- Australia

- /

- Metals and Mining

- /

- ASX:ILU

Iluka Resources (ASX:ILU) Shares Surge 49% Last Quarter

Reviewed by Simply Wall St

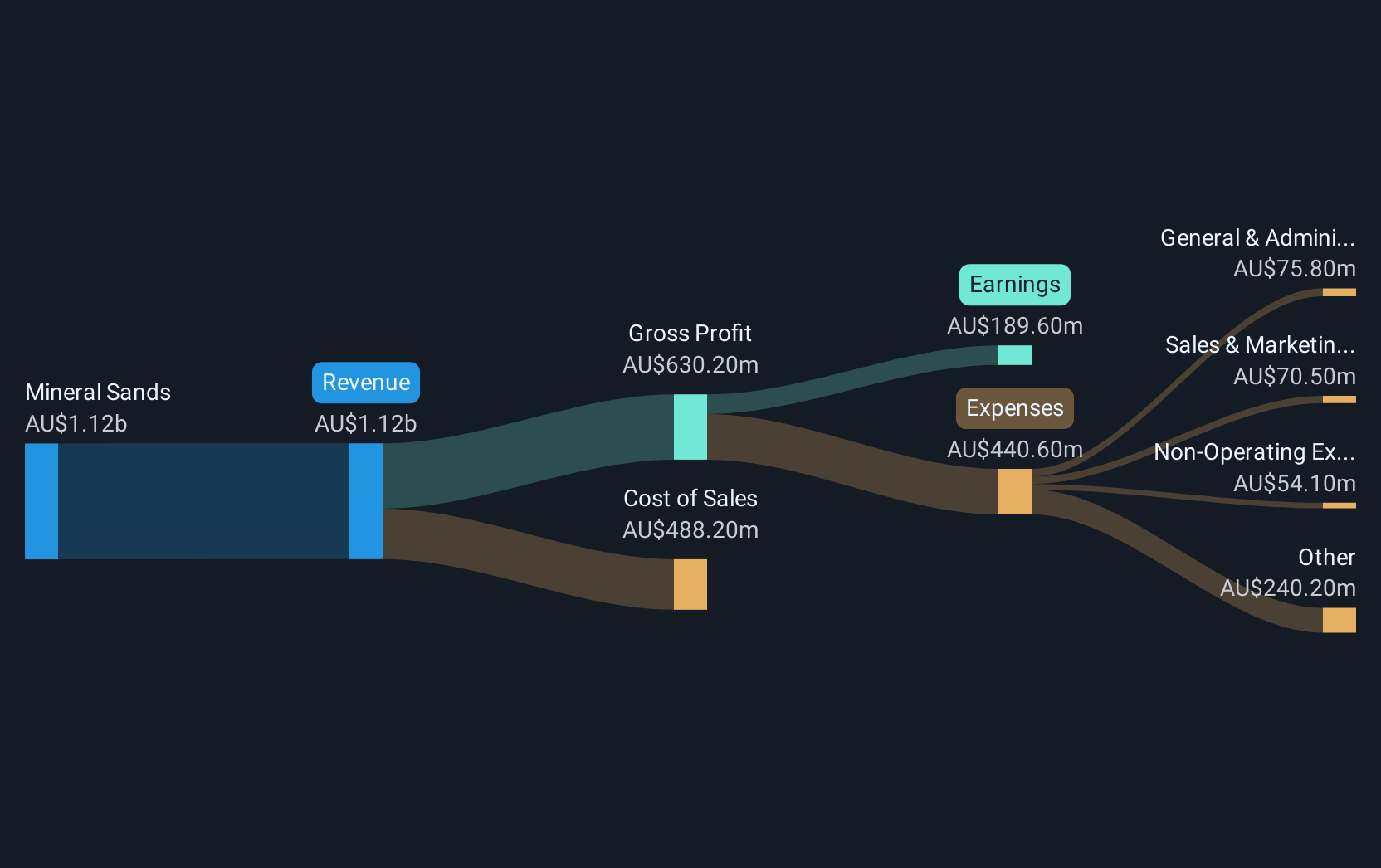

Iluka Resources (ASX:ILU) recently announced a decrease in sales and net income for the first half of 2025, along with a reduced dividend payout. Despite these downward financial trends, the company's share price experienced a significant 49% increase over the last quarter. This upward move contrasts with the broader market's steady growth, where the S&P 500 and Nasdaq reached all-time highs, buoyed by declining producer price index data and strong performance from tech stocks like Oracle, driven by AI demand. Iluka's price movement suggests factors beyond financial earnings may have attracted investor interest.

We've spotted 1 weakness for Iluka Resources you should be aware of.

The recent decrease in Iluka Resources' sales and net income, alongside a reduced dividend payout, presents a mixed picture when juxtaposed with the company's significant 49% share price increase over the last quarter. This discrepancy suggests that factors beyond immediate earnings may be influencing investor sentiment, possibly tied to strategic developments like the Eneabba and Balranald projects, which are expected to enhance supply despite cost pressures. Over the longer term, Iluka has achieved a total shareholder return of 29.10% over five years, indicating more modest but consistent growth. This performance is noteworthy when viewed against the Australian Metals and Mining industry's one-year return of 23.5%, particularly given Iluka's recent underperformance compared to the broader Australian market, which grew by 10.3% in the last year.

The recent financial results and project developments may directly impact revenue and earnings forecasts. Analysts predict a 16.9% annual revenue growth, although profit margins may compress from 17.0% to 10.8% over the coming years. Despite current market turbulence and potential risks such as increased costs and market oversupply in rare earths, the company's share price currently trades at A$5.55, which is below the consensus analyst price target of A$6.68. This gap implies that, given the projected revenue growth and associated risks, there might be room for upward movement, contingent upon successful project executions and market conditions aligning with expectations. Investors might need to reconcile these forecasts with the anticipated challenges in the rare earth market and associated costs to form a balanced view of Iluka's future prospects.

Examine Iluka Resources' past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ILU

Iluka Resources

Engages in the exploration, project development, mining, processing, marketing, and rehabilitation of mineral sands in Australia, China, rest of Asia, Europe, the Americas, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives