The Australian market has experienced a mixed performance, with the ASX200 closing down 1.23% and energy stocks gaining traction amidst rising oil prices. For investors seeking opportunities beyond the well-known giants, penny stocks—often representing smaller or emerging companies—remain an intriguing area of investment despite their somewhat outdated label. This article will explore several penny stocks that may offer surprising value and potential stability in today's shifting economic landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$66.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.89 | A$240.44M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.94 | A$108.78M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.95 | A$322.38M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$253.28M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.265 | A$107.15M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.525 | A$779.23M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.89 | A$486.42M | ★★★★☆☆ |

Click here to see the full list of 1,049 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Cue Energy Resources (ASX:CUE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cue Energy Resources Limited is an oil and gas company involved in the exploration, development, and production of petroleum products with a market capitalization of A$67.07 million.

Operations: The company generates revenue of A$49.66 million from its production and exploration activities in hydrocarbons.

Market Cap: A$67.07M

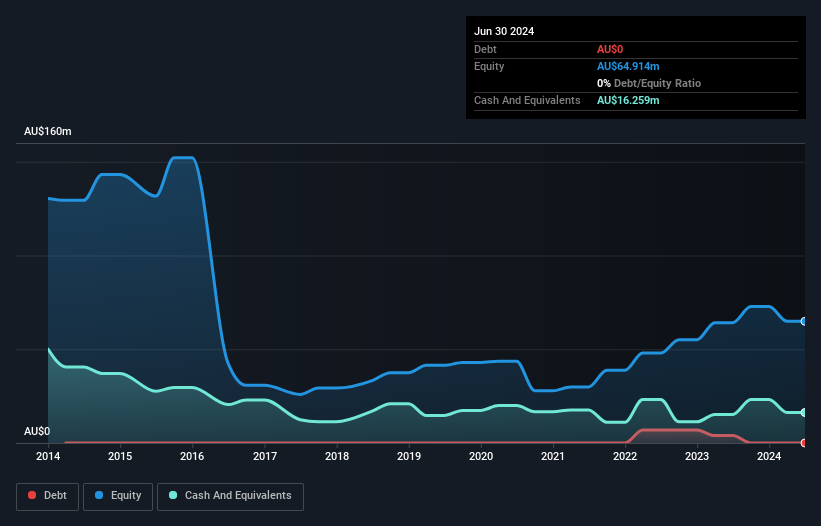

Cue Energy Resources Limited, with a market capitalization of A$67.07 million and revenue of A$49.66 million, presents both opportunities and challenges for investors in penny stocks. The company is debt-free and boasts a high return on equity at 21.9%, indicating efficient use of shareholder funds. However, its short-term assets do not cover long-term liabilities, which could pose financial risks. Despite having high-quality past earnings and stable weekly volatility, recent negative earnings growth contrasts with its previous five-year profitability trend. Recent delisting from OTC Equity due to inactivity may impact investor sentiment negatively.

- Click here and access our complete financial health analysis report to understand the dynamics of Cue Energy Resources.

- Examine Cue Energy Resources' past performance report to understand how it has performed in prior years.

Hammer Metals (ASX:HMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hammer Metals Limited is an Australian company focused on the exploration and extraction of mineral resources, with a market cap of A$31.07 million.

Operations: The company's revenue is derived entirely from its operations in Australia, totaling A$0.18 million.

Market Cap: A$31.07M

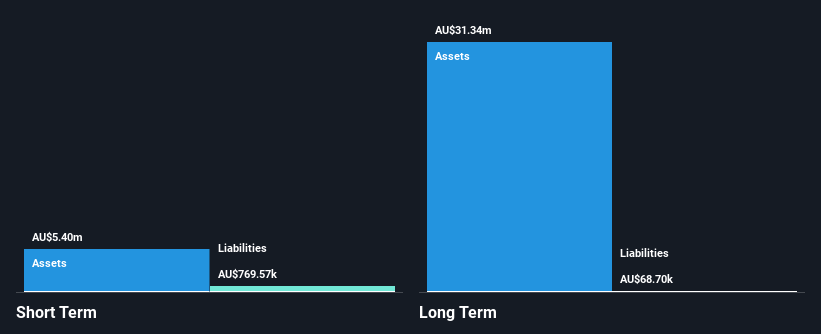

Hammer Metals Limited, with a market cap of A$31.07 million and pre-revenue status, offers a mixed bag for penny stock investors. The company recently achieved profitability, complicating comparisons to past performance and industry growth rates. Its financial stability is underscored by no debt and short-term assets exceeding liabilities. Despite low return on equity at 17.5%, the price-to-earnings ratio of 5x suggests good value compared to the broader Australian market. Management's experience adds confidence, while stable weekly volatility further supports investment considerations. Recent participation in IMARC 2024 highlights ongoing engagement within the mining sector community.

- Jump into the full analysis health report here for a deeper understanding of Hammer Metals.

- Learn about Hammer Metals' historical performance here.

Kinatico (ASX:KYP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kinatico Ltd operates in Australia and New Zealand, offering screening, verification, and SaaS-based workforce management and compliance technology systems, with a market cap of A$61.57 million.

Operations: The company generates revenue of A$29.10 million from providing screening and verification checks.

Market Cap: A$61.57M

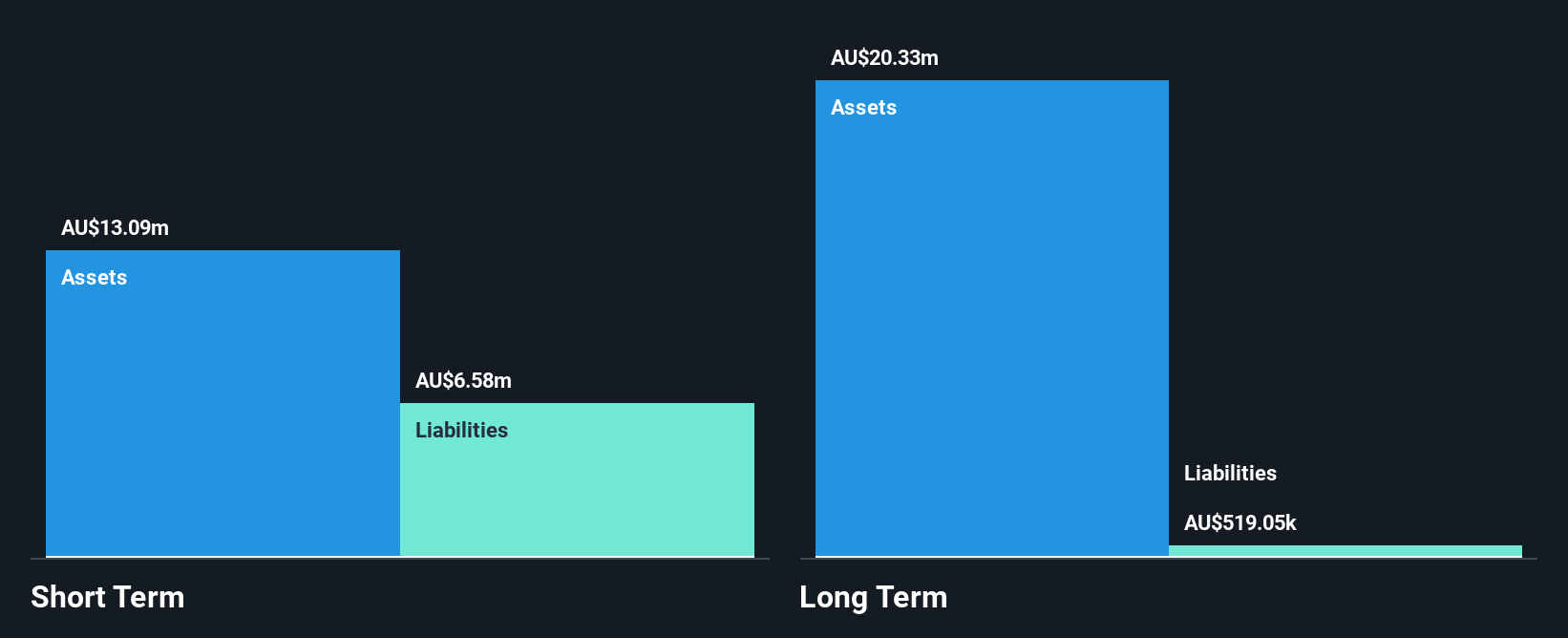

Kinatico Ltd, with a market cap of A$61.57 million, presents a compelling profile for penny stock investors. The company has achieved profitability over the past five years, with earnings growing at 34.6% annually and an impressive 230% increase last year, outpacing the IT industry average. Despite dilution by 3.2%, Kinatico remains debt-free and maintains strong financial stability, as short-term assets exceed liabilities significantly. Trading at 60.7% below its estimated fair value suggests potential undervaluation, though its low return on equity of 3% warrants caution. Management's seasoned experience further bolsters confidence in operational oversight and strategic direction.

- Navigate through the intricacies of Kinatico with our comprehensive balance sheet health report here.

- Examine Kinatico's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Gain an insight into the universe of 1,049 ASX Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinatico might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KYP

Kinatico

Provides screening, verification, and SaaS-based workforce management and compliance technology systems in Australia and New Zealand.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives