- Australia

- /

- Metals and Mining

- /

- ASX:HMX

3 ASX Penny Stocks Below A$60M Market Cap

Reviewed by Simply Wall St

The Australian market has been navigating a period of economic adjustment, highlighted by the Reserve Bank of Australia's recent interest rate cut, which reflects ongoing debates about inflation and employment. Amid these macroeconomic shifts, investors are increasingly turning their attention to smaller-cap stocks that offer potential growth opportunities. Penny stocks, though an outdated term for some, continue to represent a viable investment area when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.97 | A$92.93M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.22 | A$346.95M | ★★★★☆☆ |

| SHAPE Australia (ASX:SHA) | A$2.99 | A$250.39M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.11 | A$67.25M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.08 | A$340.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.81 | A$101.78M | ★★★★★★ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

DeSoto Resources (ASX:DES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DeSoto Resources Limited is a mineral exploration company focused on exploring and evaluating mineral properties in the Northern Territory, with a market cap of A$9.72 million.

Operations: DeSoto Resources Limited has not reported any revenue segments.

Market Cap: A$9.72M

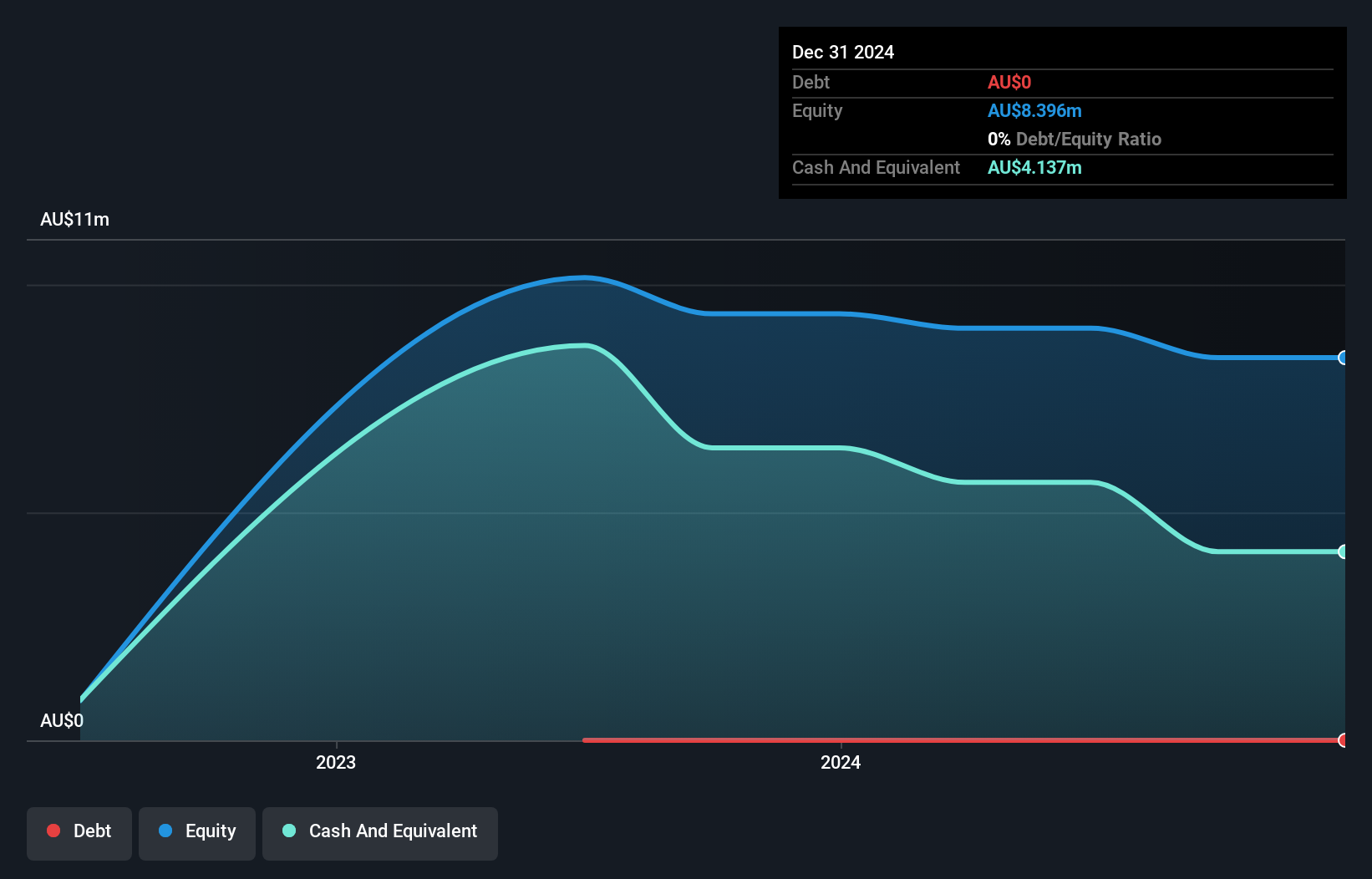

DeSoto Resources Limited, with a market cap of A$9.72 million, operates as a pre-revenue mineral exploration company in the Northern Territory. It is debt-free and has sufficient short-term assets (A$5.8M) to cover both its short-term (A$408.8K) and long-term liabilities (A$102.7K). The company maintains a cash runway for over a year despite not generating revenue, although its negative return on equity (-18.74%) reflects current unprofitability. While the board's average tenure is 2.8 years, suggesting inexperience, shareholders have not faced significant dilution recently, indicating stability in shareholding structure amidst ongoing exploration activities.

- Navigate through the intricacies of DeSoto Resources with our comprehensive balance sheet health report here.

- Gain insights into DeSoto Resources' historical outcomes by reviewing our past performance report.

Engenco (ASX:EGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Engenco Limited, with a market cap of A$55.30 million, provides transportation solutions through its subsidiaries.

Operations: The company's revenue is primarily derived from its business segments: Gemco Rail (A$93.60 million), Drivetrain (A$65.05 million), Convair Engineering (A$31.58 million), Workforce Solutions (A$18.05 million), and Hedemora Turbo & Diesel (A$8.32 million).

Market Cap: A$55.3M

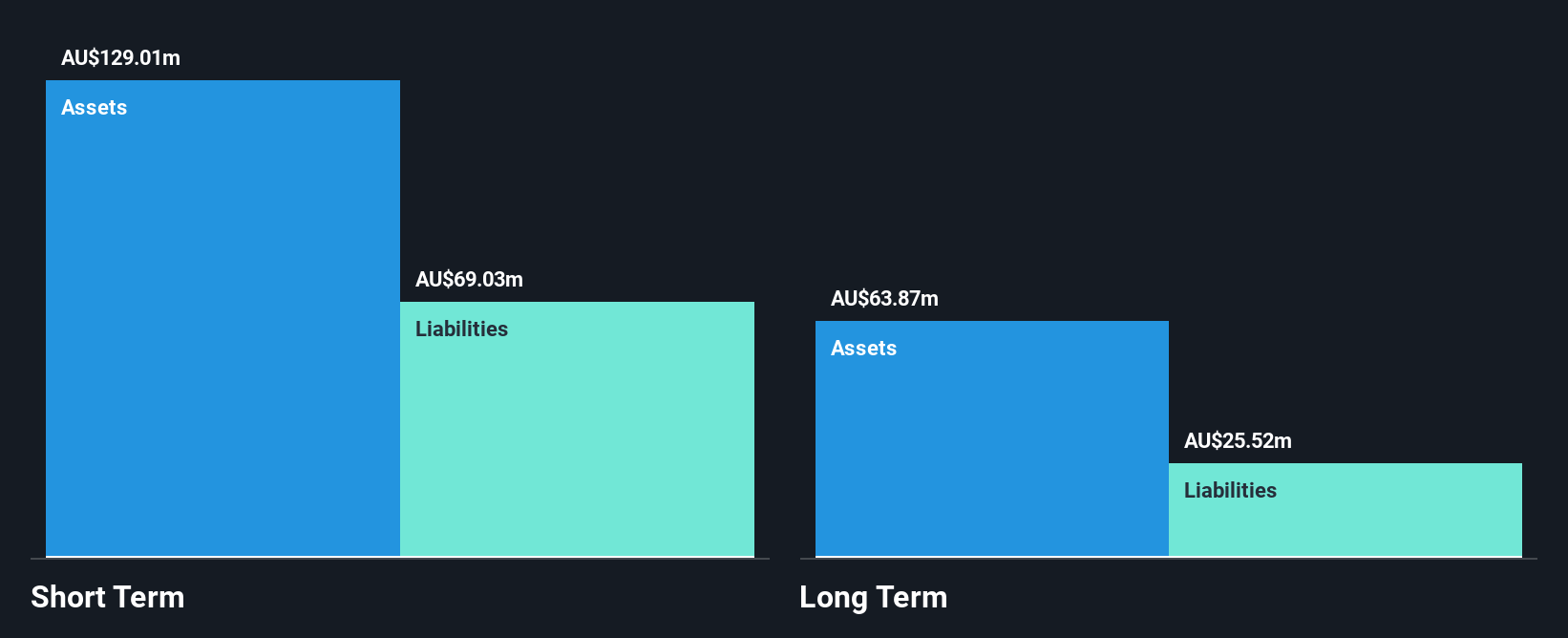

Engenco Limited, with a market cap of A$55.30 million, provides transportation solutions through various segments. Despite stable weekly volatility and an experienced management team, the company faces challenges with low return on equity (4.1%) and declining earnings growth over the past five years (-22.6% annually). Although debt is well covered by operating cash flow (176.2%), interest payments are not fully supported by EBIT (2.8x coverage). Short-term assets exceed both short-term and long-term liabilities, indicating financial stability; however, profit margins have decreased from 2.7% to 1.8%, partly due to large one-off gains impacting recent results.

- Take a closer look at Engenco's potential here in our financial health report.

- Understand Engenco's track record by examining our performance history report.

Hammer Metals (ASX:HMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hammer Metals Limited is an Australian company focused on the exploration and extraction of mineral resources, with a market cap of A$30.18 million.

Operations: The company generates its revenue primarily from operations in Australia, amounting to A$0.18 million.

Market Cap: A$30.18M

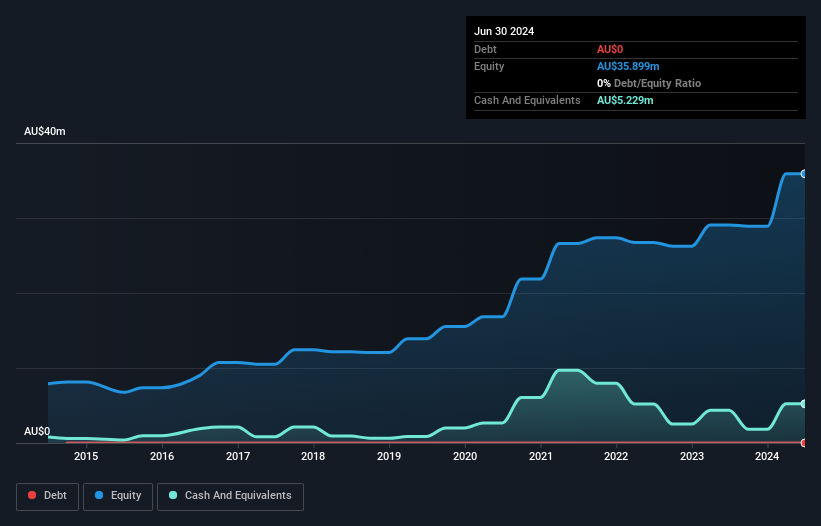

Hammer Metals Limited, with a market cap of A$30.18 million, has recently transitioned to profitability, making it challenging to compare its past earnings growth with industry benchmarks. The company remains pre-revenue with minimal revenue of A$0.18 million. Its financial stability is underscored by short-term assets of A$5.4 million surpassing both short-term and long-term liabilities and a debt-free status for five years. The Price-To-Earnings ratio stands at 4.8x, suggesting potential value compared to the broader Australian market average of 19.7x. An experienced management team further strengthens the company's operational foundation amidst stable weekly volatility levels.

- Click here and access our complete financial health analysis report to understand the dynamics of Hammer Metals.

- Learn about Hammer Metals' historical performance here.

Where To Now?

- Unlock our comprehensive list of 1,032 ASX Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammer Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HMX

Hammer Metals

Engages in the exploration and extraction of mineral resources in Australia.

Flawless balance sheet slight.

Market Insights

Community Narratives