- Australia

- /

- Metals and Mining

- /

- ASX:GNG

If You Had Bought GR Engineering Services (ASX:GNG) Stock Five Years Ago, You Could Pocket A 76% Gain Today

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the GR Engineering Services Limited (ASX:GNG) share price is up 76% in the last 5 years, clearly besting than the market return of around 8.0% (ignoring dividends).

Check out our latest analysis for GR Engineering Services

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

GR Engineering Services's earnings per share are down 13% per year, despite strong share price performance over five years. Essentially, it doesn't seem likely that investors are focused on EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In fact, the dividend has increased over time, which is a positive. It could be that the company is reaching maturity and dividend investors are buying for the yield. The revenue growth of about 14% per year might also encourage buyers.

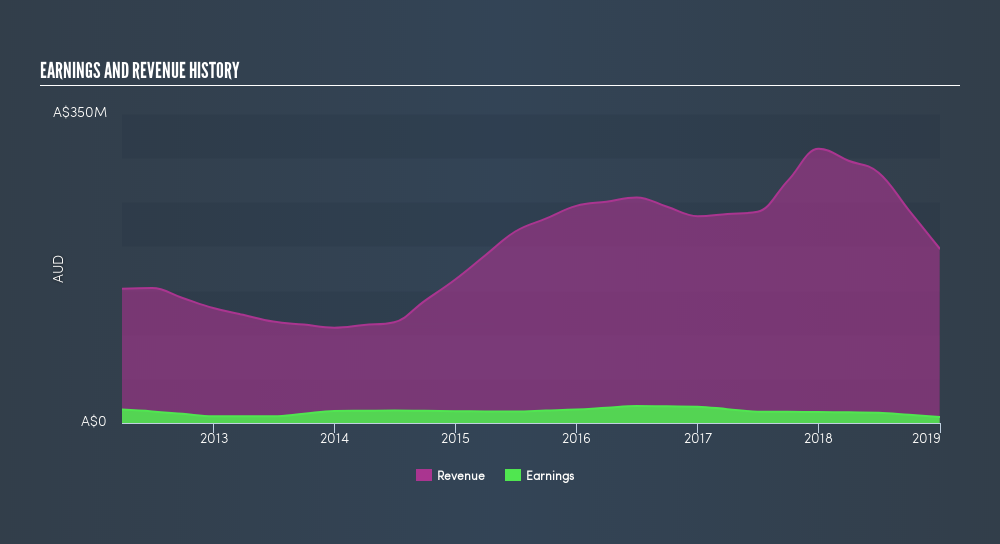

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Take a more thorough look at GR Engineering Services's financial health with this freereport on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of GR Engineering Services, it has a TSR of 147% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

GR Engineering Services shareholders are down 18% for the year (even including dividends), but the market itself is up 9.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 20%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before forming an opinion on GR Engineering Services you might want to consider the cold hard cash it pays as a dividend. This freechart tracks its dividend over time.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:GNG

GR Engineering Services

Provides engineering, procurement, and construction services to the mining and mineral processing industries in Australia and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives