- Australia

- /

- Metals and Mining

- /

- ASX:ILU

Iluka Resources Limited (ASX:ILU) Stock Catapults 35% Though Its Price And Business Still Lag The Market

Despite an already strong run, Iluka Resources Limited (ASX:ILU) shares have been powering on, with a gain of 35% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

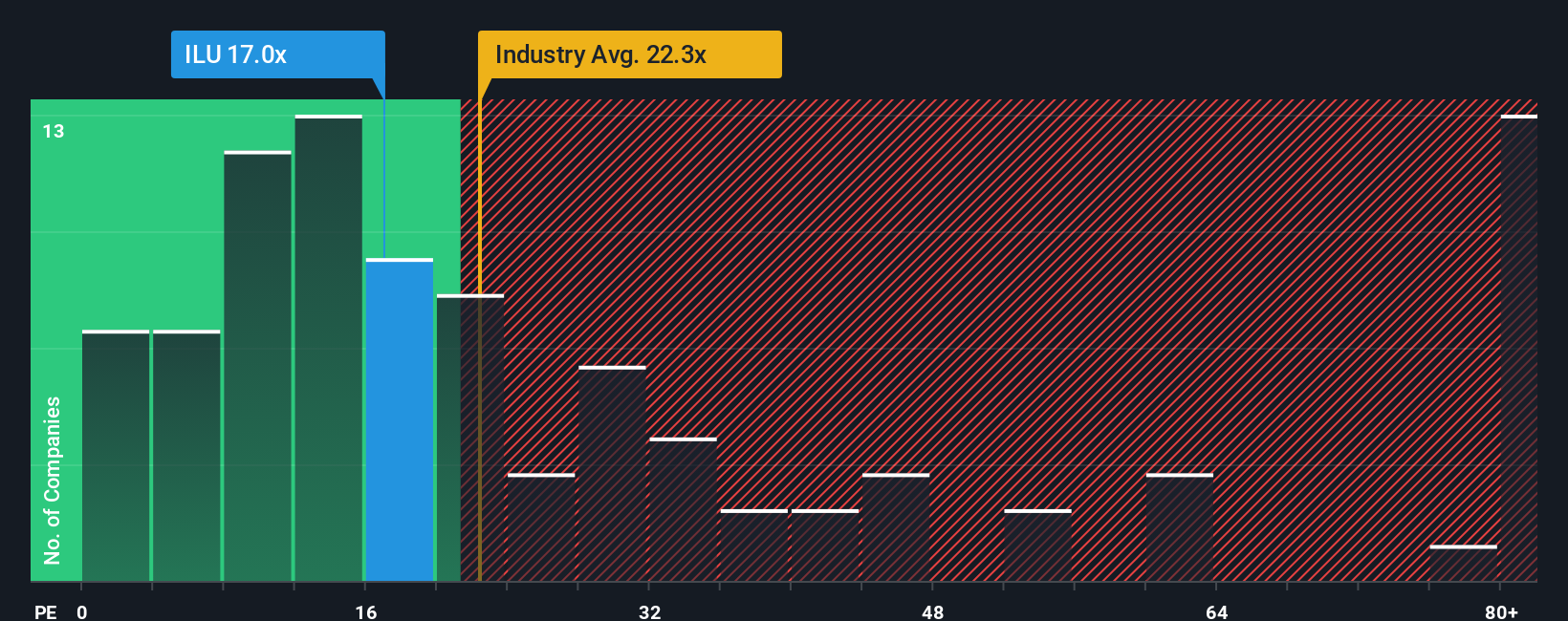

Even after such a large jump in price, Iluka Resources may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 17x, since almost half of all companies in Australia have P/E ratios greater than 22x and even P/E's higher than 41x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Iluka Resources hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Iluka Resources

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Iluka Resources would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 62% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 2.7% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 17% per year, which is noticeably more attractive.

In light of this, it's understandable that Iluka Resources' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Iluka Resources' P/E

Iluka Resources' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Iluka Resources maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for Iluka Resources you should be aware of.

Of course, you might also be able to find a better stock than Iluka Resources. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ILU

Iluka Resources

Engages in the exploration, project development, mining, processing, marketing, and rehabilitation of mineral sands in Australia, China, rest of Asia, Europe, the Americas, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success