- Australia

- /

- Real Estate

- /

- ASX:PPC

Top ASX Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As the ASX 200 hovers just above the 9,000-point mark, investors are cautiously navigating the market's recent highs amidst global economic events like the U.S.'s Jackson Hole meeting. In such an environment, dividend stocks can offer a measure of stability and income, making them an attractive consideration for those looking to balance potential market volatility with steady returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Sugar Terminals (NSX:SUG) | 8.08% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 4.16% | ★★★★☆☆ |

| Northern Star Resources (ASX:NST) | 3.32% | ★★★★☆☆ |

| New Hope (ASX:NHC) | 9.40% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.88% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.94% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.23% | ★★★★☆☆ |

| IVE Group (ASX:IGL) | 5.92% | ★★★★☆☆ |

| GWA Group (ASX:GWA) | 6.22% | ★★★★☆☆ |

| Fiducian Group (ASX:FID) | 3.84% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

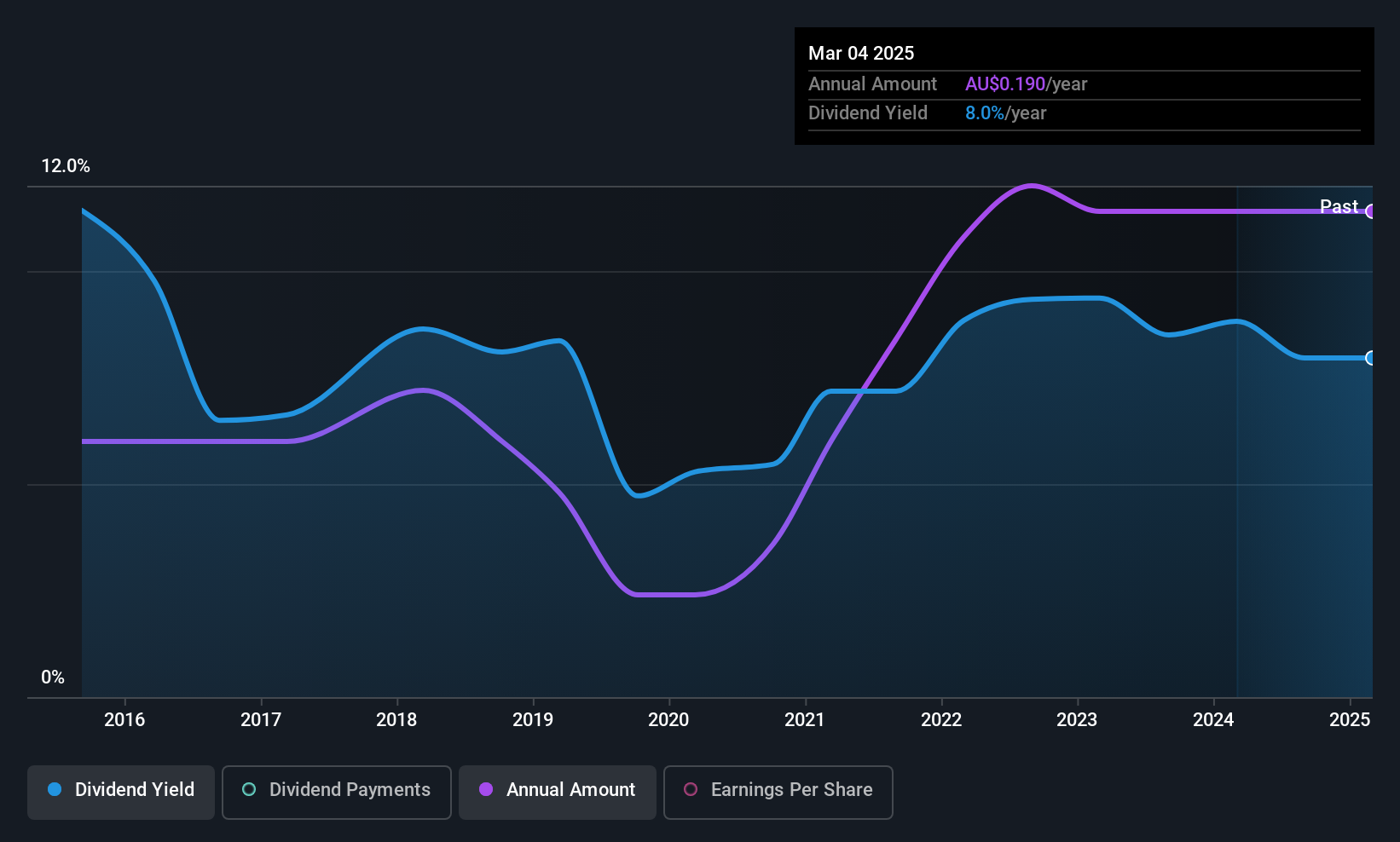

GR Engineering Services (ASX:GNG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services to the mining and mineral processing industries both in Australia and internationally, with a market cap of A$738.27 million.

Operations: GR Engineering Services Limited generates revenue from two main segments: A$96.61 million from Oil and Gas and A$412.30 million from Mineral Processing.

Dividend Yield: 4.5%

GR Engineering Services offers a mixed dividend profile. Its dividends are well-covered by both earnings, with a payout ratio of 86%, and cash flows, which have a cash payout ratio of 37.6%. Though dividends have grown over the past decade, they remain volatile and unreliable. The current yield of 4.54% is below the top quartile in Australia. Despite trading at a significant discount to estimated fair value, investors should consider its unstable dividend history carefully.

- Click here and access our complete dividend analysis report to understand the dynamics of GR Engineering Services.

- Insights from our recent valuation report point to the potential overvaluation of GR Engineering Services shares in the market.

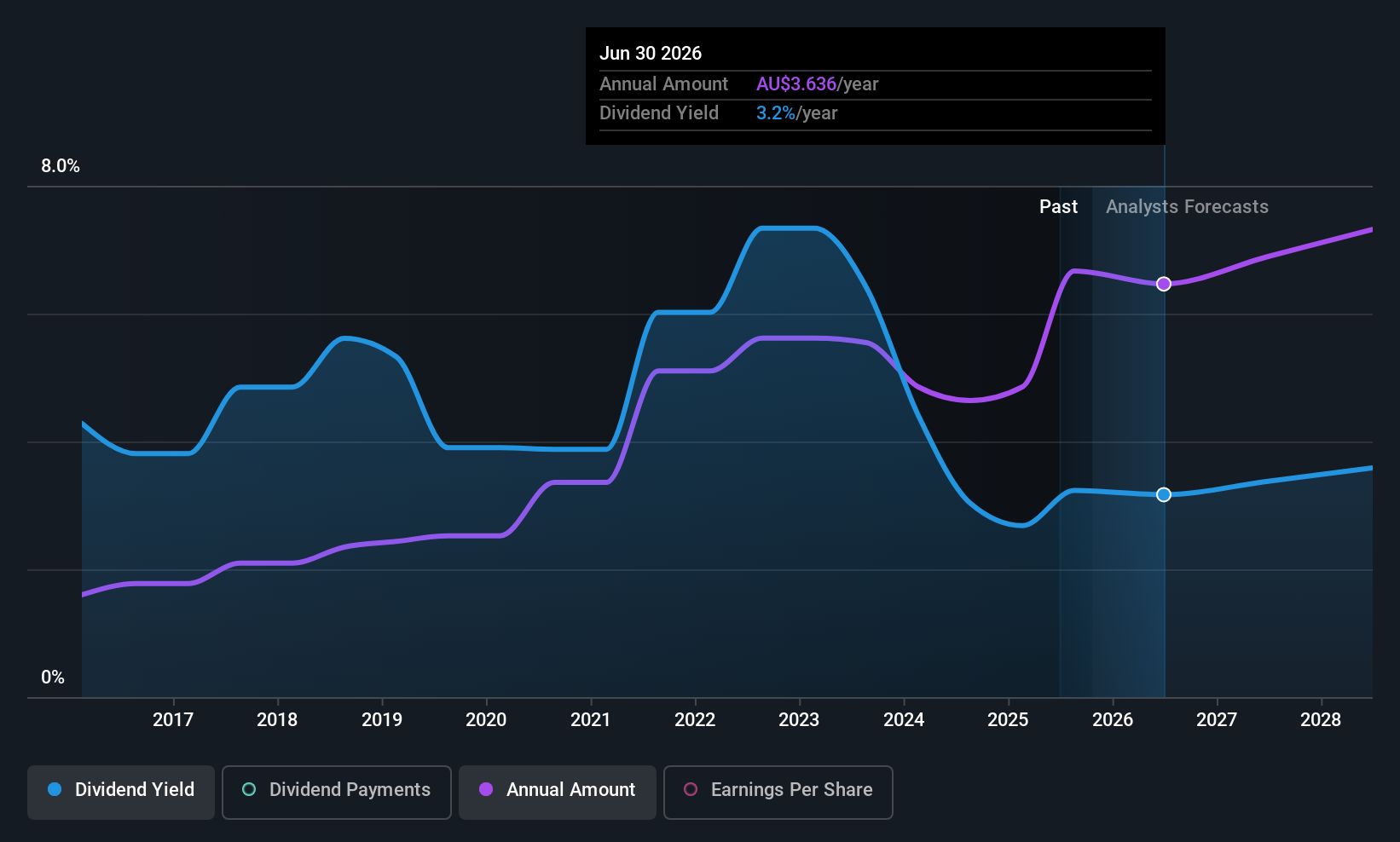

JB Hi-Fi (ASX:JBH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Hi-Fi Limited is a retailer of home consumer products with a market capitalization of A$12.91 billion.

Operations: JB Hi-Fi Limited's revenue is segmented into E & S with A$225.20 million, The Good Guys (TGG) at A$2.87 billion, JB Hi-Fi Australia (JB Aust) contributing A$7.10 billion, and JB Hi-Fi New Zealand (JB NZ) at A$361.40 million.

Dividend Yield: 3.2%

JB Hi-Fi's dividend profile shows some strengths and weaknesses. While the payout ratio of 65% indicates dividends are well-covered by earnings and cash flows, the company's dividend history has been volatile over the past decade. The recent announcement of a special dividend and an increase in the payout ratio to 70-80% from fiscal year 2026 may appeal to investors seeking higher returns. However, its current yield of 3.18% lags behind top-tier Australian dividend payers.

- Dive into the specifics of JB Hi-Fi here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that JB Hi-Fi is priced higher than what may be justified by its financials.

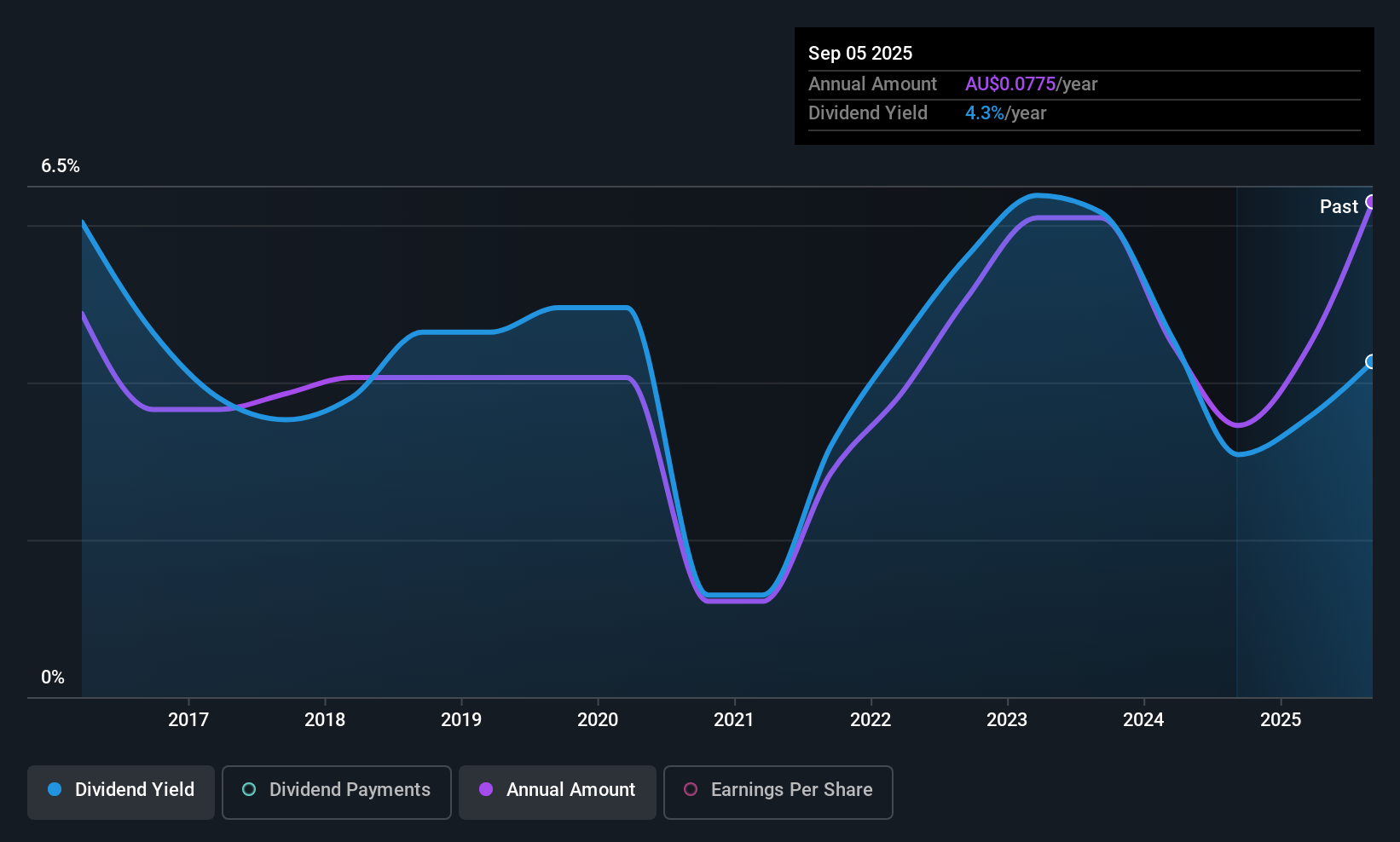

Peet (ASX:PPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peet Limited acquires, develops, and markets residential land in Australia with a market capitalization of A$800.55 million.

Operations: Peet Limited generates revenue from three key segments: Funds Management (A$56.39 million), Joint Arrangements (A$51.88 million), and Company Owned Projects (A$313.24 million).

Dividend Yield: 4.5%

Peet's dividend history reveals volatility, with payments not consistently growing over the past decade. Despite this, its dividends are well-covered by earnings and cash flows, with payout ratios of 62.1% and 34.1% respectively. Recent earnings growth of A$58.47 million from A$36.55 million supports potential for future payouts. However, its current yield of 4.53% is below top-tier Australian dividend stocks, and a strategic review is underway to leverage market conditions and enhance shareholder value amidst high debt levels.

- Take a closer look at Peet's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Peet is trading behind its estimated value.

Key Takeaways

- Gain an insight into the universe of 27 Top ASX Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PPC

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives