- Australia

- /

- Metals and Mining

- /

- ASX:HAS

Hastings Technology Metals (ASX:HAS) Is Up 51.4% After US-Australia Strategic Minerals Deal Talks

Reviewed by Sasha Jovanovic

- In recent days, rare earths and critical minerals companies including Hastings Technology Metals have seen increased market activity, as global policy changes such as China’s export controls and a new US Department of Defense price floor for NdPr have brought fresh attention to the sector.

- Discussions between Australia and the United States regarding a multi-billion dollar strategic minerals reserve and direct investment in Australian rare earth projects highlight the elevated geopolitical and supply chain significance of these resources.

- Let’s explore how expanded government focus on critical mineral supply chains shapes Hastings Technology Metals’ investment narrative moving forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Hastings Technology Metals' Investment Narrative?

To be a shareholder in Hastings Technology Metals right now, you’d need confidence in the longer-term demand for critical minerals, especially as global players push for rare earths security. The recent surge in sector-wide interest, spurred by China’s export controls and the new US Department of Defense price floor for NdPr, has brought rare earth exposure back into focus, with price returns for Hastings up sharply in the past month. For Hastings, these headlines could help attract capital or accelerate strategic partnerships, potentially enhancing its ability to fund the Yangibana project. However, the most important near-term catalysts remain tied to funding and project execution. The company posted an A$222.11 million annual net loss and still has no revenue, while its auditor flagged going concern doubts. That risk profile hasn’t disappeared with the recent sector momentum, though it could shift if government support for Australian rare earth projects becomes more tangible. It’s a high-risk, high-potential scenario, and the recent news may only partly offset the need for significant further progress on the company’s operational and financial foundations.

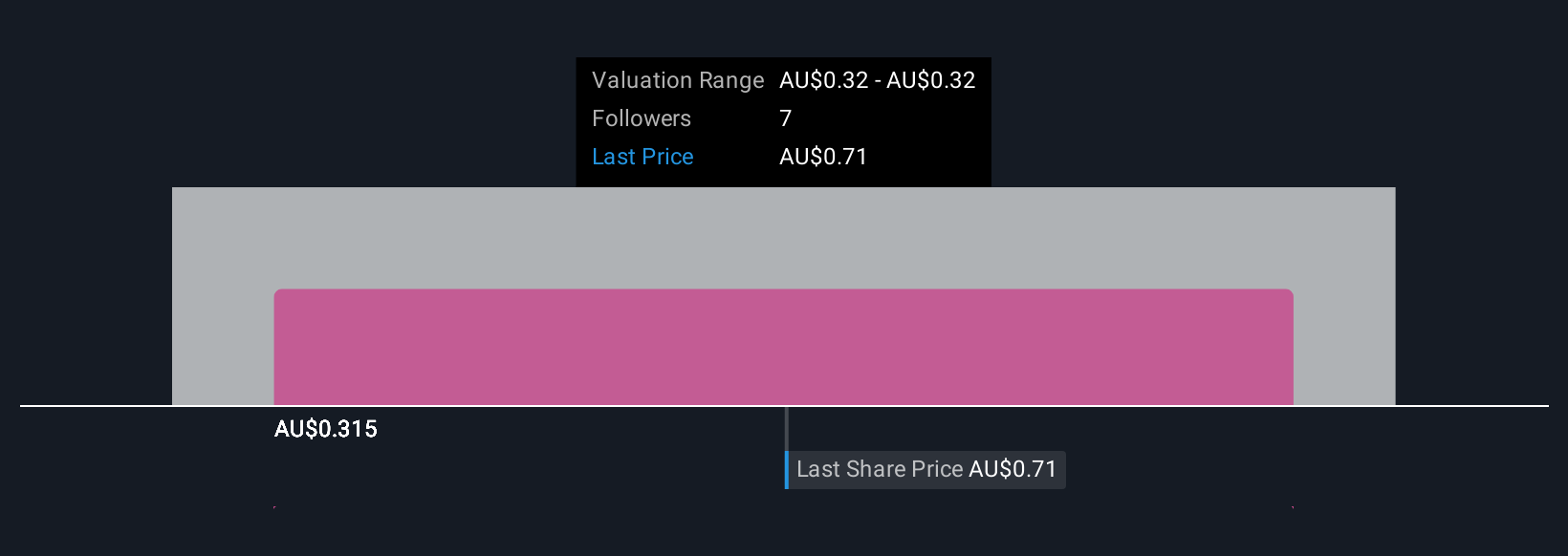

But even with optimism in the sector, investors need to be aware of the company’s recent going concern warning. Our comprehensive valuation report raises the possibility that Hastings Technology Metals is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore another fair value estimate on Hastings Technology Metals - why the stock might be worth as much as A$0.315!

Build Your Own Hastings Technology Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hastings Technology Metals research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Hastings Technology Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hastings Technology Metals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hastings Technology Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HAS

Hastings Technology Metals

Engages in the exploration and evaluation of mineral deposits in Australia.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives