- Australia

- /

- Metals and Mining

- /

- ASX:BGD

Barton Gold Holdings And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

Amidst fears of a looming recession and significant market turmoil, Australian shares are bracing for a substantial downturn, with the ASX 200 expected to experience its steepest decline since the early COVID-19 pandemic days. Despite this challenging backdrop, penny stocks continue to capture investor interest as they offer potential growth opportunities in smaller or newer companies. These stocks, while often overlooked due to their niche status, can provide compelling investment prospects when backed by strong financial health and resilience.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.55 | A$120.92M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.46 | A$68.87M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.32 | A$358.42M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$115.64M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.26 | A$2.58B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.00 | A$142.35M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.975 | A$662.41M | ✅ 5 ⚠️ 3 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$241.6M | ✅ 3 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.60 | A$1.19B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.385 | A$45.17M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 977 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Barton Gold Holdings (ASX:BGD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Barton Gold Holdings Limited is involved in the exploration and development of mineral projects in South Australia, with a market cap of A$78.78 million.

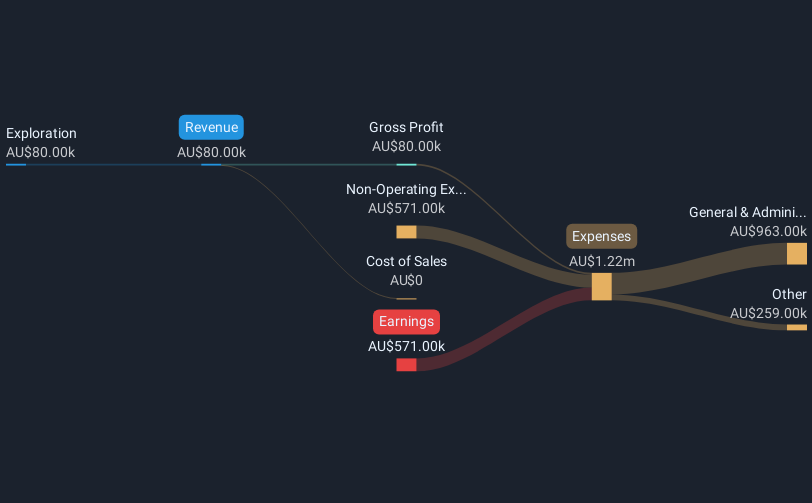

Operations: Currently, there are no reported revenue segments for Barton Gold Holdings Limited.

Market Cap: A$78.78M

Barton Gold Holdings Limited, with a market cap of A$78.78 million, is a pre-revenue company involved in mineral exploration in South Australia. Recent high-grade assay results from the Tolmer prospect at its Tarcoola Gold Project highlight potential for significant gold and silver mineralization, indicating promising exploration prospects. Despite being debt-free and having sufficient cash runway for over a year, Barton remains unprofitable with no meaningful revenue streams. The company reported net income of A$3.12 million for the half-year ending December 2024, contrasting with losses from the previous year, suggesting financial improvements amidst ongoing exploration activities.

- Navigate through the intricacies of Barton Gold Holdings with our comprehensive balance sheet health report here.

- Evaluate Barton Gold Holdings' prospects by accessing our earnings growth report.

Horizon Gold (ASX:HRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Horizon Gold Limited focuses on the exploration, evaluation, development, and production of gold deposits in Australia with a market cap of A$64.45 million.

Operations: The company's revenue is derived from its exploration activities, amounting to A$0.08 million.

Market Cap: A$64.45M

Horizon Gold Limited, with a market cap of A$64.45 million, is a pre-revenue company engaged in gold exploration and development. Despite its unprofitability and negative return on equity (-1.65%), the company benefits from being debt-free and having experienced management and board teams. Horizon's short-term assets (A$3.7M) cover its short-term liabilities but fall short of long-term liabilities (A$11.9M). Recent executive changes aim to enhance corporate development as the Gum Creek Feasibility Study progresses, while earnings for the half-year show improvement with net income of A$0.017 million compared to a significant loss previously reported.

- Get an in-depth perspective on Horizon Gold's performance by reading our balance sheet health report here.

- Understand Horizon Gold's track record by examining our performance history report.

Otto Energy (ASX:OEL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Otto Energy Limited is an oil and gas exploration, production, and sales company operating in North America with a market cap of A$52.75 million.

Operations: The company generates revenue of $17.61 million from its oil and gas exploration and production activities.

Market Cap: A$52.75M

Otto Energy Limited, with a market cap of A$52.75 million, operates in oil and gas exploration and production, generating US$8.16 million in sales for the recent half-year despite a net loss of US$5 million. The company benefits from being debt-free and has experienced management and board teams, with average tenures of 3.4 years and 4.8 years respectively. Its short-term assets (US$34.9M) comfortably cover both short-term (US$1.5M) and long-term liabilities (US$6.2M). Although currently unprofitable with negative return on equity (-2.56%), Otto Energy's cash runway exceeds three years if free cash flow growth continues historically.

- Click here to discover the nuances of Otto Energy with our detailed analytical financial health report.

- Evaluate Otto Energy's historical performance by accessing our past performance report.

Next Steps

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 974 more companies for you to explore.Click here to unveil our expertly curated list of 977 ASX Penny Stocks.

- Seeking Other Investments? We've found 25 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barton Gold Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BGD

Barton Gold Holdings

Engages in the exploration and development of mineral projects in South Australia.

Excellent balance sheet slight.

Market Insights

Community Narratives