- Australia

- /

- Metals and Mining

- /

- ASX:ILU

Iluka Resources Limited's (ASX:ILU) large institutional owners must be happy as stock continues to impress, up 4.4% over the past week

To get a sense of who is truly in control of Iluka Resources Limited (ASX:ILU), it is important to understand the ownership structure of the business. With 67% stake, institutions possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

And as as result, institutional investors reaped the most rewards after the company's stock price gained 4.4% last week. The gains from last week would have further boosted the one-year return to shareholders which currently stand at 19%.

Let's delve deeper into each type of owner of Iluka Resources, beginning with the chart below.

Check out our latest analysis for Iluka Resources

What Does The Institutional Ownership Tell Us About Iluka Resources?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

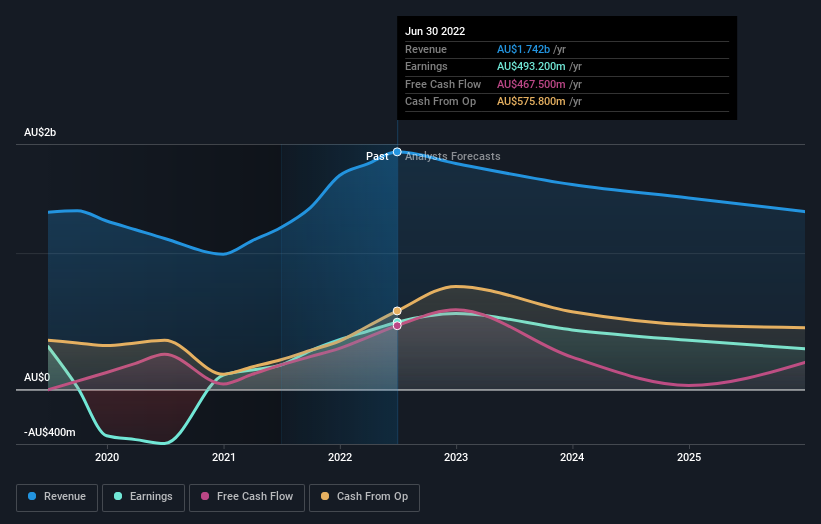

As you can see, institutional investors have a fair amount of stake in Iluka Resources. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Iluka Resources' earnings history below. Of course, the future is what really matters.

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. Iluka Resources is not owned by hedge funds. The company's largest shareholder is BlackRock, Inc., with ownership of 6.8%. In comparison, the second and third largest shareholders hold about 6.4% and 6.0% of the stock.

Looking at the shareholder registry, we can see that 52% of the ownership is controlled by the top 11 shareholders, meaning that no single shareholder has a majority interest in the ownership.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Iluka Resources

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that Iluka Resources Limited insiders own under 1% of the company. It's a big company, so even a small proportional interest can create alignment between the board and shareholders. In this case insiders own AU$15m worth of shares. It is good to see board members owning shares, but it might be worth checking if those insiders have been buying.

General Public Ownership

The general public, who are usually individual investors, hold a 32% stake in Iluka Resources. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Iluka Resources (of which 1 doesn't sit too well with us!) you should know about.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ILU

Iluka Resources

Engages in the exploration, project development, mining, processing, marketing, and rehabilitation of mineral sands in Australia, China, rest of Asia, Europe, the Americas, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success