- Australia

- /

- Metals and Mining

- /

- ASX:GRR

With EPS Growth And More, Grange Resources (ASX:GRR) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Grange Resources (ASX:GRR). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for Grange Resources

How Fast Is Grange Resources Growing Its Earnings Per Share?

In the last three years Grange Resources's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Grange Resources's EPS shot from AU$0.052 to AU$0.098, over the last year. You don't see 87% year-on-year growth like that, very often.

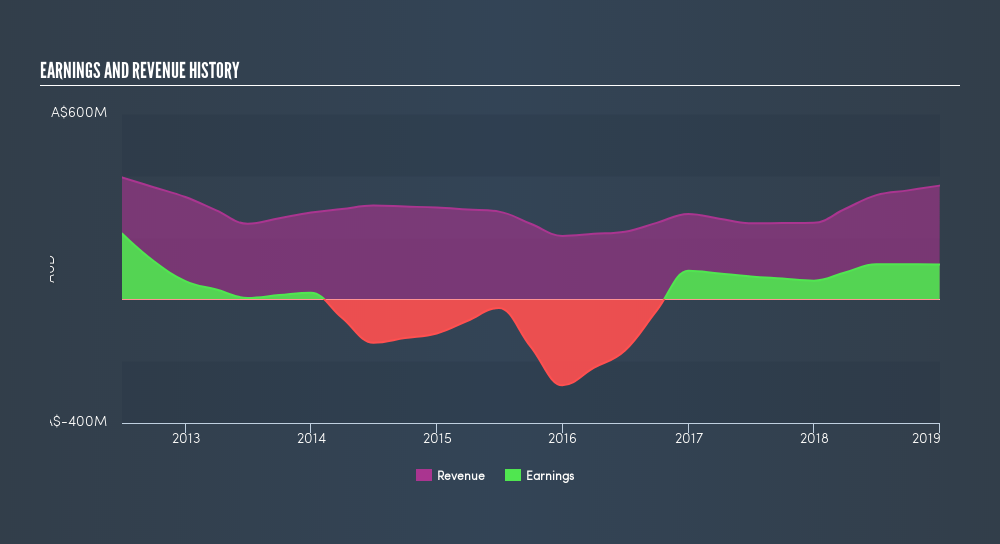

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Grange Resources shareholders can take confidence from the fact that EBIT margins are up from 29% to 34%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Grange Resources isn't a huge company, given its market capitalization of AU$324m. That makes it extra important to check on its balance sheet strength.

Are Grange Resources Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Grange Resources shares worth a considerable sum. Indeed, they hold AU$22m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 6.9% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Grange Resources Deserve A Spot On Your Watchlist?

Grange Resources's earnings have taken off like any random crypto-currency did, back in 2017. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering Grange Resources for a spot on your watchlist. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing Grange Resources's ROE with industry peers (and the market at large).

Although Grange Resources certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:GRR

Grange Resources

Owns and operates integrated iron ore mining and pellet production business in Australia and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives