- Australia

- /

- Metals and Mining

- /

- ASX:INR

ASX Penny Stocks Spotlight Horizon Gold And 2 Others

Reviewed by Simply Wall St

The ASX200 is set to open slightly higher today, reflecting optimism from a recent US market rally driven by hopes of resolving trade tensions. In light of these developments, investors are increasingly exploring diverse opportunities within the Australian market. Penny stocks, while often considered niche investments, continue to attract attention for their potential growth prospects and affordability. This article will explore several penny stocks that stand out due to their financial health and potential for long-term growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.74 | A$140.15M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.94 | A$1.1B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.55 | A$73.12M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.71 | A$417.83M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.625 | A$119.45M | ✅ 3 ⚠️ 2 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.69 | A$450.18M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.34 | A$158.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.43 | A$816.88M | ✅ 4 ⚠️ 4 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.515 | A$742.47M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.83 | A$1.29B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 988 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Horizon Gold (ASX:HRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Horizon Gold Limited focuses on the exploration, evaluation, development, and production of gold deposits in Australia with a market capitalization of A$79.66 million.

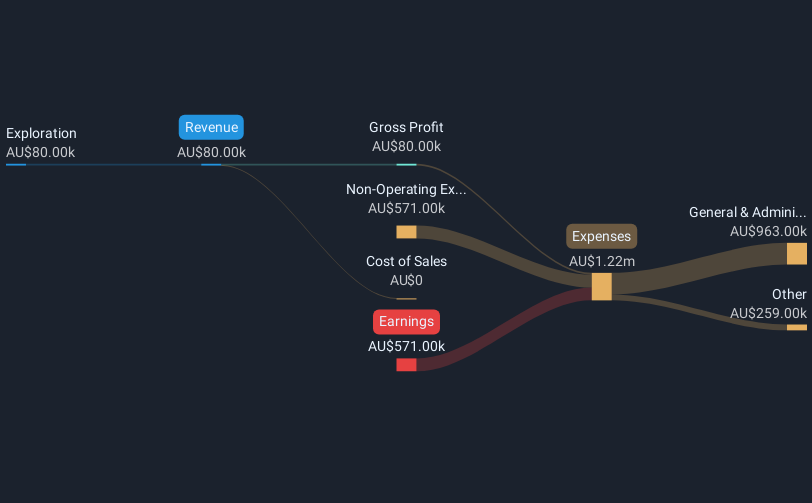

Operations: The company generates revenue from its exploration activities, amounting to A$0.08 million.

Market Cap: A$79.66M

Horizon Gold Limited, with a market cap of A$79.66 million, remains pre-revenue, generating minimal income from exploration activities. Despite being debt-free and having stable weekly volatility at 12%, the company faces challenges with short-term assets (A$3.7M) not covering long-term liabilities (A$11.9M). Recent executive changes saw Peter Sullivan become Executive Chairman to enhance corporate development amid the Gum Creek Feasibility Study. Although Horizon reported a slight net income improvement for the half-year ending December 2024, its cash runway is limited if free cash flow growth persists at historical rates.

- Take a closer look at Horizon Gold's potential here in our financial health report.

- Understand Horizon Gold's track record by examining our performance history report.

ioneer (ASX:INR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ioneer Ltd is involved in the exploration and development of mineral properties in North America, with a market cap of A$329.79 million.

Operations: As there are no revenue segments reported for ioneer Ltd, the company is currently focused on the exploration and development of mineral properties in North America.

Market Cap: A$329.79M

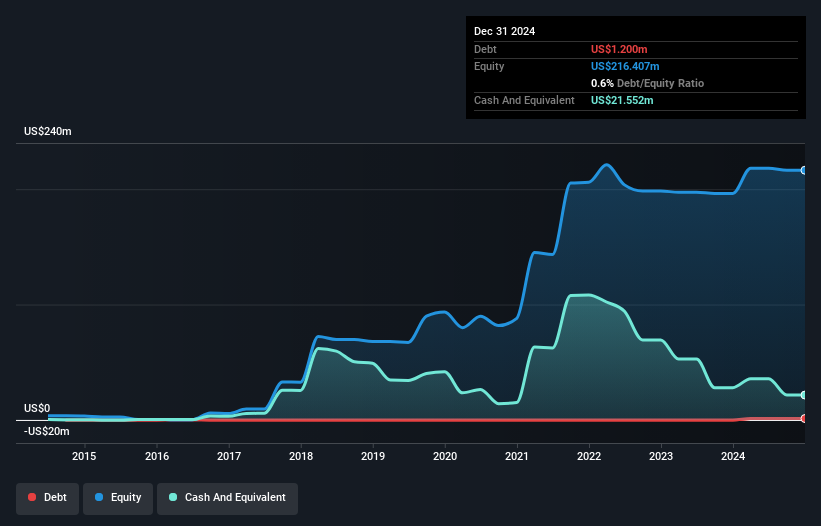

ioneer Ltd, with a market cap of A$329.79 million, is currently pre-revenue and focused on its Rhyolite Ridge Lithium-Boron Project in Nevada. Despite being unprofitable, the company maintains more cash than debt and has short-term assets of US$22.1 million exceeding both short- and long-term liabilities. Recent developments include a 45% increase in mineral resource estimates for Rhyolite Ridge and a binding agreement with Esmeralda County to enhance local infrastructure, potentially boosting economic activity by US$340 million annually. However, earnings are forecasted to decline significantly over the next three years amid ongoing project development challenges.

- Navigate through the intricacies of ioneer with our comprehensive balance sheet health report here.

- Evaluate ioneer's prospects by accessing our earnings growth report.

MFF Capital Investments (ASX:MFF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.39 billion.

Operations: The firm's revenue is derived entirely from its equity investment segment, totaling A$1.01 billion.

Market Cap: A$2.39B

MFF Capital Investments, with a market cap of A$2.39 billion, demonstrates strong financial health and investment potential. The firm boasts high-quality earnings and significant profit growth, with a 51.9% increase last year exceeding the industry average. Its Return on Equity is robust at 28.2%, indicating efficient use of equity capital. MFF's short-term assets significantly surpass its liabilities, ensuring liquidity stability, while debt levels are minimal and well-covered by operating cash flow at a very large multiple. Trading below estimated fair value suggests potential upside for investors seeking undervalued opportunities in the capital markets sector.

- Get an in-depth perspective on MFF Capital Investments' performance by reading our balance sheet health report here.

- Explore historical data to track MFF Capital Investments' performance over time in our past results report.

Taking Advantage

- Discover the full array of 988 ASX Penny Stocks right here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ioneer, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ioneer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:INR

ioneer

Engages in the exploration and development of mineral properties in North America.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives