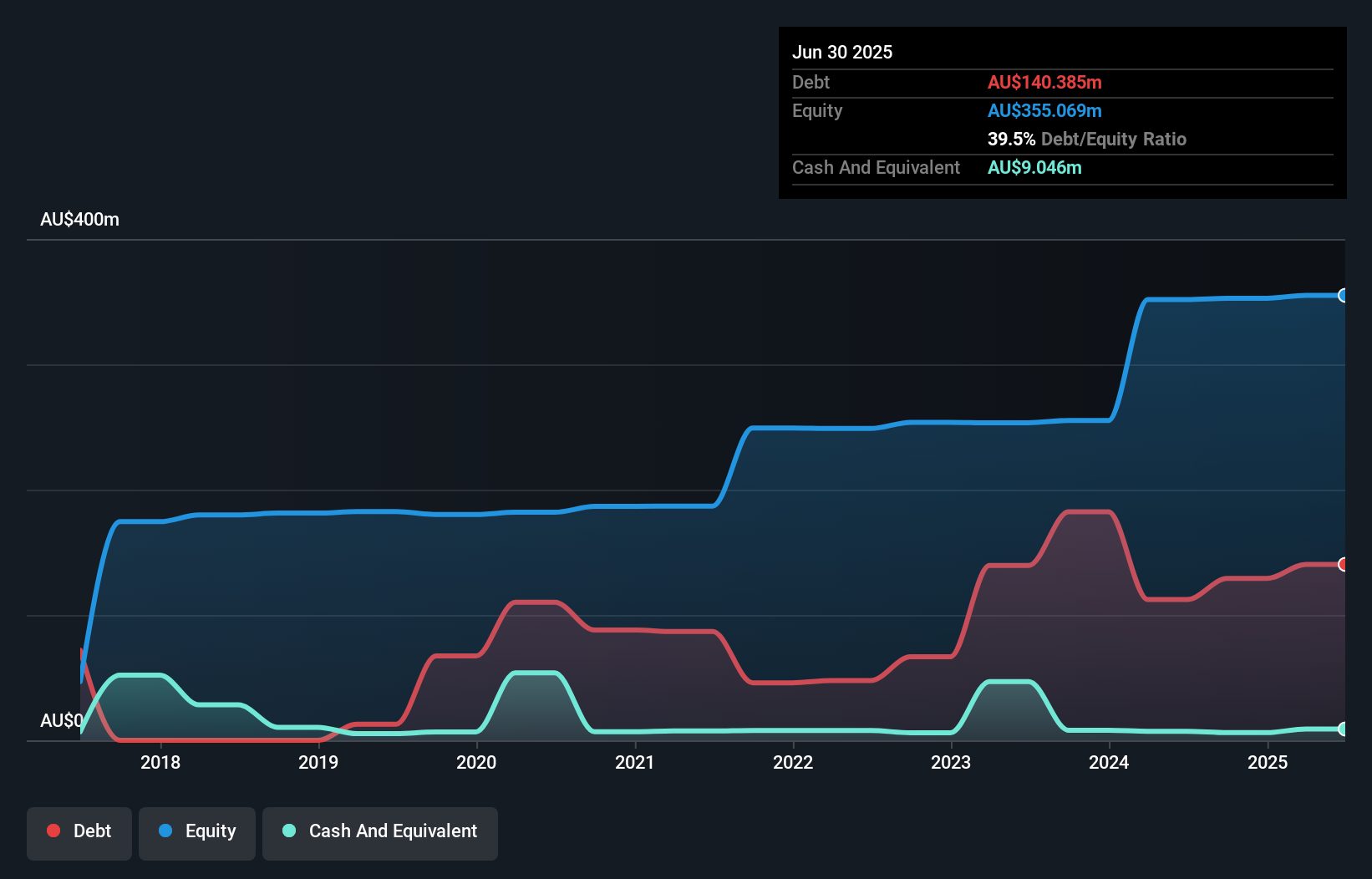

Propel Funeral Partners, with a market cap of A$680.21 million, has shown stable financial performance in the death care services industry. The company reported annual revenue of A$225.83 million and net income growth to A$20.4 million for the year ended June 30, 2025. Despite its short-term assets not covering liabilities, Propel's debt is well covered by operating cash flow and interest payments are adequately managed by EBIT. The management team is relatively new but supported by an experienced board of directors. Propel continues to explore acquisition opportunities while maintaining a dividend policy that may not be fully sustainable from earnings or free cash flows.

- Dive into the specifics of Propel Funeral Partners here with our thorough balance sheet health report.

- Assess Propel Funeral Partners' future earnings estimates with our detailed growth reports.

Summing It All Up

- Take a closer look at our ASX Penny Stocks list of 425 companies by clicking here.

- Ready For A Different Approach? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PFP

Propel Funeral Partners

Provides death care services in Australia and New Zealand.

Adequate balance sheet and fair value.

Market Insights

Community Narratives